Preview: Due October 1 - U.S. September ISM Manufacturing - Still weak

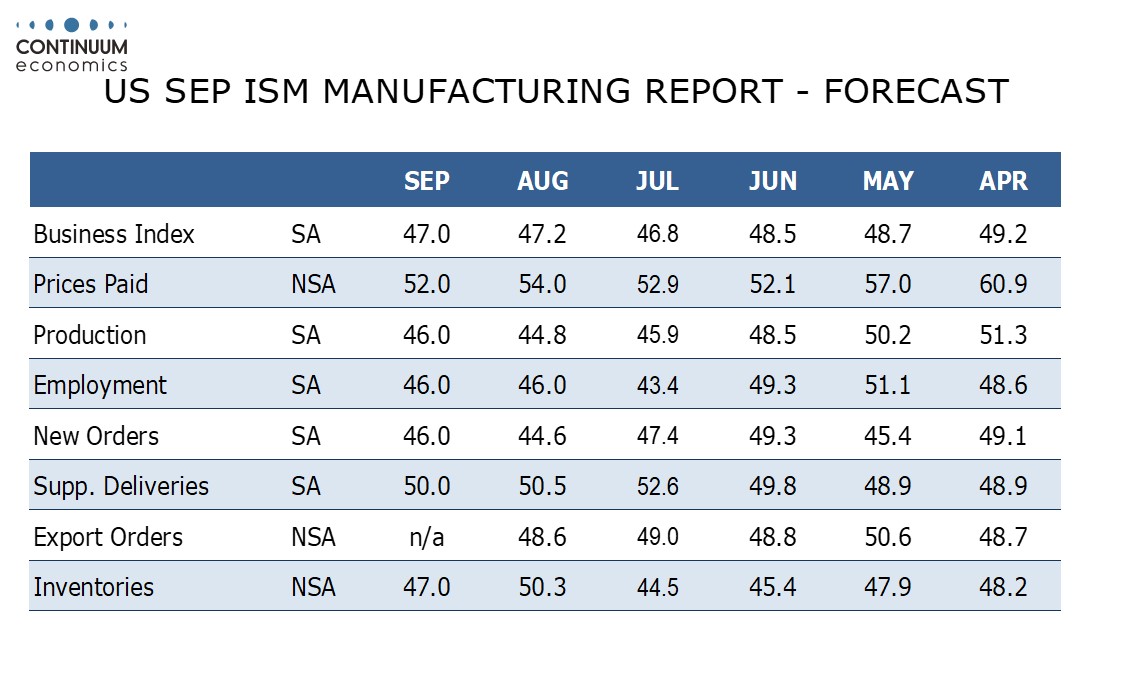

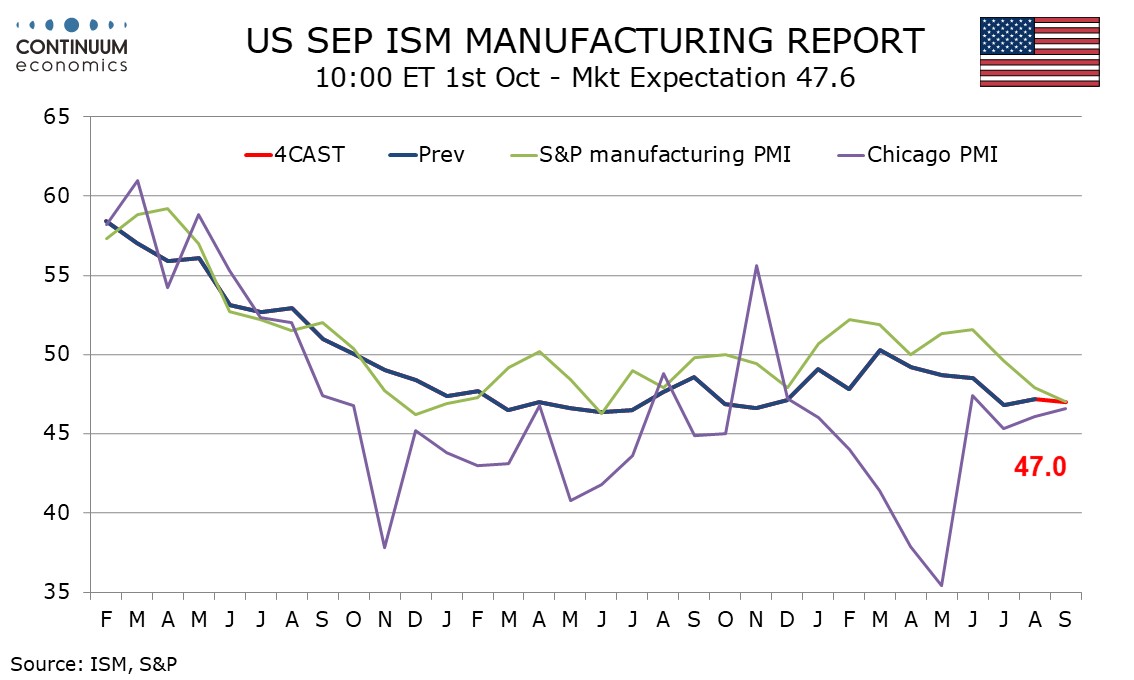

We expect a September ISM manufacturing index of 47.0, still weak and almost unchanged from August’s 47.2 and July’s 46.8, and also equal to a weaker S and P manufacturing PMI for September which was the lowest since June 2023.

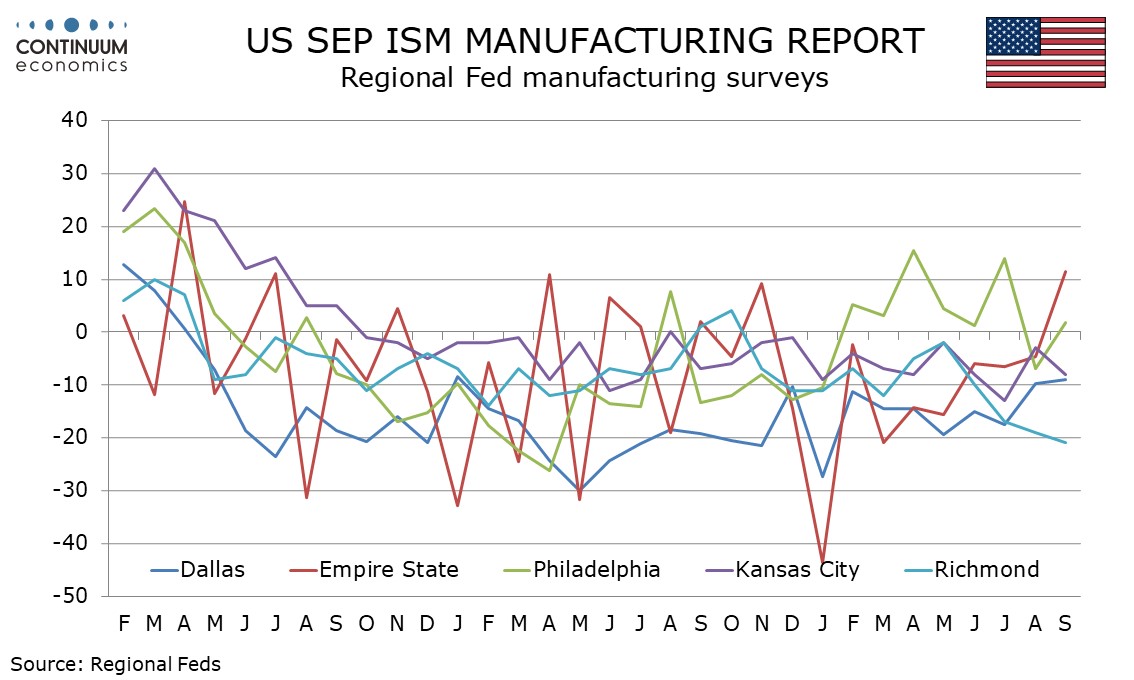

The message from other surveys is mixed with the Empire State and Philly Fed surveys improved in September, and August manufacturing output also exceeded expectations. However the Richmond Fed and Kansas City Fed manufacturing indices, like the S and P manufacturing PMI, were weaker. Dallas Fed and Chicago PMI data was little changed, and still negative.

In the ISM manufacturing detail, there is scope for new orders and production to correct higher from significantly weaker August indices of 44.6 and 44.8 respectively, but tougher seasonal adjustments limit the upside scope and we expect still weak September readings of 46.0 from both. We also see the employment index at 46.0, this unchanged from August.

Completing the breakdown of the composite will be delivery times, which we see slipping to a neutral 50.0 from 50.5, and inventories, which we see falling to 47.0 after a sharp bounce to 50.3 in August. Prices paid do not contribute to the composite, and we expect a modest slowing to 52.0 from 54.0, putting the index at its lowest since December.