Published: 2024-04-23T17:36:09.000Z

Preview: Due May 3 - U.S. April ISM Services - A correction after two straight slowings

Senior Economist , North America

1

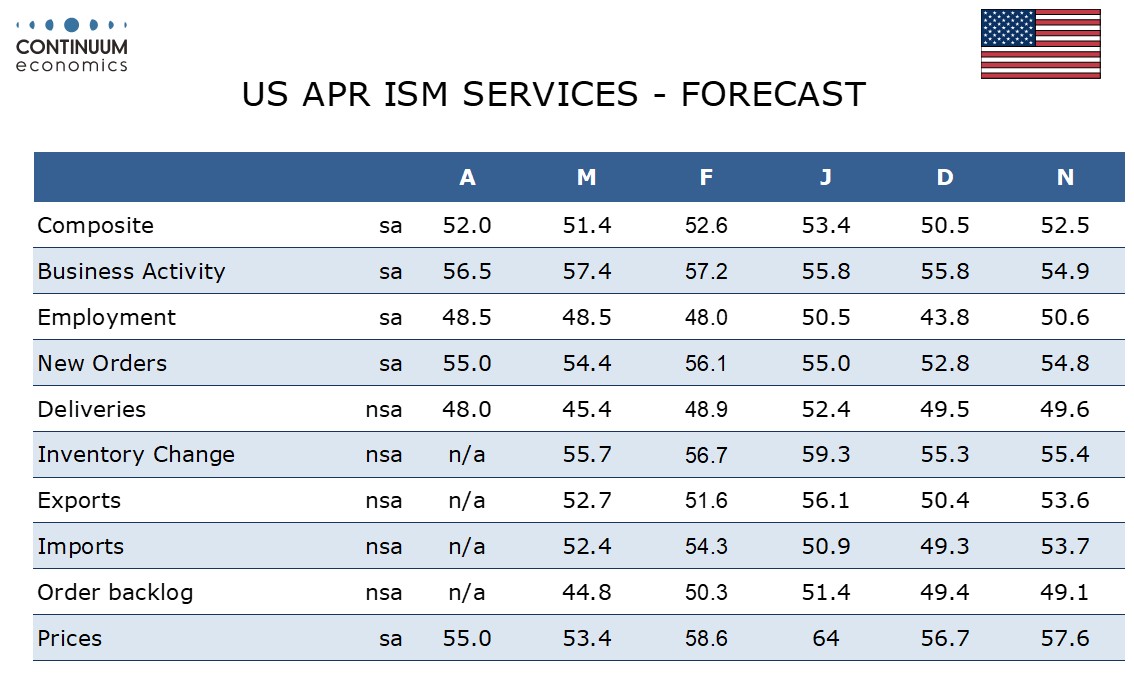

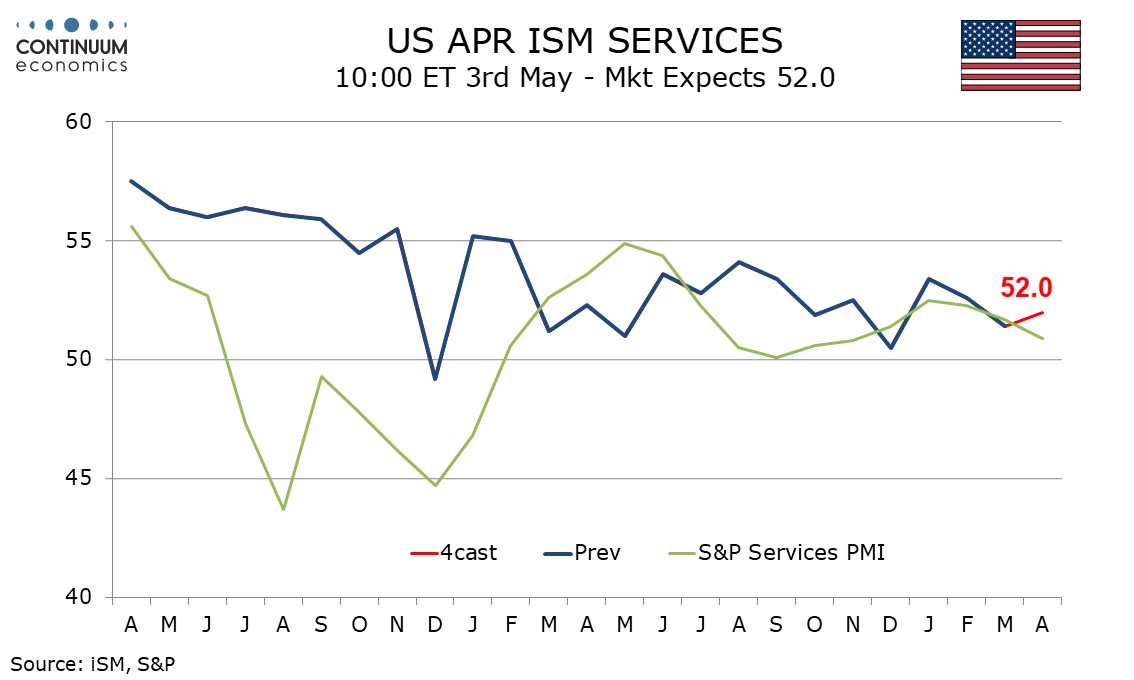

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion.

The S and P services index has seen four straight declines with its Q1 data quite consistent with the ISM services data, though such consistency is unusual and may not persist in April. Regional Fed service surveys were mixed, with the Philly Fed’s improved, the Richmond Fed’s weaker and the Empire State’s not much changed.

We expect improvement in the composite to be led by a bounce in deliveries from a very weak March. We expect marginal improvement in new orders and a marginal slowing in business activity moving the indices closer to each other, and employment stable at 48.5. Prices paid do not contribute to the composite. Here we expect a correction higher to 55.0 after March at 53.4, versus 58.6 in February, saw its weakest outcome since March 2020, at the height of the pandemic.