AUD, JPY, CHF flows: AUD bounces on employment data, JPY weak, but...

AUD bounces strongly on better thna expected employment report. JPY weak as yields dip after reports of less hawkish BoJ. CHF awaits SNB decision

AUD strength was the main feature overnight, with the AUD rising sharply on the back of a much stronger than expected employment report. A larger than expected rise of 36k in employment was stronger than it looked because there was a 53k rise in full time employment, while the unemployment rate fell sharply to 3.9% from 4.2%. AUD yields rose strongly on the news, and the AUD gained more than 1% after hitting new lows for the year on Wednesday.

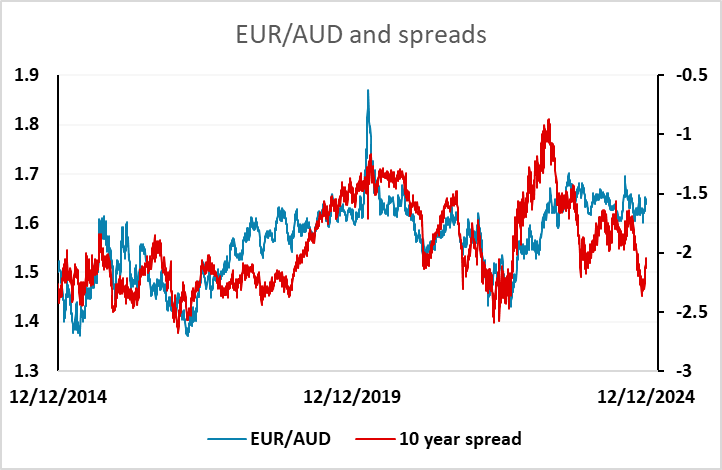

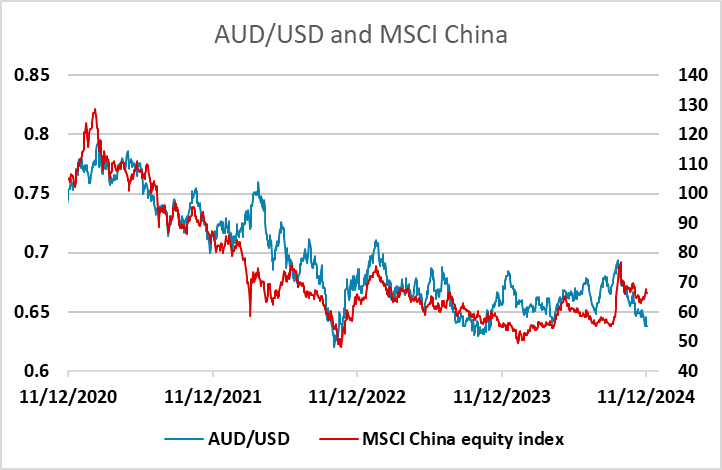

We continue to see much more substantial upside scope for the AUD, as it has underperformed the usual yield spread relationships this year, and has also lagged behind the usual correlation with equity market performance, both globally and locally.

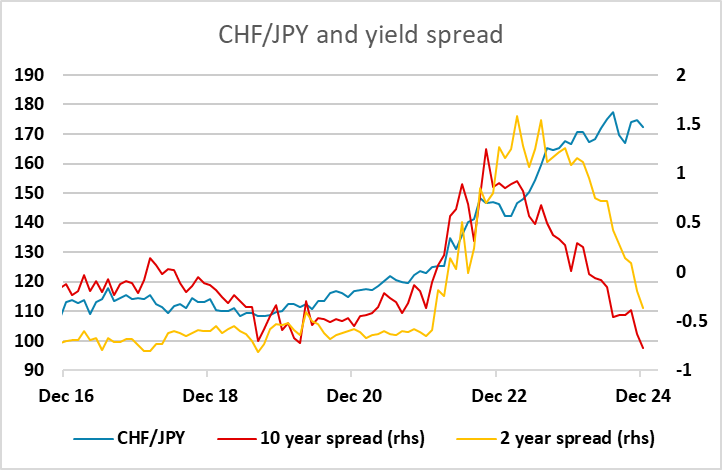

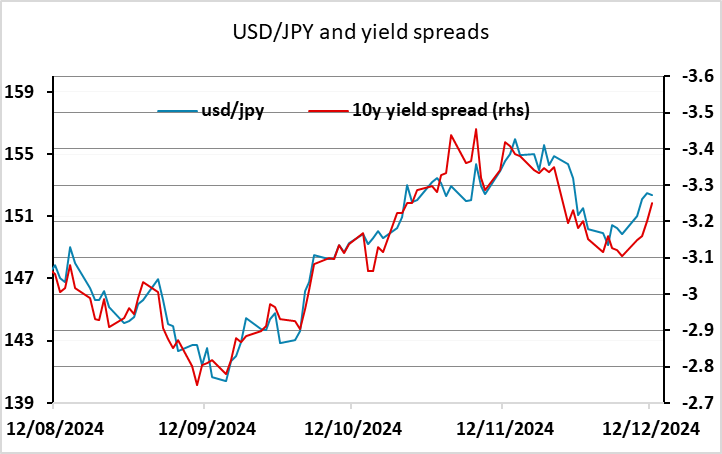

The JPY struggled overnight, with 10 year yield spreads moving in the USD’s favour and justifying most of the move up from 150 we have seen over the week. Yesterday’s reports that the BoJ may wait before hiking have fed through to generally lower yields along the curve. However, with only 6bps of tightening priced in for the December meeting, the risks may now be skewed to the JPY’s upside. We would continue to see CHF/JPY as the most clear-cut value trade in the JPY’s favour, as yield spreads have fully reversed the move up that drove the 50% gain in CHF/JPY in the last few years. However, today’s action will depend on the SNB decision at 08:30GMT. There should be scope for CHF losses if the SNB cut 50bps, which is priced as a 67% chance, but the majority (85%) of forecasters in the latest Reuters poll are only looking for a 25bp cut, which could be expected to trigger a short term CHF rally.