USD flows: USD generally lower on Powell

Powell signals September rate cut liekly. US yields lower and USD down with them. JPY leads the way

The USD has dropped in response to the Powell comments, which are being seen as a sign that a September rate cut is on the way. Powell notes downside risks to employment are rising, but also upside risks to inflation which creates a challenging situation for the Fed. Saying a policy adjustment may be warranted with rates still restrictive is seen as a green light for the September cut, which is now priced as a 90% chance from 70% before he spoke.

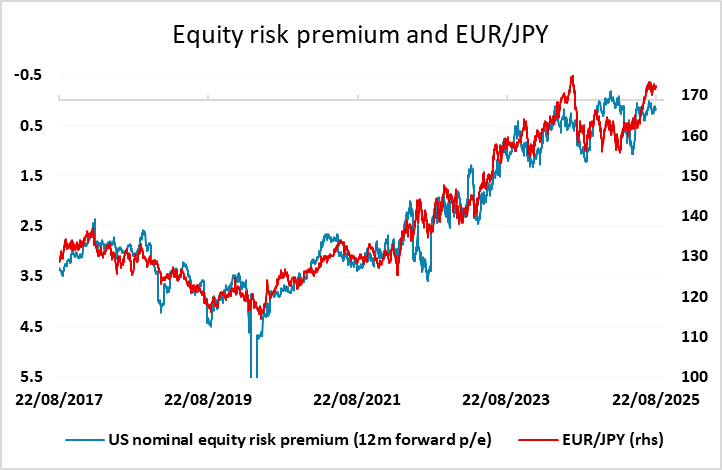

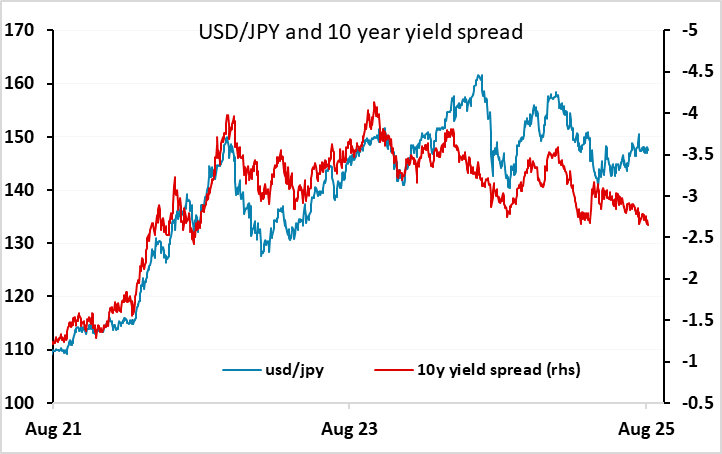

Lower yields have led to a lower USD across the board, with the JPY slightly outperforming. While equities have risen in the comments, this reflects lower yields rather than a better economic outlook, and implied risk premia have moved a little higher. The combination of higher inflation and weakening employment/growth is not normally seen as a favourable one for risk, so we would continue to favour the JPY. USD/JPY still looks a long way above levels consistent with current yield spreads. However, while a September cut looks very likely, the 128bps of cuts now priced in by the end of 2026 remains more speculative in an environment of rising inflation, so there may still not be much more downside for yields. But if yields rise, growth concerns will increase, so the risk picture looks fragile at the current high level of equity market valuation.