USD flows: Little impact from US data

Initial USD gains on US data fade

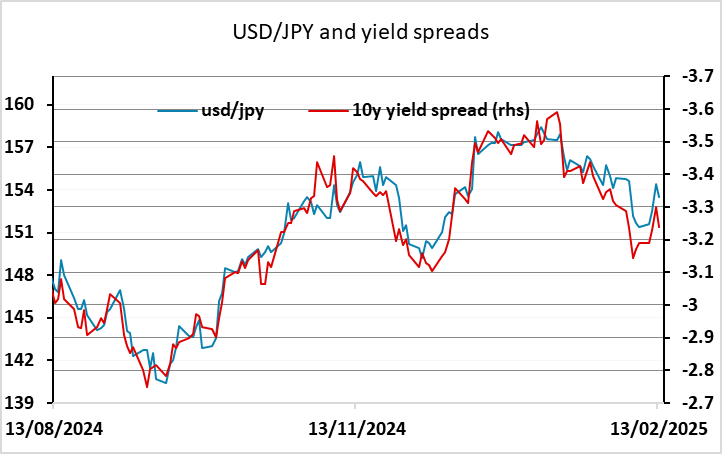

Stronger than expected US PPI and another solid jobless claims number provide the USD and US yields with some support, although the reaction has been quite muted as the numbers aren’t going to make a lot of difference to Fed policy. Initial USD gains have been reversed and some of yesterday's gains against the JPY are now being corrected. USD/JPY in any case still looks extended relative to yield spreads, so there may be scope to 153.

The market had already priced out any second Fed rate cut this year after Wednesday’s CPI data, and today’s numbers aren’t strong enough to further reduce market expectations of easing. Even so, the combination of above consensus price increases and solid labour market data makes it hard to favour any significant USD weakness near term. The USD losses against the EUR and other risky currencies seen yesterday on the back of expectations of peace in the Ukraine may be reversed further given the strength of the US data and the uncertainty around any peace deal. While risky assets are looking towards a peace dividend, the deal that Trump and Putin appear to be favouring is not one that Ukraine currently sees as acceptable. While in the end they may have no choice, a resolution seems unlikely to be entirely smooth, and it is also not clear that any deal will be favourable for the European economy, as restarting relations with Russia is unlikely to be achieved without opposition.