Published: 2024-04-05T18:05:56.000Z

Preview: Due April 16 - U.S. March Industrial Production - Bounce above weak recent trend

Senior Economist , North America

1

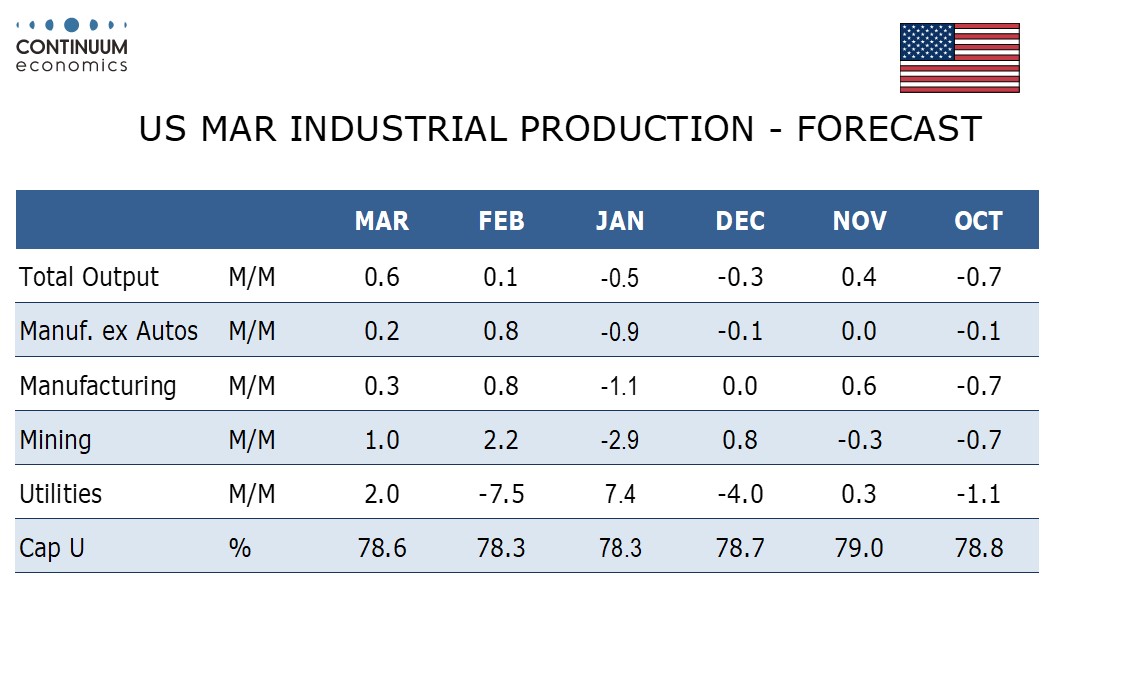

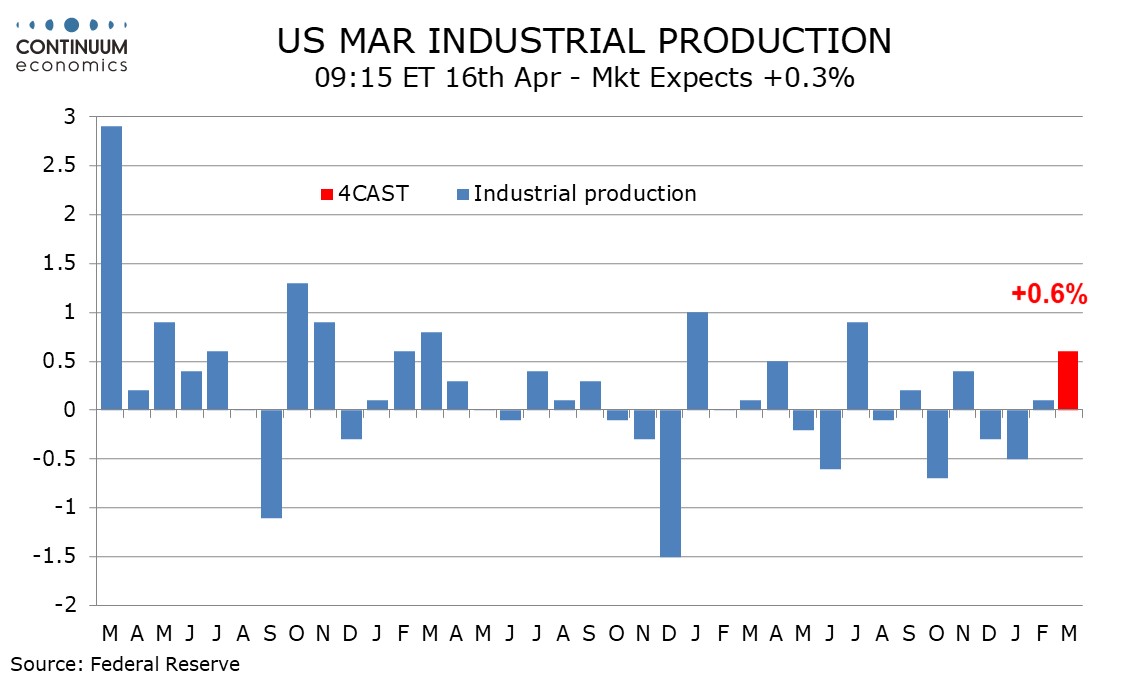

We expect March industrial production to rise by 0.6% which would be a significant improvement from a recent marginally negative trend. For manufacturing we expect a modest 0.3% increase, with a 0.2% increase in manufacturing ex autos.

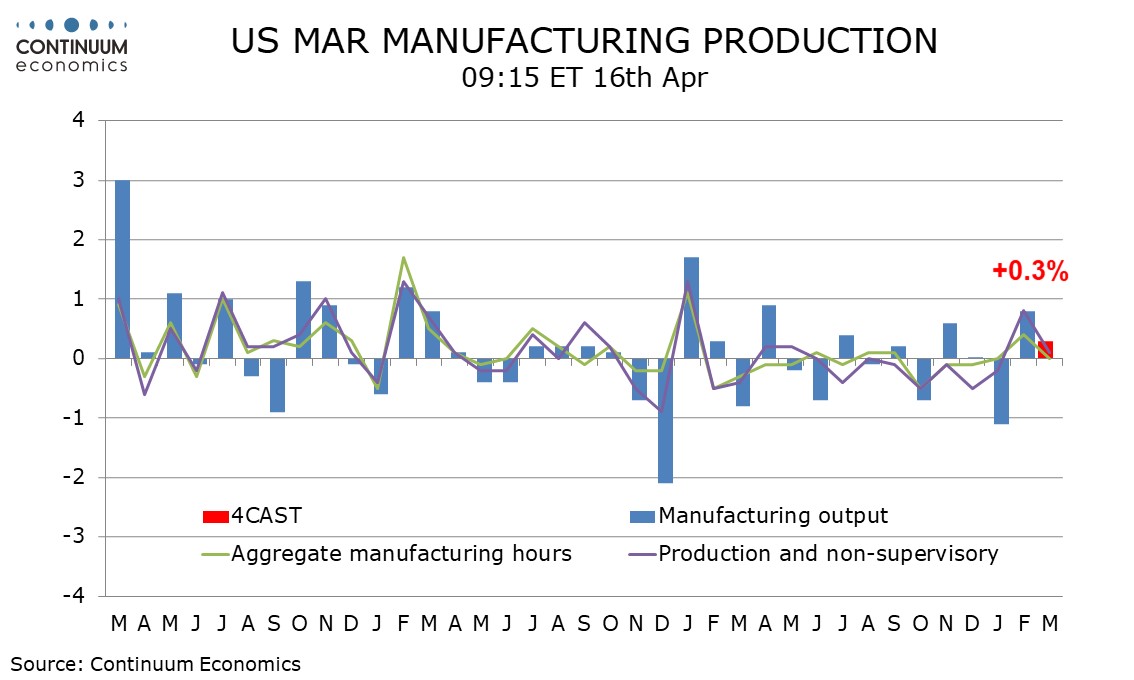

March’s non-farm payroll shows manufacturing employment and aggregate hours worked unchanged, though there was a 0.1% increase for production and non-supervisory workers. This with productivity gains should allow a modest 0.3% rise in manufacturing output, completing a reversal of January’s 1.1% weather-induced decline after a 0.8% rebound in February. The ISM manufacturing index turned positive in March for the first time in over a year.

The non-farm payroll aggregate hours data implies a 1.0% rise in mining output while utilities look set for a gain, we expect by 2.0%, after a sharp fall in February. These sectors should lift overall industrial production to a 0.6% increase.

We expect capacity utilization to ruse to 78.6% overall from 78.3% with a marginal rise in manufacturing to 77.1% from 77.0%. These would both remain below late 2023 levels.