Published: 2024-01-23T13:14:56.000Z

Preview: Due January 24 - U.S. January S&P PMIs - Remaining close to neutral

Senior Economist , North America

-

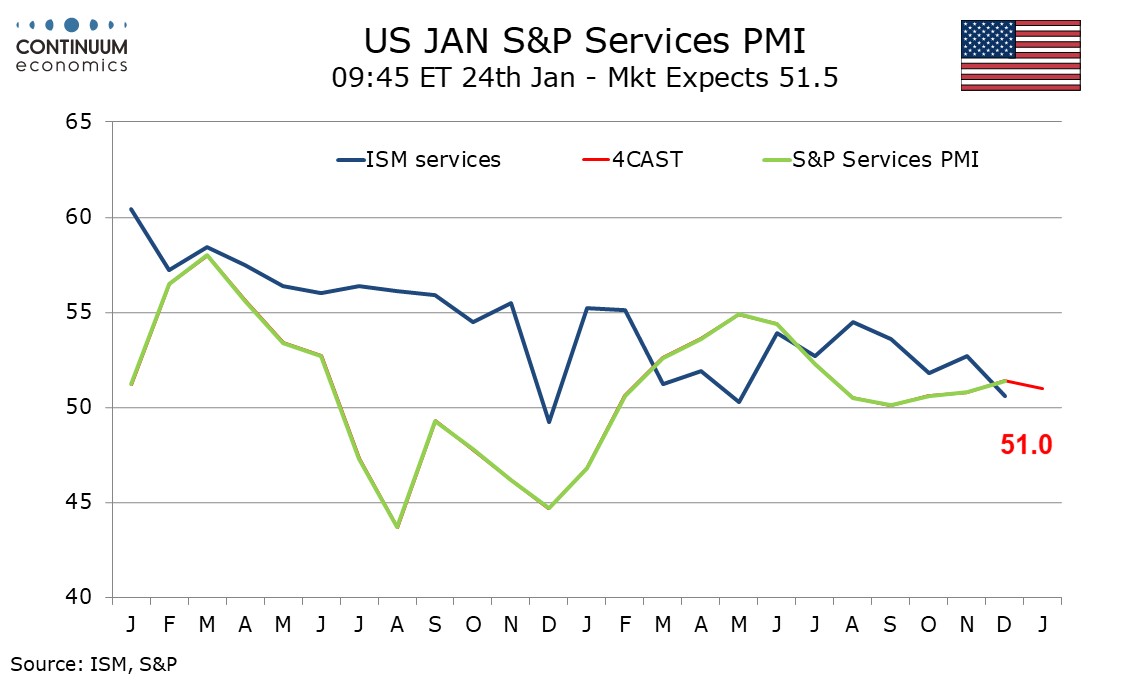

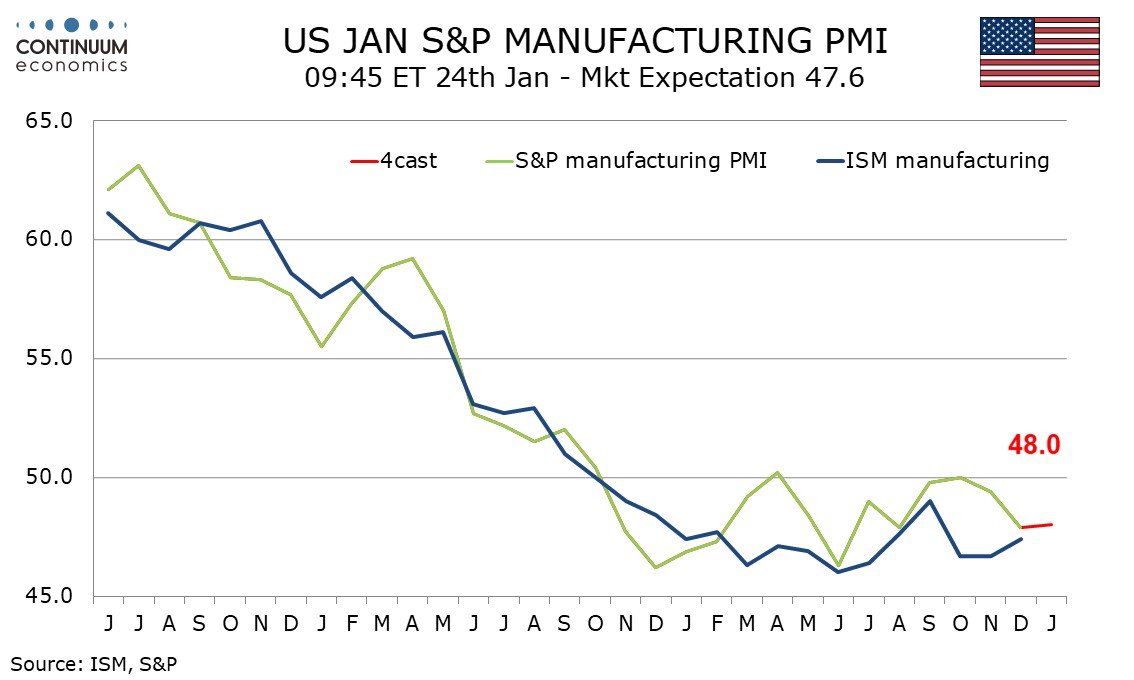

We not expect much change in January’s S and P PMIs, with manufacturing remaining marginally negative at 48.0 from 47.9 and services remaining marginally positive at 51.0 from 51.4.

Most manufacturing surveys have been showing marginally negative readings with a very weak January Empire State index probably erratic. The S and P manufacturing index has moved back into line with other surveys after reaching the neutral 50 level for the second time in 2023 in October. After two straight declines some stabilization may be due.

The ISM and S and P services indices are less well correlated than the manufacturing indices, though both are marginally positive currently. The S and P services index has seen three straight gains after falling to near neutral at 50.1 in September. This may be related to optimism on interest rates, which may fade a little in the upcoming report.