SEK flows: SEK little changed after Riksbank rate cut

Dovish sounding statement suggests some SEK downside risks

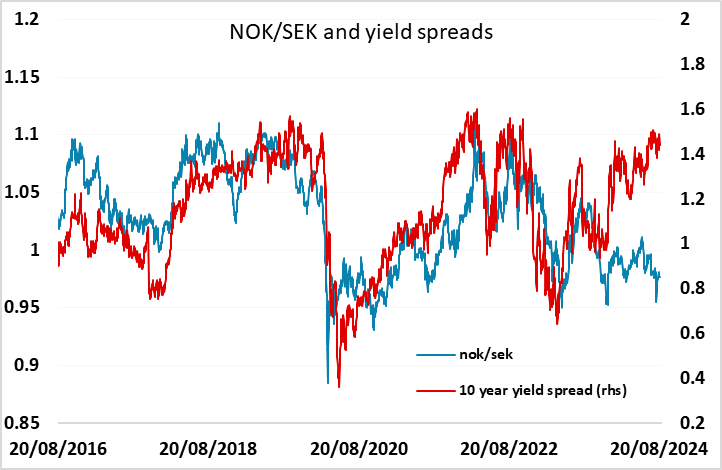

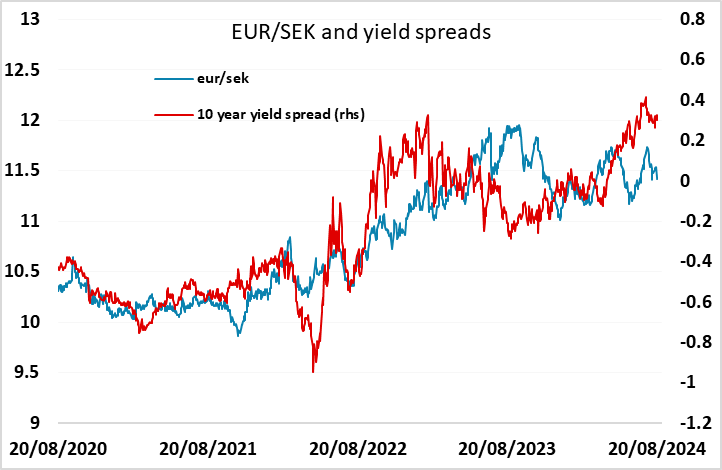

The Riksbank cut its key interest rate to 3.50% from 3.75% as expected and said it could possibly speed up policy easing ahead. "If the inflation outlook remains the same, the policy rate can be cut two or three more times this year, which is somewhat faster than the Executive Board assessed in June," the central bank said in a statement. The market is currently pricing two more 25bp cuts by December, so there is some scope for short term yields to fall further. EUR/SEK is not much changed after the decision, having dropped quite sharply yesterday afternoon. It still looks a little stretched on the downside, given the Riksbank indication that the market could price in further Swedish rate cuts. NOK/SEK remains a long way out of line with the normal yield spread relationship, but this looks to be a NOK phenomenon that has persisted through the year.