This week's five highlights

Sweden Riksbank Slightly Less Gradual

U.S. Initial Claims and GDP improve, Durables and Trade deteriorate

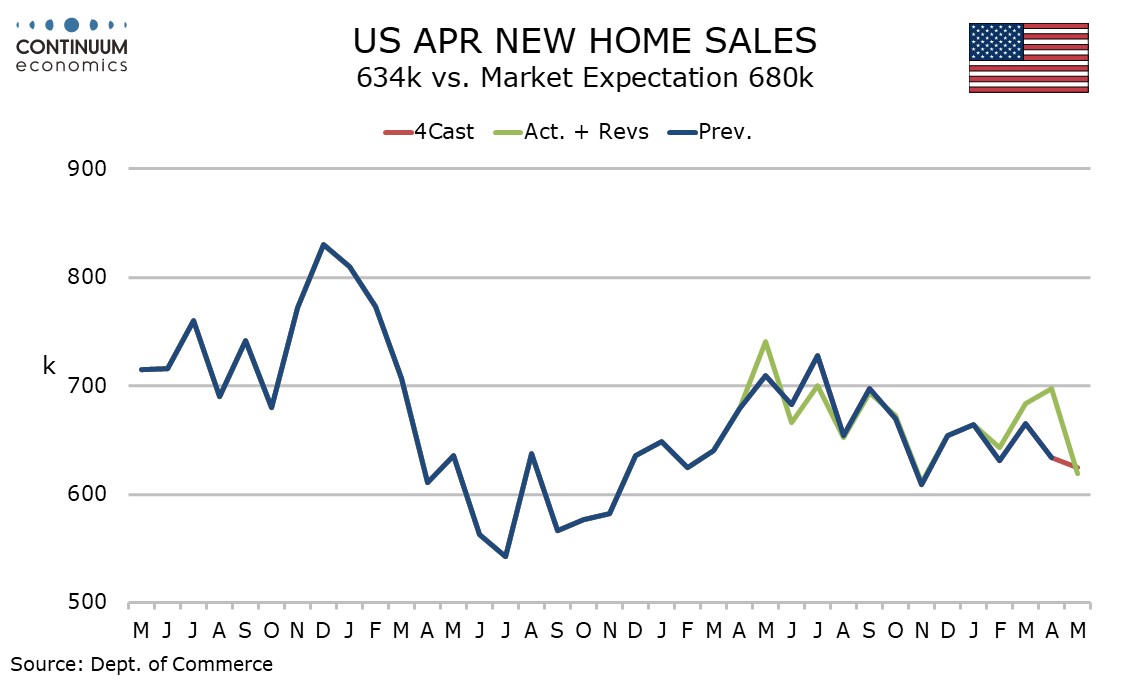

U.S. Consumer Confidence and New Home Sales

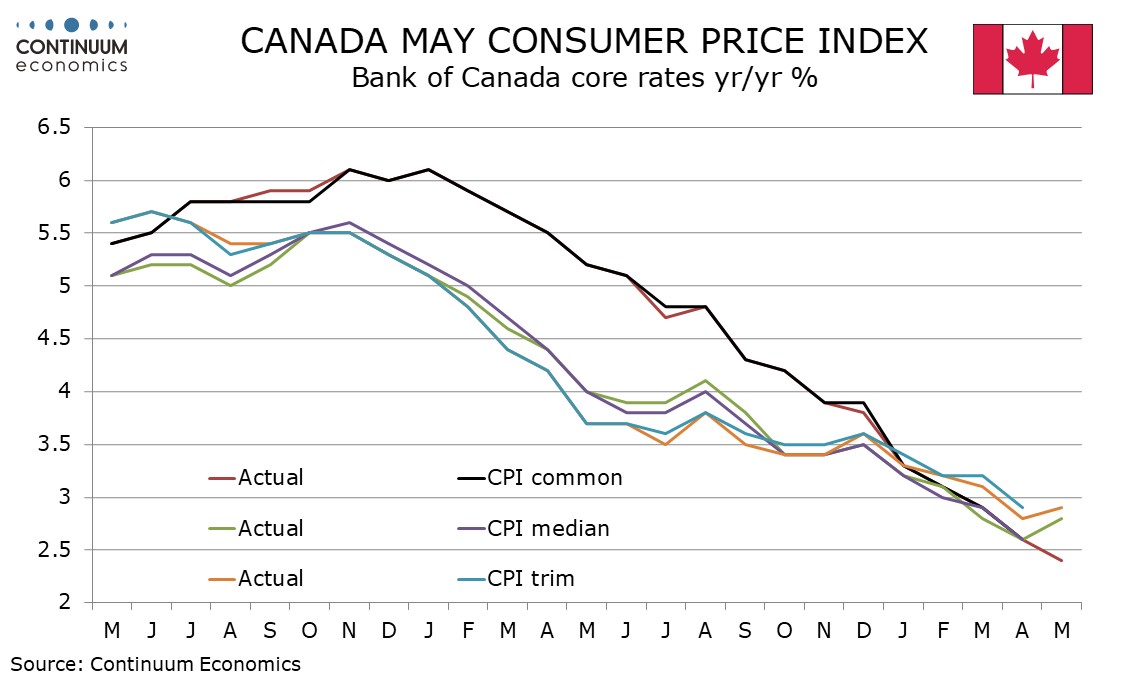

Canada May CPI strong after five straight subdued ones

USD/JPY Reaches New High

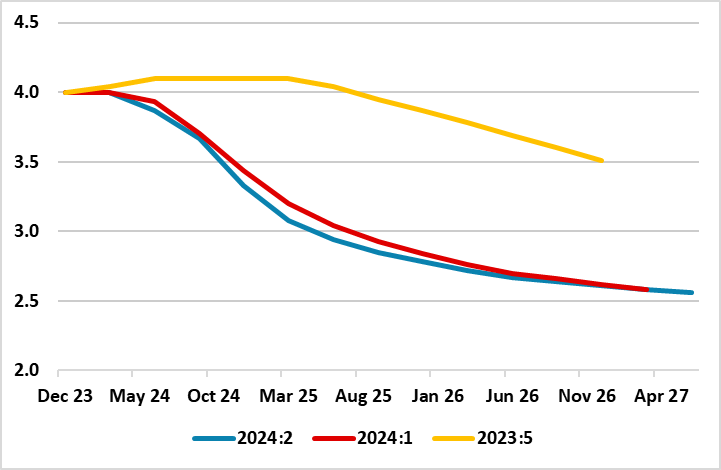

Figure : Policy Outlook Details

The Riksbank is more confident in the current disinflation process. While none expected any further cuts at this policy verdict today, especially after the 25 bp rate cut it made last month, the Board updated Monetary Policy Report suggested there may an additional such cut in H2 over and beyond the two further such moves it previously suggested. This though is merely a slightly less gradual policy easing outlook with the picture further out practically unchanged (Figure), still implying a terminal, if not perceived neutral rate of around 2.5%. Indeed, this reflects inflation returning to the 2% target at the end of the forecast horizon, the question being whether it will subsequently remain there or diverge afresh. It seems that a partly energy induced faster than previously expected fall in inflation through the coming year (Figure 2) reflects economic activity being somewhat weaker, and the krona exchange rate being a little stronger, in turn suggesting the rationale for why the forecast for the policy rate has been adjusted down somewhat. At this juncture, we stick to the two further cuts this year but also to the slightly speedier journey to a 2.5% policy rate we still see occurring by end-2025!

It was very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with Figure 1 underscoring how policy thinking has been markedly reshaped this year. By initiating easing relatively early last month, the Board was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it thinks needs to be a gradualist approach to further easing. That has not changed fundamentally, even given the slightly faster policy path now been flagged - a move is now very likely at the next meeting (Aug 20), with three meetings then left in the remainder of the year to deliver the 1-2 added cuts.

This slight shift in thinking is all the more notable given stronger than expected Q1 GDP reading and disappointing May CPI data, at least in terms of service prices. But the Riksbank (with justification) see both being aberrant. Indeed, as the Riksbank stresses the Q1 GDP jump was largely due to a temporarily large contribution from inventories, while. Interest-sensitive parts of the economy, such as household consumption and housing investment, continued to develop weakly. We would add that monthly outcomes for production and consumption, and confidence indicators for households and companies on the whole indicate weak growth during the current quarter. Meanwhile, the pick-up in the May CPI data was probably a clear aberration due to one-off special entertainment events. This disinflation is very evident in seasonally adjusted m/m core CPI readings which have showed a much softer profile prior to May, very much hinting that ex-energy (core) inflation on this basis is already undershooting target, this having persuaded the Riksbank to bring forward its forecast for CPIF annual inflation to hit target from its previous circa-Q1 2026 forecast by the Riksbank. Indeed, the Riksbank now echoes our long-standing call that CPIF inflation (the actual targeted measure) may drop below target in coming months, this all the more notable given a revised back projection of a negative output gap.

The latest round of US data is mixed but on balance we would see it as on the weak side of expectations, despite a fall in initial claims and upward revisions to Q1 GDP and core PCE price indices. Weakness is visible in advance goods trade and core durable goods orders for May.

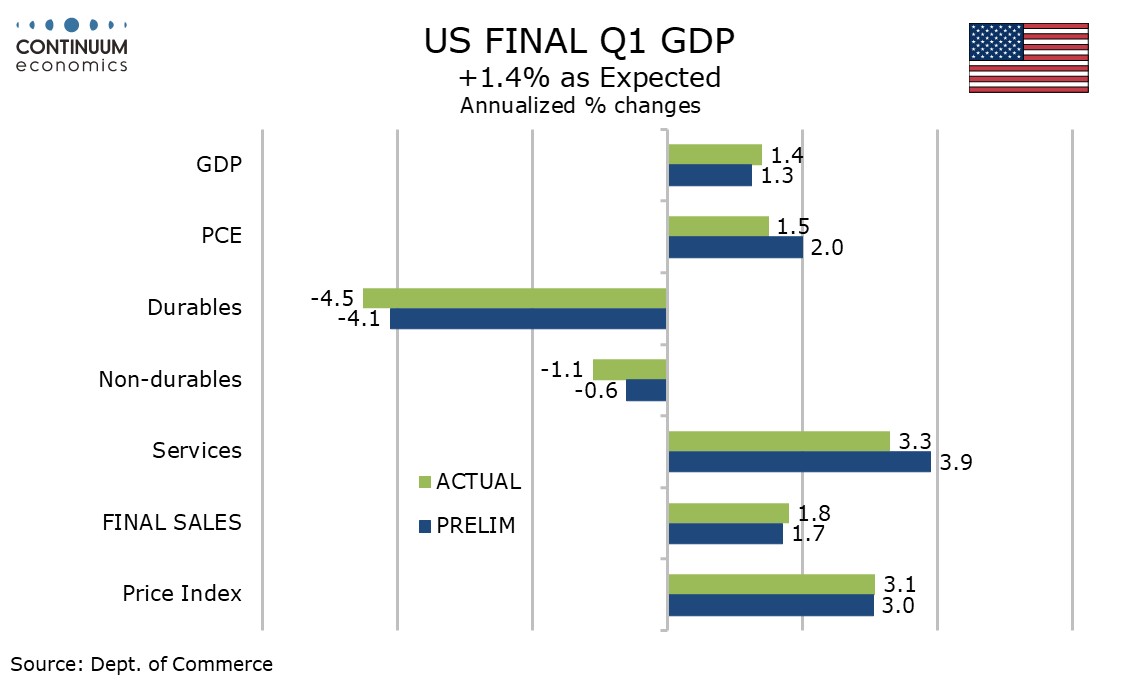

The upward revision to Q1 GDP to 1.4% from 1.3% was as expected but the upward revision to core PCE prices to 3.7% from 3.6% was disappointing. There were a few surprises in the breakdown, with consumer spending revised significantly lower to 1.5% from 2.0% with goods as suggested by retail sales revisions revised to -2.3% from -1.9% and less expectedly services revised to 3.3% from 3.9%. There were upward revisions elsewhere to business and housing investment, government and net exports, the latter with exports revised higher and imports revised lower, both revisions led by services as suggested by recent trade revisions. Inventories saw a marginal upward revision but final sales (GDP less inventories) were revised marginally higher to 1.8% from 1.7% in line with the GDP revision but final sales to domestic purchasers (GDP less inventories and net exports) were revised lower to 2.4% from 2.5%. Even with the upward revision net exports remain negative in Q1 and look set to be more negative in Q2 with the advance goods trade deficit increasing to $100.6bn from $98.0bn, extending an April deterioration. Exports fell by 2.7% after a 1.3% April increase while imports fell by 0.7% after a 3.1% April increase.

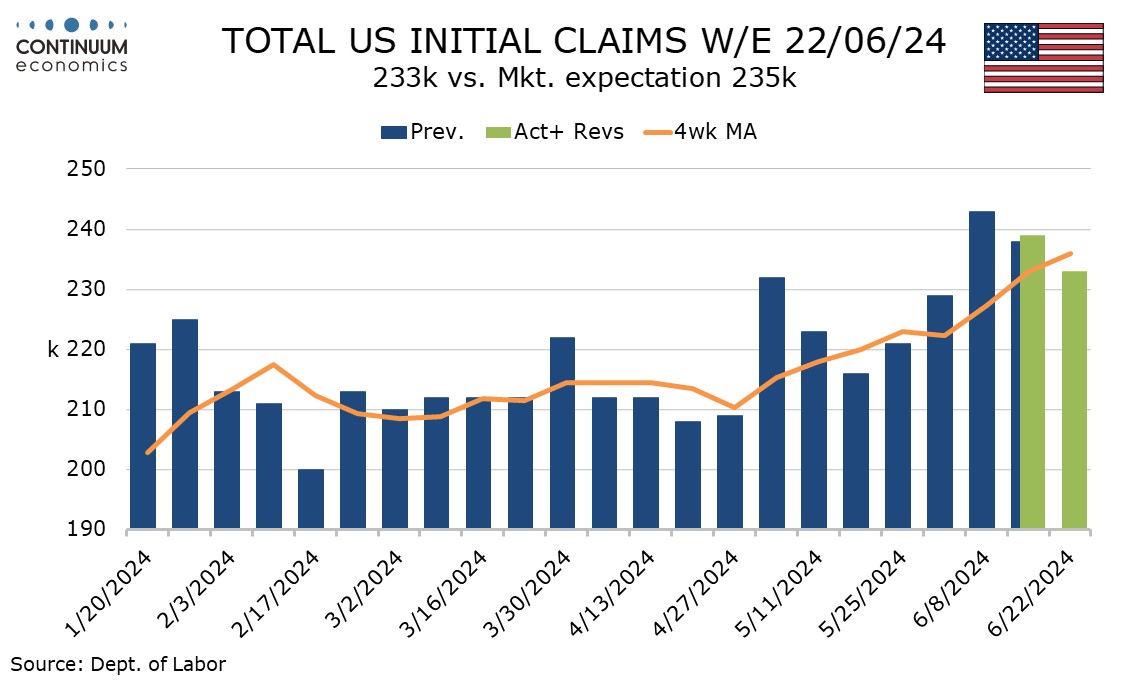

Initial claims with a 6k decline to 233k extended last week’s 4k decline though have still not fully erased the 14k spike seen two weeks ago. The 4-week average of 236k is the highest since September 2023. Continued claims, covering the week before initial claims and also the survey week for June’s non-farm payroll rose by 18k to 1.839m, an eighth straight increase and putting the 4-week average at its highest since December 2021.

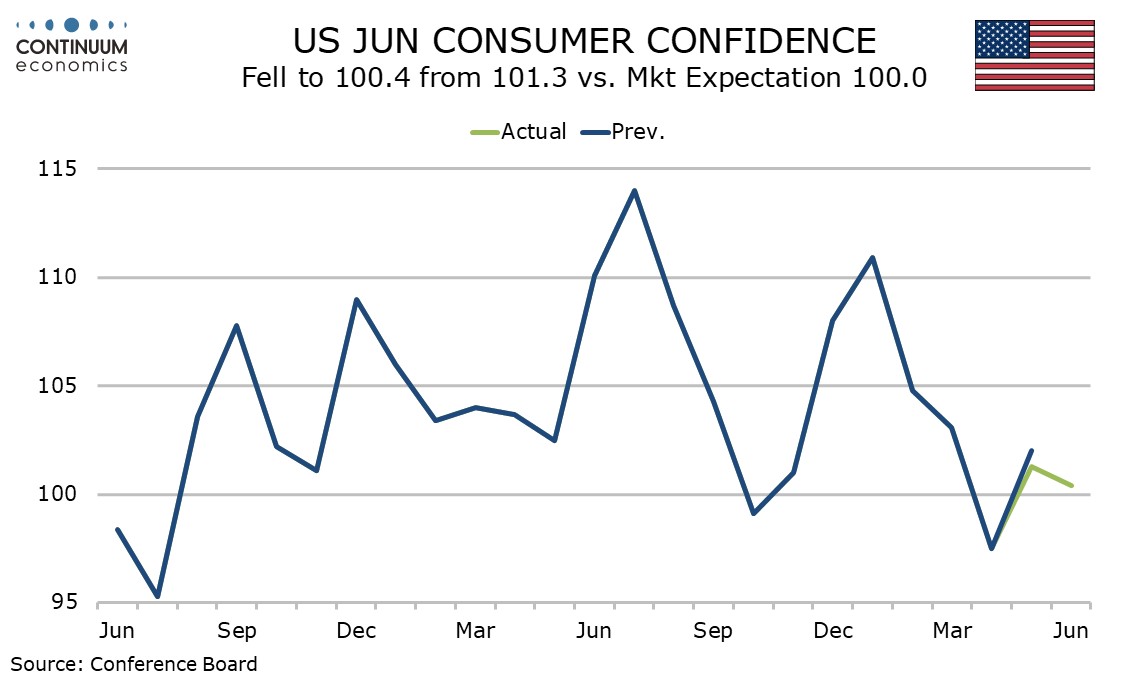

June consumer confidence is in line with expectations at 100.4, little changed from 101.3 in May and showing more resilience than a weaker preliminary June Michigan CSI reading, though not strong by recent standards. The Michigan CSI was led lower by current conditions. In this survey released by the Conference Board the present situation index was marginally improved at 141.5 from 140.8 while expectations were marginally weaker at 73.0 from 74.9. The present situation index was supported by a more positive view of the labor market, those seeing jobs as plentiful exceeding those seeing them as hard to get by a 3-month high of 24.0%, up from 22.9% in May, though well below March’s 29.5%. Inflation expectations were marginally weaker, the average 1-year view at 5.3% from 5.4% and the median at 4.3% from 4.4%, both returning to April levels after a marginal increase in May. The contrast between Conference Board resilience and the Michigan CSI falling to its lowest since November is not easy to explain, but the Conference Board data tends to be more sensitive to the labor market, where iys June findings were stronger.

May’s 619k total for new home sales is a little weaker than expected, but the 11.3% fall from April is sharp given that April was revised to 698k from 634k and leaves the net total higher than expected. We do however believe that trend in home sales is starting to move lower. April’s revised number is the highest since July 2023 while the May number is the lowest since November 2023. Underlying trend appears marginally negative over the past year but with plenty of volatility, with April’s strength moving above trend. That May is weaker could be corrective, and as April’s data shows could still see a significant revision. However the May dip is consistent with signals from the NAHB homebuilders’ survey which also suggests further slippage in June. Housing starts and permits also weakened in May. Price data was mixed with the median down by 0.1% on the month and down by 0.9% yr/yr while the average rose by 3.2% on the month fir a 4.9% yr/yr increase. The median is trending near zero on a yr/yr basis while the average has seen five straight moderately positive yr/yr outcomes.

May’s Canadian CPI at 2.9% yr/yr from 2.7% has surprised on the upside and while the BoC will have June CPI data too to look at before its next meeting on July 24 this data makes a second straight easing at that meeting less likely. The data on the BoC’s core rates is mixed with CPI-median at 2.8% from 2.6% and CPI-trim at 2.9% from 2.8%, though CPI-common slipped to 2.4% from 2.6%. The BoC trends to see the former two as more important than CPI-common so they are likely to see the data as disappointing.

On the month CPI rose by 0.6% both overall and ex food and energy before seasonal adjustment with the seasonally adjusted gains 0.3% overall and 0.4% ex food and energy, the latter the strongest since July 2022. The preceding five months have not even seen a 0.3% adjusted ex food and energy gain, though April was revised up to 0.2% from 0.1%. Seasonally adjusted data shows strength most pronounced in health and personal care at 0.7% and recreation, education and reading at 0.6%. Shelter remains quite firm at 0.4% but slowed from 0.5% in April. While one strong month after five straight subdued ones is not a clear sign of an acceleration in trend it is a warning that even a lengthy string of subdued data is not grounds for complacency. The United States saw two straight subdued quarters in late 2023 before a strong quarter in Q1 2024. The BoC cannot exclude the possibility that we may see a multi-month correction higher after a multi-month soft streak.

USD/JPY has busted though 160 figure and reached the 161 figure after Presidential debate on Friday. While the pace of rally is not as rapid as previous upmove, such weakness in JPY will be unfavorable in the eyes of MoF. While it is difficult to gauge exact intervention interval, the MoF may take their time in allowing market to adjust FX rates for the BoJ will be announcing plans to cut bond purchase in July and potentially hike by 10bps as per our central forecast. However, if the pace of rally accelerates, there is a good chance the BoJ will need to intervene to slow the JPY weakness.

On the chart, the consolidation below the 160.87 high has given way to break to fresh high through the 161.00 to extend the underlying bull trend. Higher will see scope to the 162.00/163.00 congestion area. Beyond this, if seen, will shift focus to the 164.05/164.95, the December/November 1986 highs. Meanwhile, support is raised to the 160.00 level and this should limit corrective pullback. Break here, will turn focus lower to extend deeper correction to the 159.00 level then the strong support at the 158.00/157.70 area.