Published: 2024-07-23T14:30:56.000Z

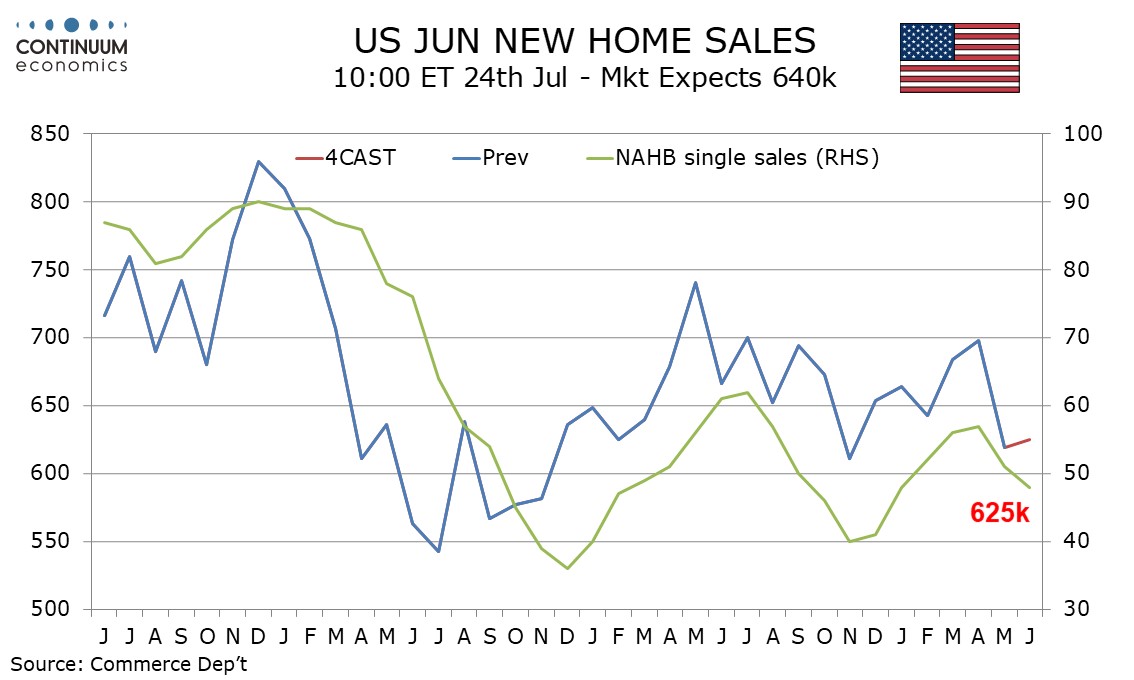

Preview: Due July 24 - U.S. June New Home Sales - A modest correction after a steep May decline

1

We expect a modest 1.0% increase in June new home sales to 625k, which would correct a 11.3% decline in May that more than fully reversed two straight preceding gains. This assumes no revision to May’s data though new home sales often see significant revisions.

The NAHB homebuilders’ index extended a May dip in June but a further dip in new home sales would put the series near the 2023 low of 611k seen in November, when the NAHB index was weaker than seen in June 2024. This suggests scope for a correction from May’s steep decline in new home sales. We expect sales in the Northeast and South to correct from steep May declines, but the Midwest and West to extend more moderate May declines to confirm a weakening in trend.

Trend in prices looks subdued and on the month we expect no change in the median but the average to correct lower by 2.0% after a bounce in May. This would see the median yr/yr pace at 0.0% versus -0.9% in May and the average sling to 0.4% yr/yr increase from a 4.9% rise in May.