JPY flows: JPY testing recent highs

JPY testing recent highs on yield spreads and risk aversion

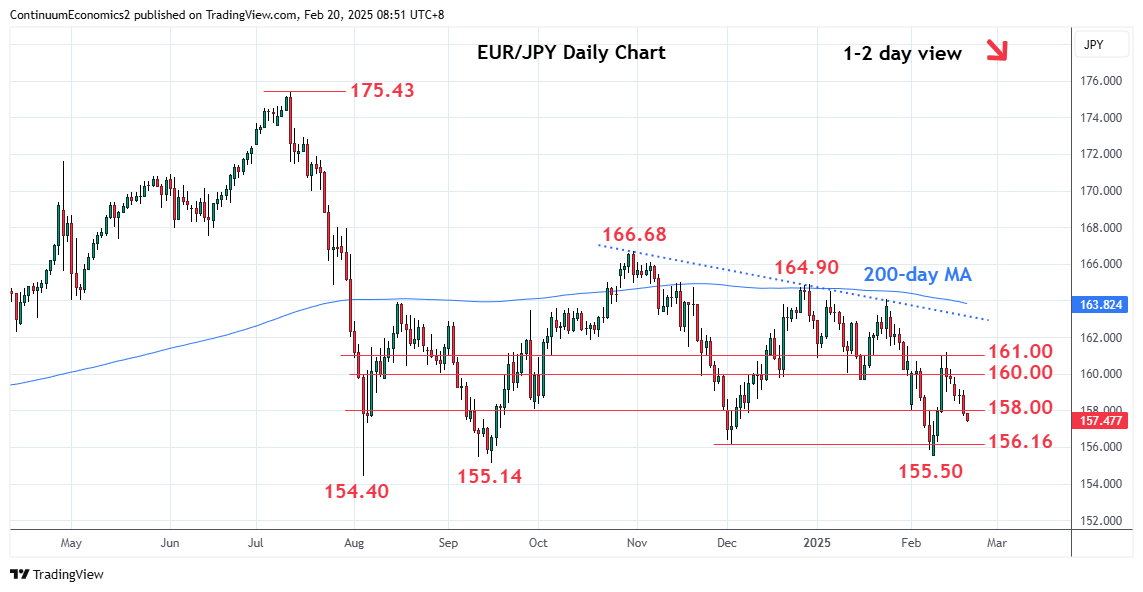

JPY strength has been the main feature overnight, helped by weaker regional equities which have been undermined by the latest volley of tariff threats from Trump. There have also been some comments from former BoJ board member Sakurai suggesting the possibility of another rate hike as early as May. Currently the market is looking at the July/September meetings as the likely time for the next move. USD/JPY has hit its lowest since December, briefly dipping below 150, and yield spreads still suggests there is scope for further losses. JPY crosses are also testing support, with the 154.40-155.50 area in EUR/JPY containing several lows seen in the last six months. We continue to expect further declines in USD/JPY in the longer term, but we may need some more clear-cut news to break this support area in EUR/JPY and the 148.64 low from December in USD/JPY. It’s a quiet calendar today with not much due until the US jobless claims and Philly Fed survey later, but the USD and JPY may be generally on the front foot due to the Trump tariff threats and the negative equity market response in Asia, which could spread to Europe this morning.