Preview: Due May 27 - U.S. April Durable Goods Orders - Aircraft to plunge, ex transport also seen lower

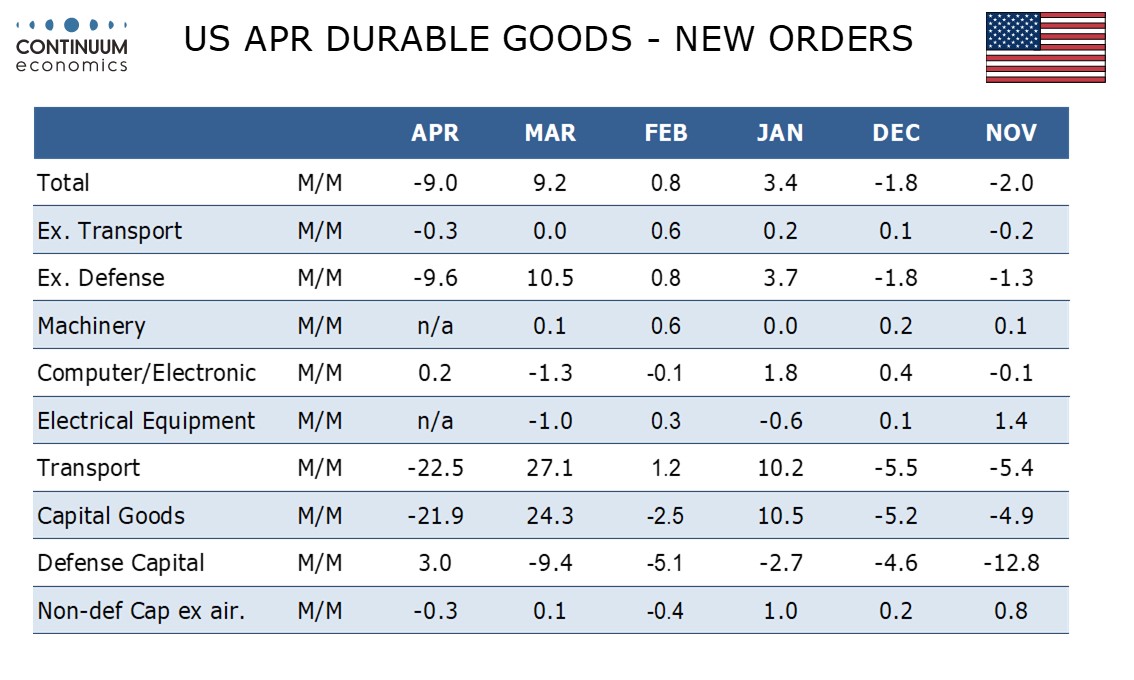

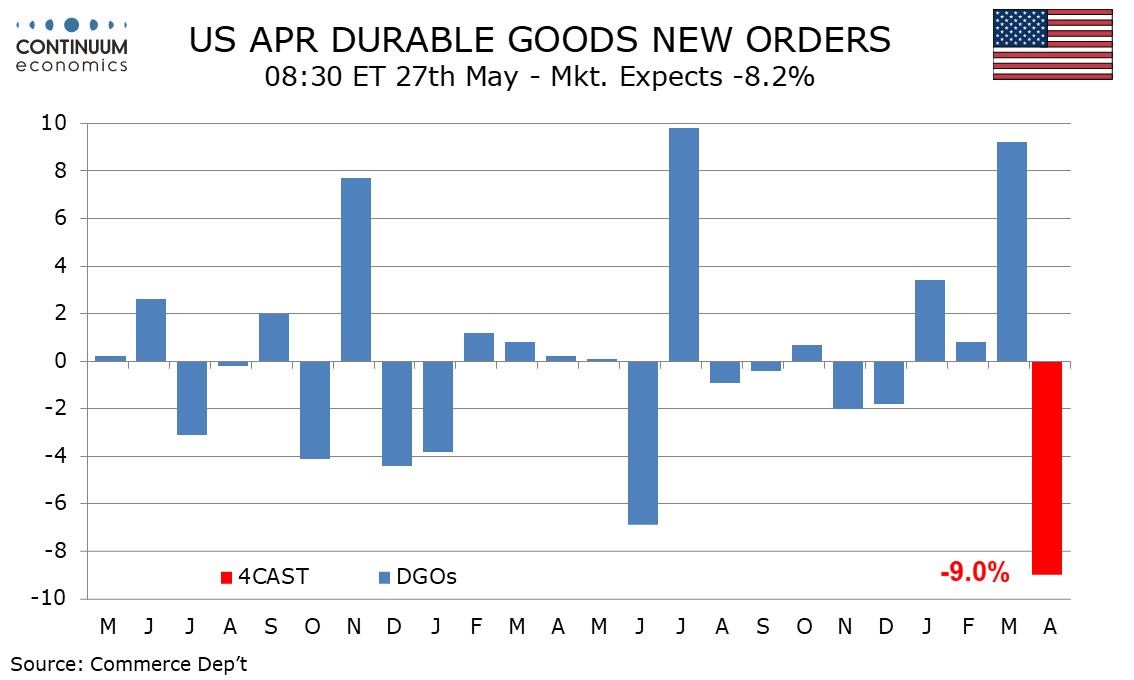

We expect April durable goods to fall by 9.0% after a 9.2% increase in March. The fall will be largely on a reversal a of a March surge in aircraft, but we expect a 0.3% decline ex transport, which would be the first fall since November 2024 and the steepest fall since January 2024.

After a sharp rise in March Boeing orders saw more than a full reversal in April and this should lead a plunge in transport orders. We also expect autos to slip after two straight gains. We do however expect an upward correction in defense, which has a significant overlap with transport, even if trend in defense is now negative. Ex defense, we expect orders to fall by 9.6%.

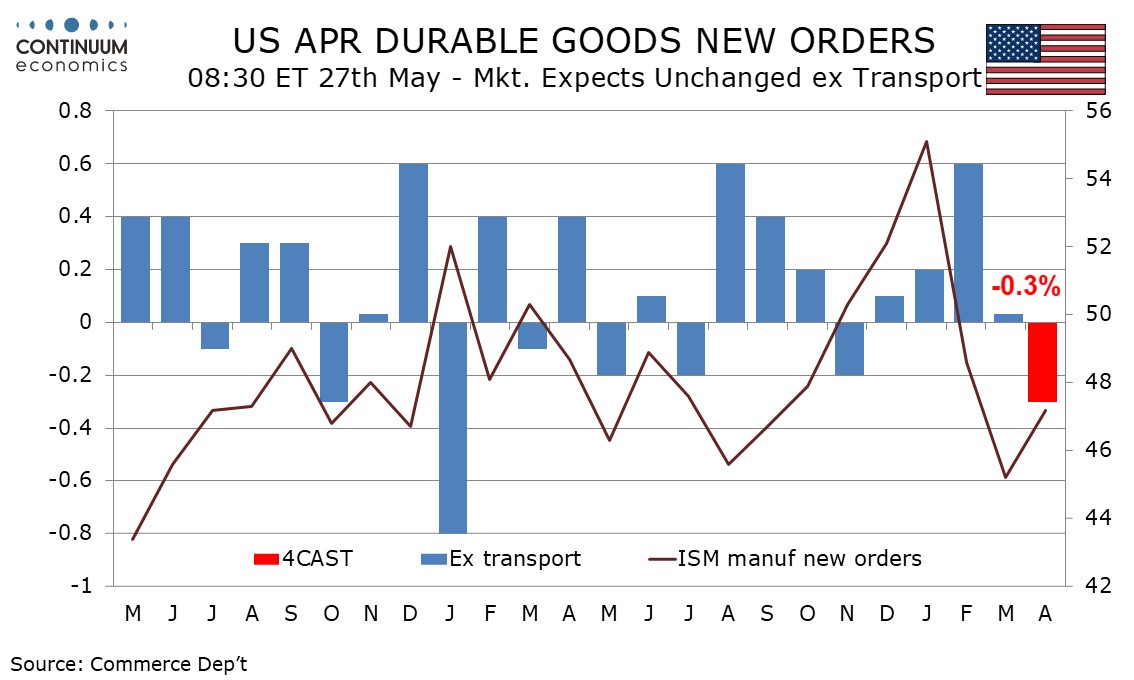

Ex transport orders showed some strength in February with a 0.6% increase which followed a strong January ISM manufacturing new orders index. March ex transport orders were flat though iSM data was very weak, and this should lead weakness in April ex transport data even with a modest upward correction in the ISM data.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to also fall by 0.3, also showing loss of momentum. Recent data for durable goods orders generally may have received some support ahead of tariffs and weakness in April could persist through Q2.