Preview: Due September 5 - U.S. August ISM Services - Unlikely to match strong S&P Services PMI

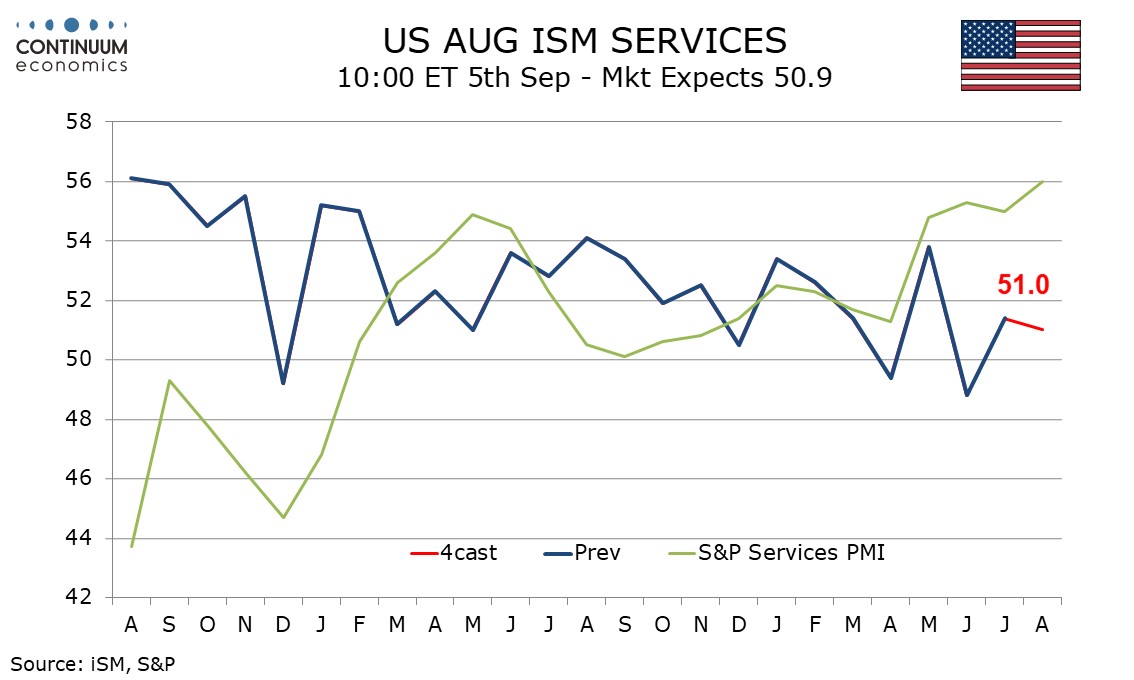

We expect August’s ISM services index to slip marginally to 51.0 from 51.4. This would be consistent with a gentle underlying slowing in trend that has been visible over the last two years, albeit with plenty of volatility around the gentle slowing in trend.

This would contrast a stronger S and P services PMI for August which the ISM services index does not have a good relationship with. The S and P index is currently trending higher in what appears to be a response to rising expectations for Fed easing. Regional Fed service sector surveys for August are mixed, but on balance subdued, with modest positives from Kansas City, Dallas and the Empire State surveys, but significant negatives from the Richmond and Philly Feds.

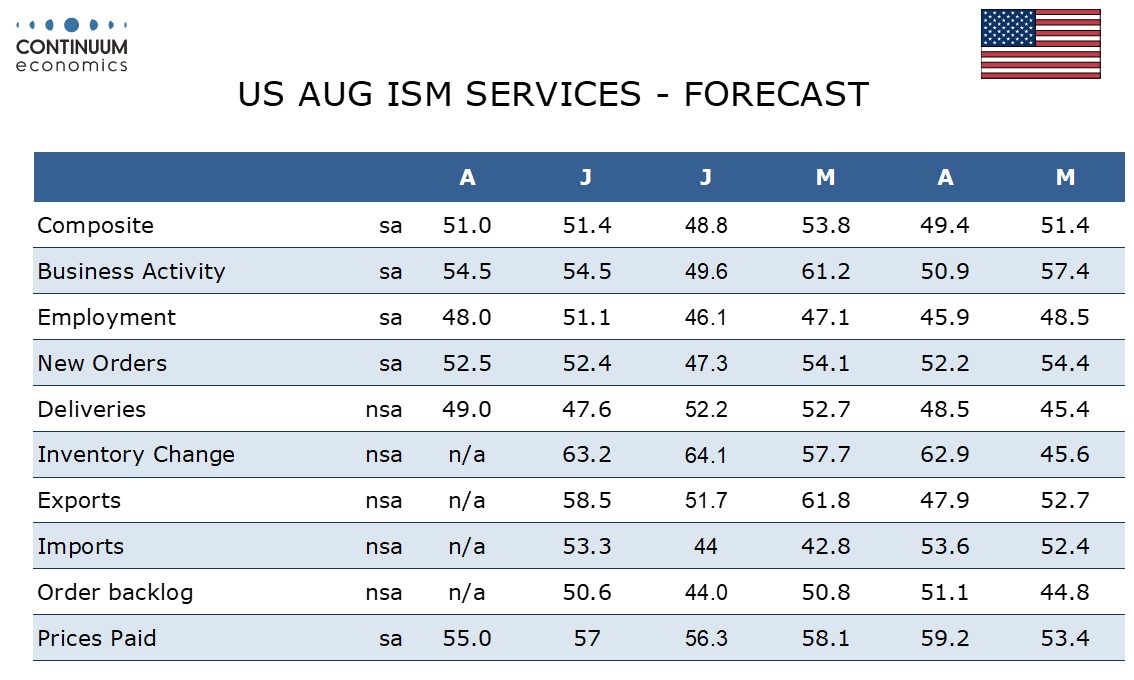

In the ISM services detail we expect new orders at 52.5 and business activity at 54.5 to be almost unchanged from July. However employment is unlikely to sustain a July move above neutral for the first time since January and we expect a correction lower in employment to outweigh a correction higher in delivery times. Prices paid do not contribute to the composite. Here we expect a modest slowing to 55.0 from 57.0 which would be the slowest since March, though trend has little direction.