JPY flows: JPY bids continue with BoJ suspected

JPY remains well bid, with talk of some official intervention, though no confirmation. Some support likely above 157 initially.

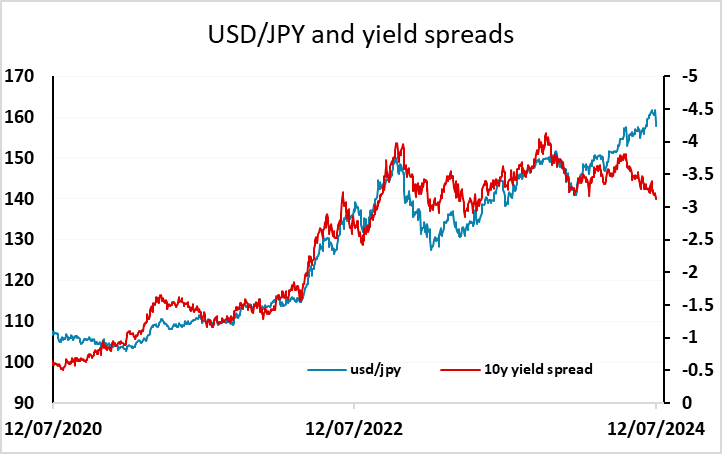

There is no real clarity on whether the BoJ have been involved in the JPY’s gains today. Although the BoJ daily data suggests there was some intervention after the US CPI data yesterday, it isn’t 100% clear, and there has been no official admission. Today’s JPY gains also might have some official involvement, but after the long JPY decline in the last few weeks/months/years it is also the case that there are likely to be a lot of short JPY positions in the market, so there could be some big position unwinding going on as well. Certainly, if the market believes that the Japanese authorities are making a stand here, it would be sensible to square up some profitable JPY short positions. From a bigger picture perspective, there is still a lot of downside risk for USD/JPY, with the losses of the last couple of days barely making a dent in its long-term overvaluation. Even the shorter-term correlation with nominal yields still suggests scope for substantial declines. But some will be reluctant to give up the long term uptrend, and this may mean bids come in near the short term trendline support near 157. However, if this breaks there may be scope down to the bottom of the longer-term trend channel, currently around 147, which is broadly in line with where nominal yield spreads currently suggest is appropriate.