This week's five highlights

Ukraine War Update

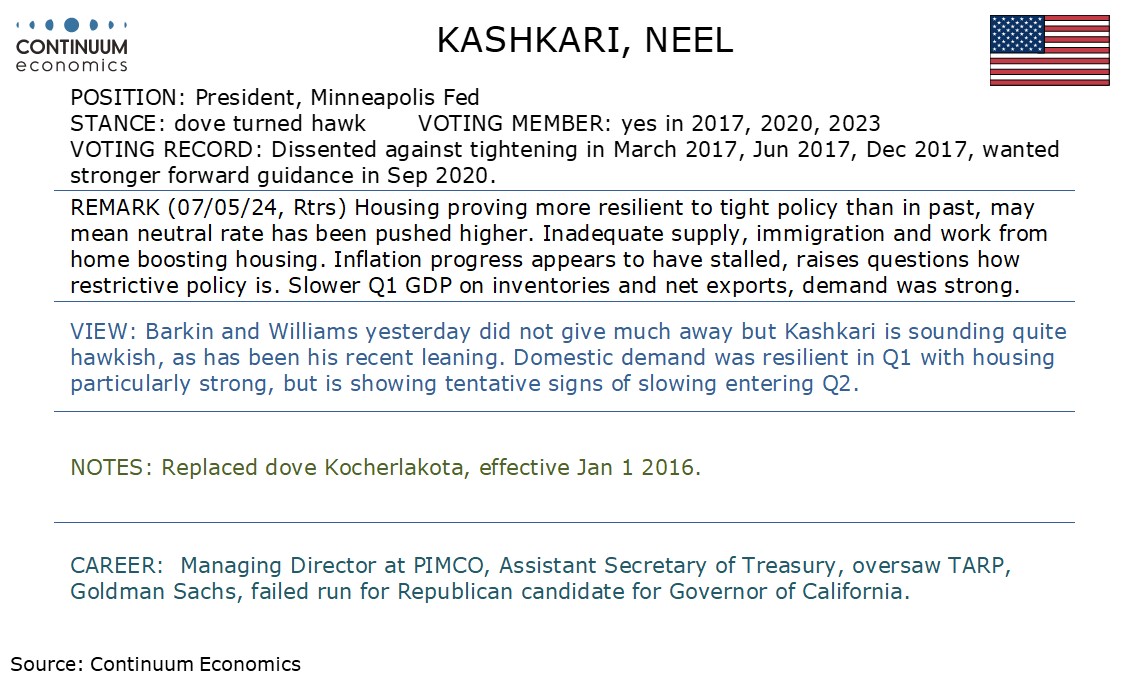

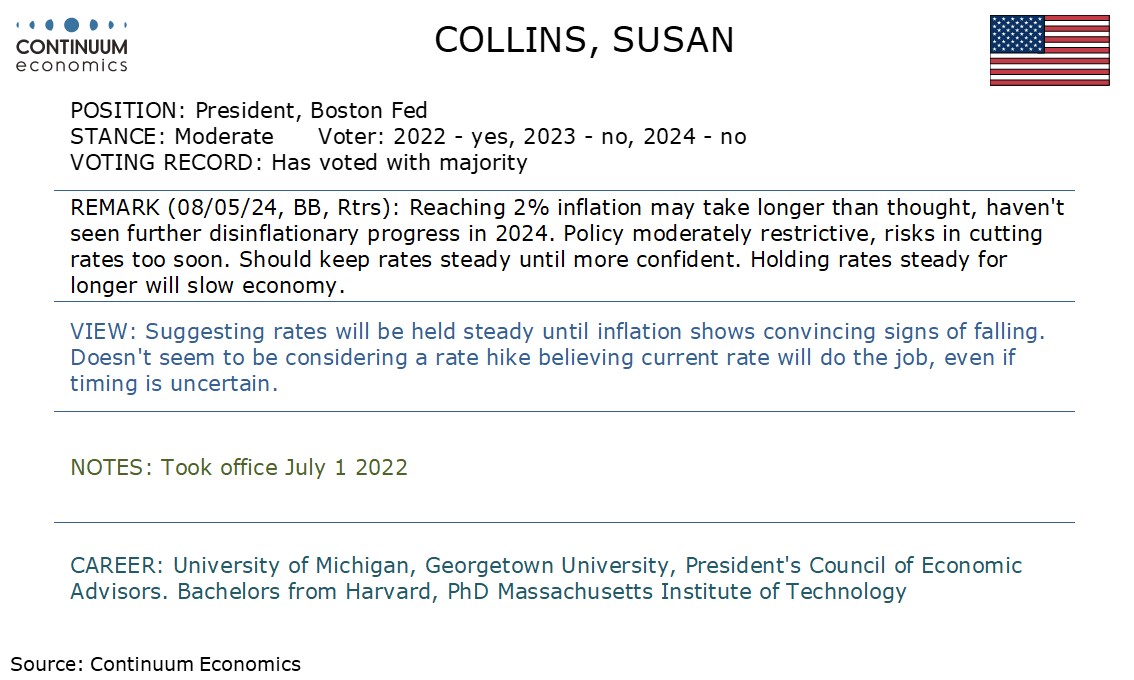

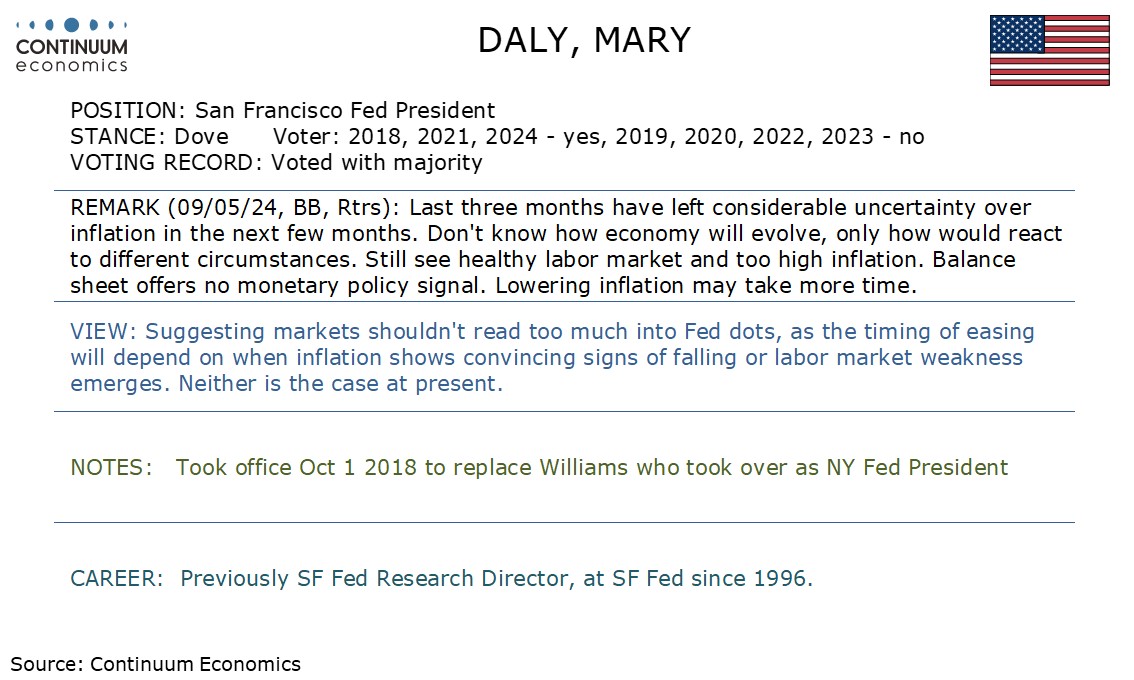

This Week's Fed Speakers

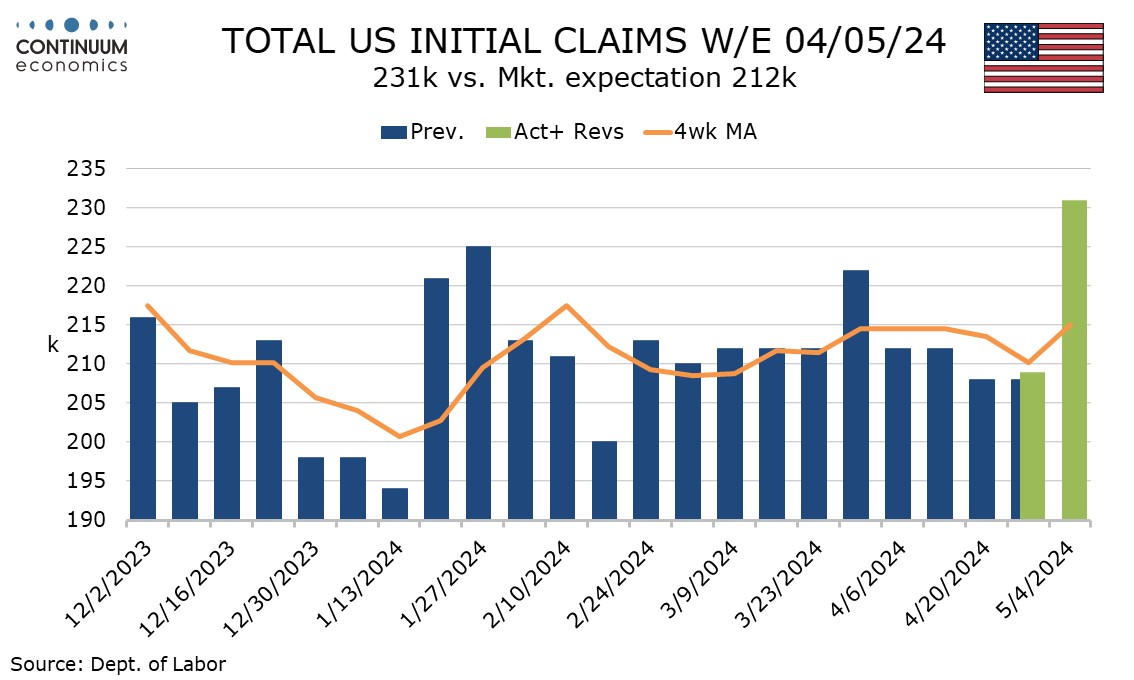

U.S. Initial Claims rise but signs of labor market slowing still tentative

RBA Change wordings of guidance but no change in heart

UK GDP Shows Clearer Growth Momentum But Mainly Import Led

The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion wartime aid package for Ukraine late April. Military analysts consider that it would probably be summer at best, and year’s end at worst, before Ukraine can stabilize its front lines with the new infusion of aid. We think the fate of the war will be determined by the U.S. presidential elections as Putin continues to hope that Trump is reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal with current territories, likely in 2025.

According to sources, Russian forces already made significant tactical gains as Ukraine waits for U.S. security assistance to arrive at the front lines. The tempo of Russian offensive operations is currently higher in the Avdiivka direction and near Chasiv Yar, as Chasiv Yar is a critical point which would likely provide Russian forces with the opportunity for more operationally significant advances.

Ukrainian officials recently indicated that Russian forces in Ukraine have not significantly increased in size in recent months but that the Russian military continues to improve its fighting qualities overall despite suffering degradation, especially among elite units since the start of the war. On this matter, ISW recently highlighted that Russian military will likely maintain its current personnel replacement rate and will not generate the significant number of available personnel needed to establish strategic-level reserves for larger-scale offensive operations in 2024.

Initial claims at 231k from 209k in the first week of May are the highest since August 26, and coming after a slower payroll gain for April add to what remain tentative hints of labor market cooling. We see no obvious special factors behind the latest rise in initial claims. Before seasonal adjustment claims also increased, by 19.7k to 209k. The initial claims 4-week average of 215k is still quite low, with the latest higher figure coming after two straight numbers marginally below recent trend.

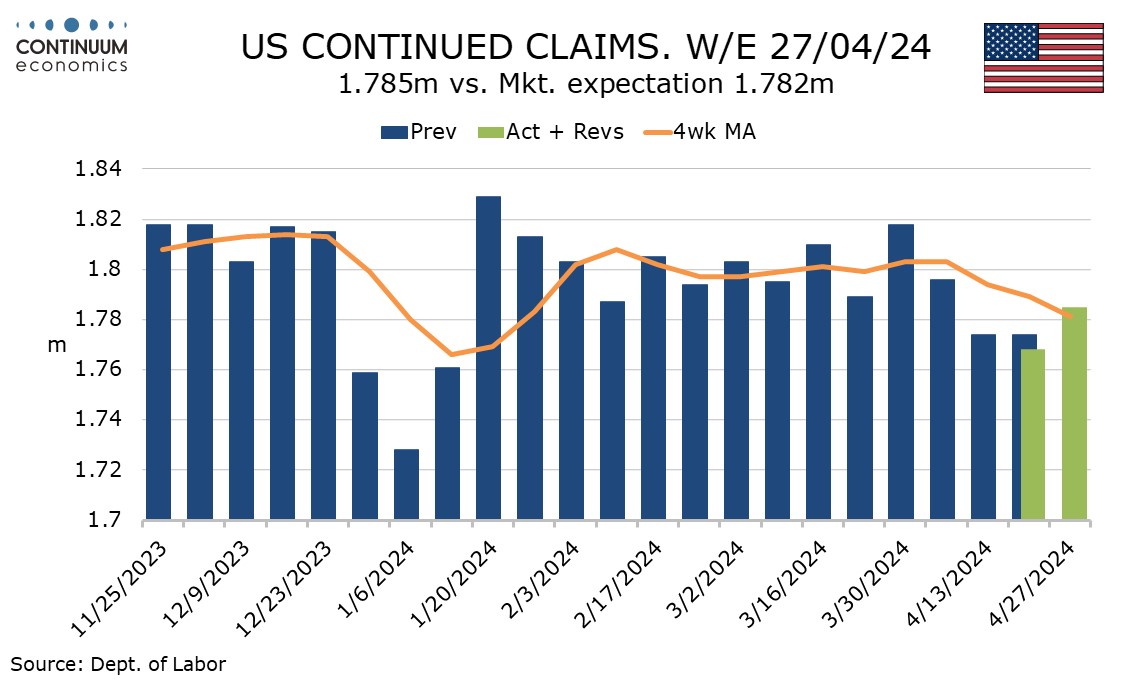

Continued claims, which cover the week before initial claims, saw a modest 17k increase to 1.785m though this comes after three straight declines and the 4-week average of 1.781m is the lowest since January 20. The labor market still looks tight, with signs of a loss of momentum still tentative.

The RBA has kept the cash rate on hold at 4.35% as per our forecast. The current inflation picture does not support any change of monetary policy from the RBA despite the latest quarterly CPI showing a 3.6% y/y growth, 0.2% above consensus. The key forward guidance statement of "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out." has been changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out. The Board will rely upon the data and the evolving assessment of risks." but the meaning of data dependency did not change. RBA continue to forecast inflation to be back in target range in mid 2025 but indicated the path will not be smooth.

The decision is in line with RBA's rhetoric of being data dependent and patient in assessing the effect of cumulative hikes while keeping a close eye on inflation dynamics. Bullock's remark on further tightening maybe needed if inflation stay high is followed by such is not RBA's central forecast. RBA will prefer not to further tighten because the Australian economy is showing early signs that growth will be slower in 2024 and the room for RBA to tighten without significantly hindering economic growth remains minimal. The household balance sheet are restricted by mortgage cost and inflationary living pressure, while business are facing the tightest financial conditions in months, alongside peaking labor market even as the Australian economic growth being stronger than market consensus. Preliminary data suggest that domestic demand will weaken significantly in Q1 2024, further weighing on RBA's decision to tighten more.

RBA highlights service inflation continue to moderate slower than expected, household consumption weakens and global outlook uncertainty as key risk towards their forecast. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025. We maintained our forecast of terminal rate to be 4.35% before seeing two 25bps easing in H2 2024 .

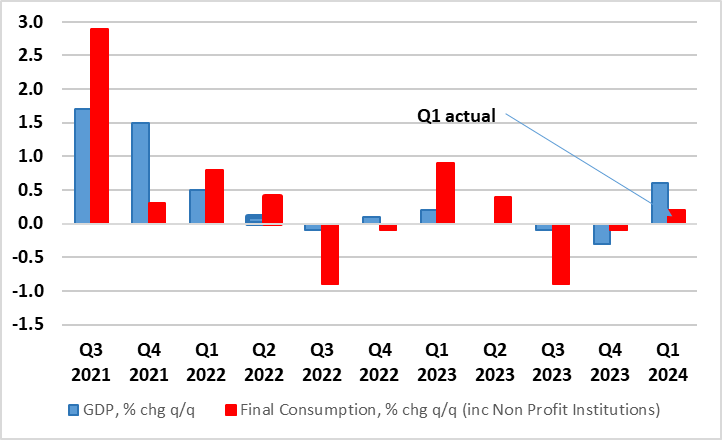

Figure: Clearer Recovery – GDP Jumps but Consumer Still Fragile?

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded bounce in the two previous months, a result that is a move away from of the monthly swings seen of late. The data resulted in a very clear end to the modest recession seen in H2 last year and also exceeded BoE thinking as Q1 growth jumped by 0.6%, an outcome dominated by a boost from net trade, mainly a sharp fall in imports, hardly indicative of firmer demand - perhaps the opposite. Regardless, it is clear that for the BoE it is price and cost data that are shaping policy thinking and these numbers alone will not defer any rate cutting that forthcoming CPI and wage data may create. Moreover, there are still areas of concern, with the latest BoE Agents survey pointing to weakness in consumer spending on goods and services in Q1 and as a result revising down their expectations of growth for 2024.

Monthly real gross domestic product (GDP) is estimated to have grown by 0.4% in March 2024, following growth of 0.2% in February 2024 (revised up from 0.1%) and an unrevised growth of 0.3% in January 2024. Real gross domestic product is estimated to have grown by 0.6% in the three months to March 2024, compared with the three months to December 2023. On a quarterly basis, this gives growth of 0.6% in Q1, following declines of 0.3% in Quarter 4 (Oct to Dec) 2023 and 0.1% Quarter 3 (July to Sept) 2023. Services output grew by 0.5% in March 2024, following growth of 0.3% in February 2024 (revised up from 0.1% growth in our previous publication), and grew by 0.7% in the three months to March 2024; services output was the largest contributor to the growth in GDP on both the month and the three months to March 2024. Production output grew by 0.2% in March 2024, following growth of 1.0% in February 2024 (revised down from 1.1% in our previous publication), and grew by 0.8% in the three months to March 2024. Construction output fell by 0.4% in March 2024, following a fall of 2.0% in February 2024 (revised down from a 1.9% fall in our previous publication), and fell by 0.9% in the three months to March 2024.