Preview: Due April 23 - U.S. April S&P PMIs - Tariffs pose downside risks

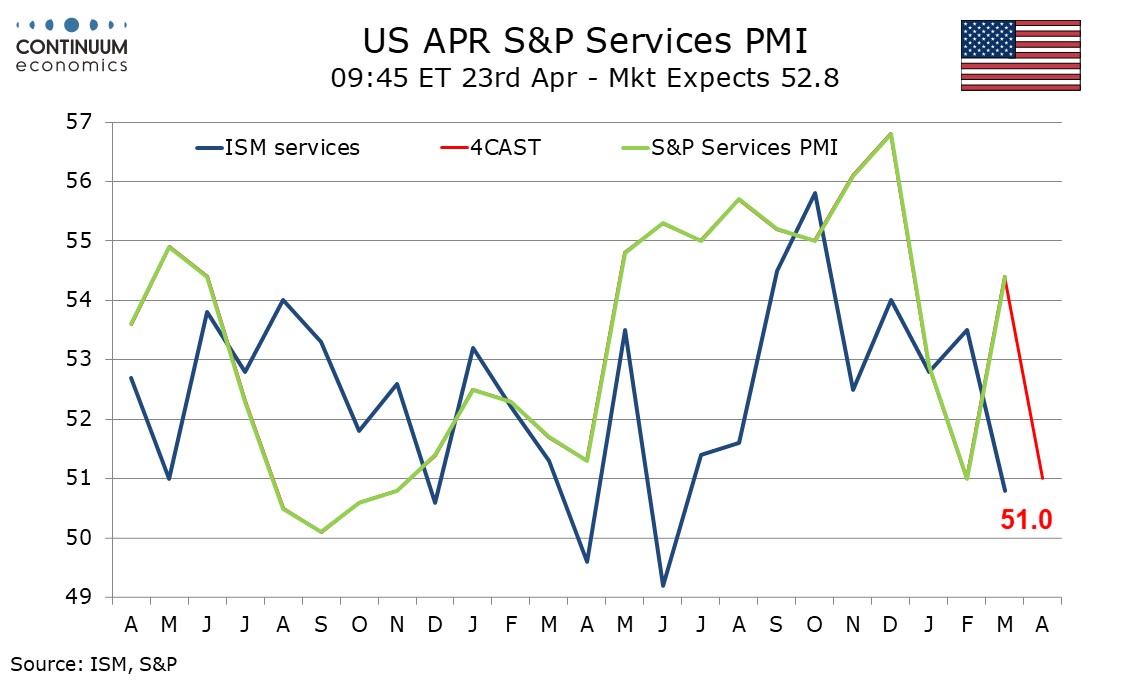

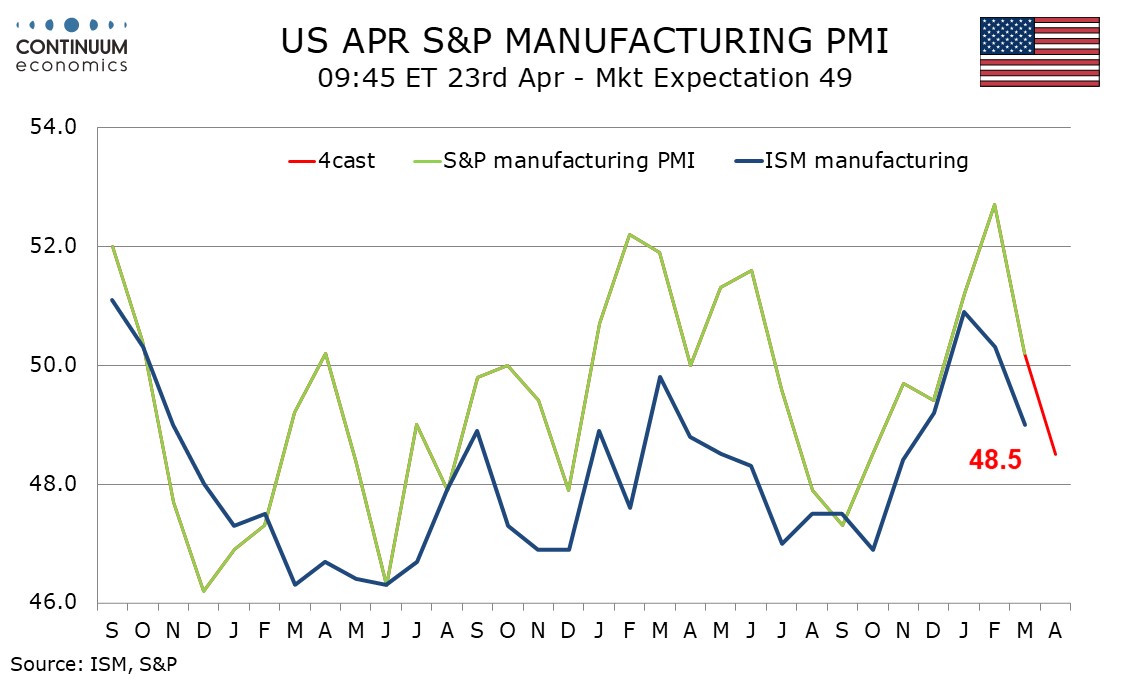

We expect April’s S and P PMIs to show slippage in both manufacturing, to 48.5 from 50.2, as the cost of supplies is lifted by tariffs, and services, to 51.0 from 54.4, as consumer sentiment is undermined. Impact is uncertain but risk is on the downside, with sharp declines not to be ruled out.

Manufacturing will be extending a dip from a strong February, and that would take the series back below neutral after three straight positive readings. In 2024 an upturn in the index peaked in February too, then without a major policy shock. Any benefits from tariffs reviving US manufacturing are likely to be confined to a few sectors and will take time to appear. Empire State data remained weak in March, and the Philly Fed's manufacturing survey plunged.

The impact of tariffs on services is less clear with consumption not always responding to sentiment. However we expect reversal of a bounce in March’s S and P services PMI, which contradicted ISM services and several regional Fed service sector surveys. Weather may have been behind the March bounce. Service sector surveys from the Empire State and particularly the Philly Fed were weak in March.