JPY flows: Another day of JPY declines

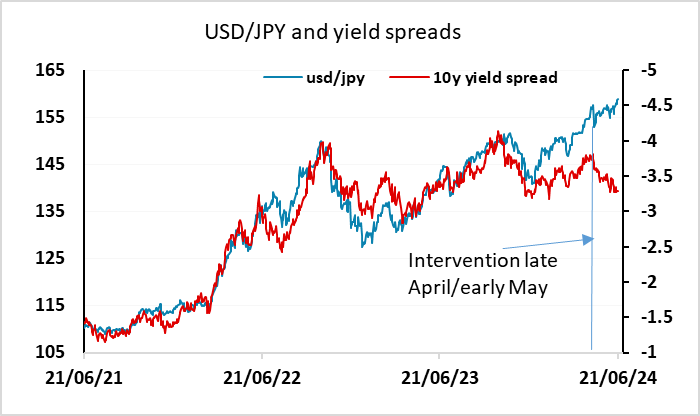

Seventh consecutive day of USD/JPY gains despite yield spreads moving in the JPY's favour. Intervention threat rising

Another day, another decline in the JPY. The seventh consecutive day of JPY declines sees USD/JPY trade above 159, once again without an obvious trigger. The verbal intervention from the Japanese authorities has increased, but there is as yet no sign of actual intervention. Perhaps they are wary of intervention since last time they intervened the JPY responded by falling further despite yield spreads moving in its favour (see chart). Even so, the market is currently too one way for them to allow it to continue with the JPY at record real terms lows, especially since they will lose face if it declines further given their public opposition. Action is still possible today. Although it is less likely once we leave Japanese hours, it has been done before. Co-operation from the US would make an enormous difference, but there is little sign that this is on the cards at this point. The Japanese CPI data did cause a brief and modest JPY rally, but was broadly as expected and with the Tokyo data having provided a strong lead was never likely to change the tone.