USD, JPY flows: USD stronger, JPY weaker on BoJ, Microsoft

The USD is generally stronger helped by positive Microsoft earnings, and the JPY has suffered from the BoJ cut to growth forecasts. But we still favour the JPY medium term

The USD is generally stronger overnight, but particularly against the JPY, which has suffered from the cut in the BoJ’s growth forecasts. This has sent JGB yields lower, but the USD has also benefited from the more positive equity market tone helped by the strong Microsoft earnings released after the close last night. With most of Europe on holiday today, a quiet European session is likely, with the focus now on the US ISM survey later.

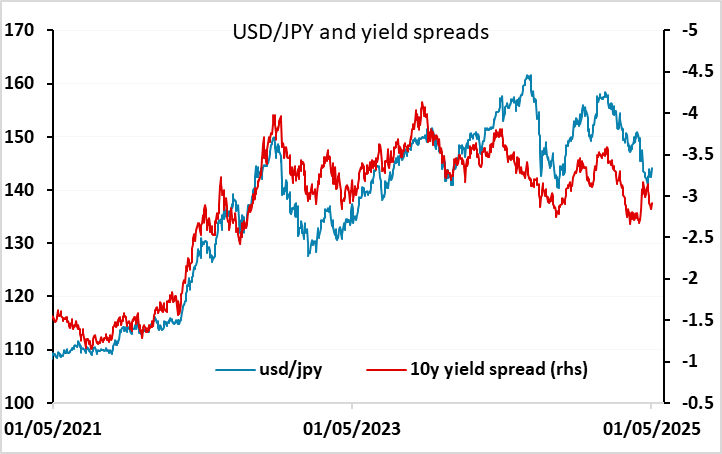

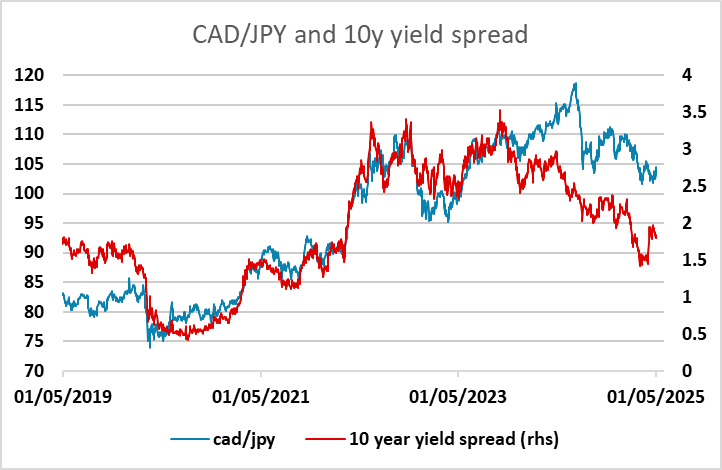

While a downgrade in Japanese growth makes sense given the likely impact of US tariffs on global growth, it isn’t clear that Japan will suffer more than others (including the US). Indeed, others are likely to suffer more, notably Canada and Mexico, with 77% of Canadian exports going to then US. While rate hikes in Japan may well be delayed due to the slowdown, there is a greater possibility of rate cuts elsewhere. The US picture is more complex as tariffs will also raise prices, possibly limiting the Fed’s willingness to cut. For today, the positive equity market tone after the Microsoft results may keep the JPY on the back foot, but the current earnings numbers are of limited relevance when the market is considering the likely effect of tariffs, and we would see the JPY decline on the crosses as representing a JPY buying opportunity.