SEK, JPY flows: SEK weakness can extend, JPY weakness pausing

SEK fell back on Monday and can extend losses. JPY weakness pausing but still lacking a trigger for major recovery.

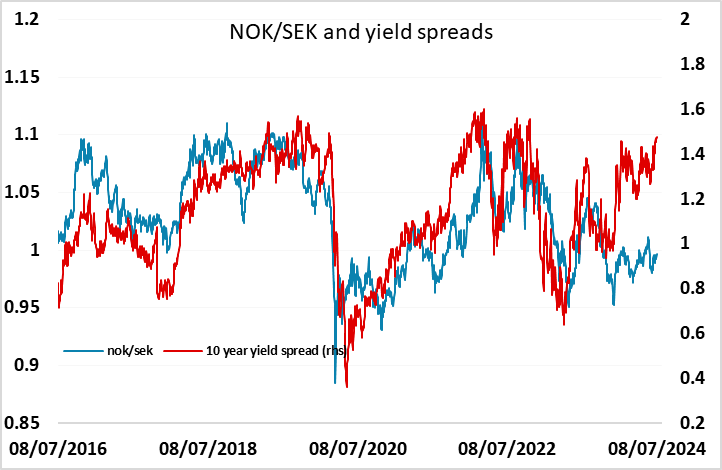

A quiet overnight session and a quiet day ahead with little on the calendar. There wasn’t a great deal of movement on Monday either, but we did see a sharp rise in EUR/SEK late in the European day, without any obvious trigger. The SEK continues to look expensive relative to yield spreads, particularly against the NOK, with NOK/SEK historically well correlated with spreads and thus more likely to move back in line with the widening of spreads we have seen in favour of the NOK. There is scope to move considerably above parity.

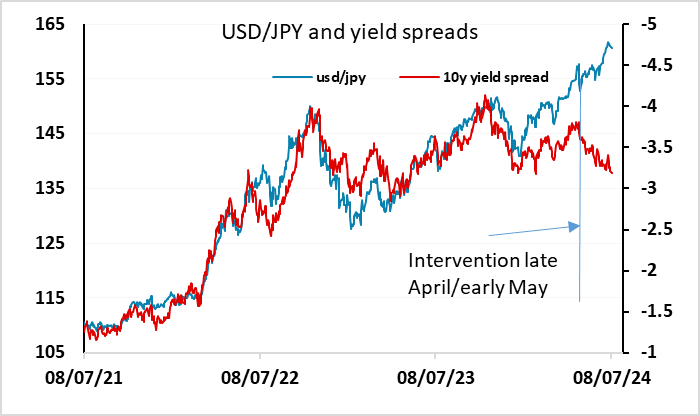

Otherwise, it’s hard to find a likely candidate for a significant FX move today. While we may be seeing some stalling in JPY weakness, and we continue to see enormous potential for a JPY recovery in the longer run, there is as yet no real evidence of any recovery momentum, and in quiet conditions there will still be a temptation to favour carry trades, so JPY bulls will need to be patient. There was news overnight that the BoJ were consulting with market participants about their proposed adjustments to JGB buying operations at this month’s meeting, but unless we see a significant divergence from the JPY1trn cut in JGB buying expected, this seems unlikely to be a trigger for a JPY recovery either.