U.S. December Existing Home Sales - Responding to Fed easing

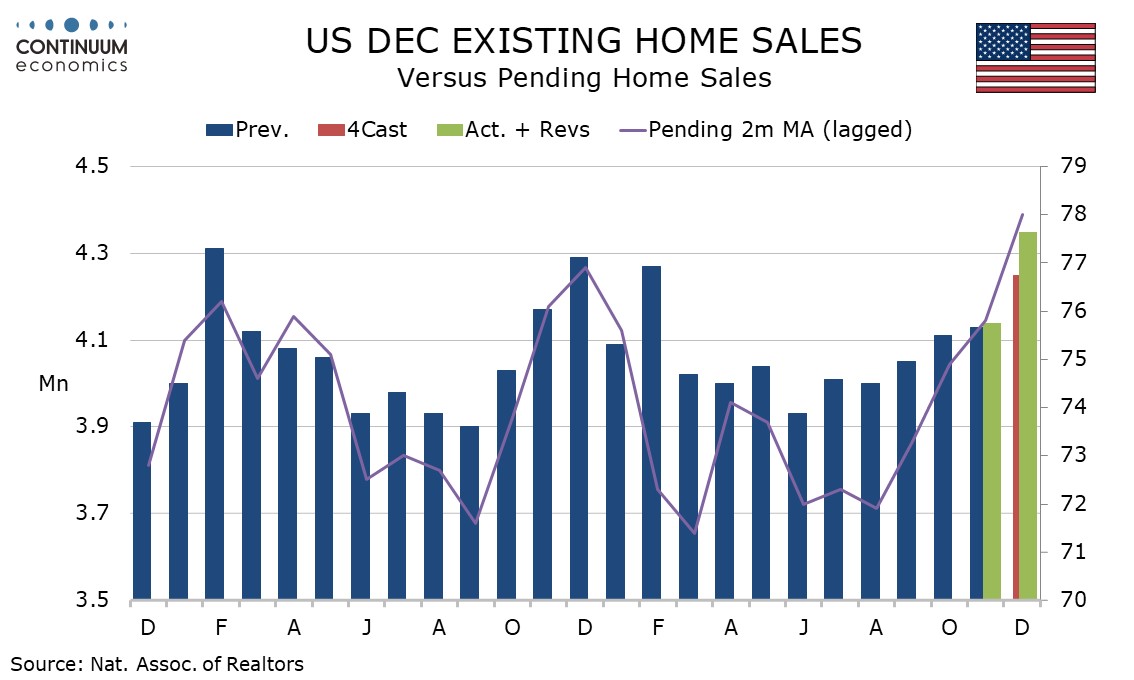

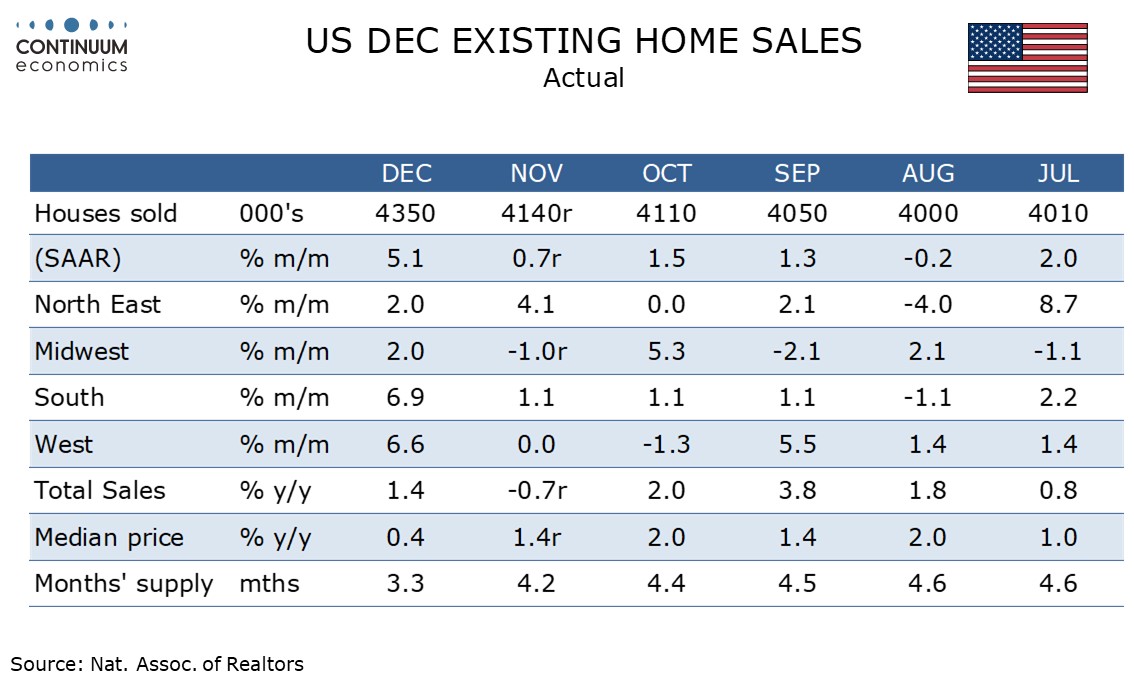

December existing home sales have seen a strong 5.1% increase to 4.35m, this the strongest of four straight gains and the highest level since February 2022.

This supports other evidence, particularly in the pending home sales series that is designed to predict existing home sales, that housing demand has picked up in response to Fed easing. The stronger than expected gain argues against the need for the Fed to do more in the near term.

Sales rose in all four regions, strongly in the Midwest and the South, moderately in the Northeast and West. Prices were however weak, the median price down by 1.1% on the month, sending yr/yr growth down to 0.4%, the slowest since June 2023, from 1.4% in November.

Released alongside the existing home sales data was a stronger than expected 0.3% rise in October business inventories, with September revised up to 0.3% from 0.2%. Autos were particularly strong in a month in which sales fell. Auto sales rebounded in November and according to industry data December too, so the rest of the quarter may not be as firm for inventory growth. Still, this data is supportive for Q4 GDP, already supported by a sharply narrower October trade deficit.