U.S. December ADP Employment improved from November but still subdued

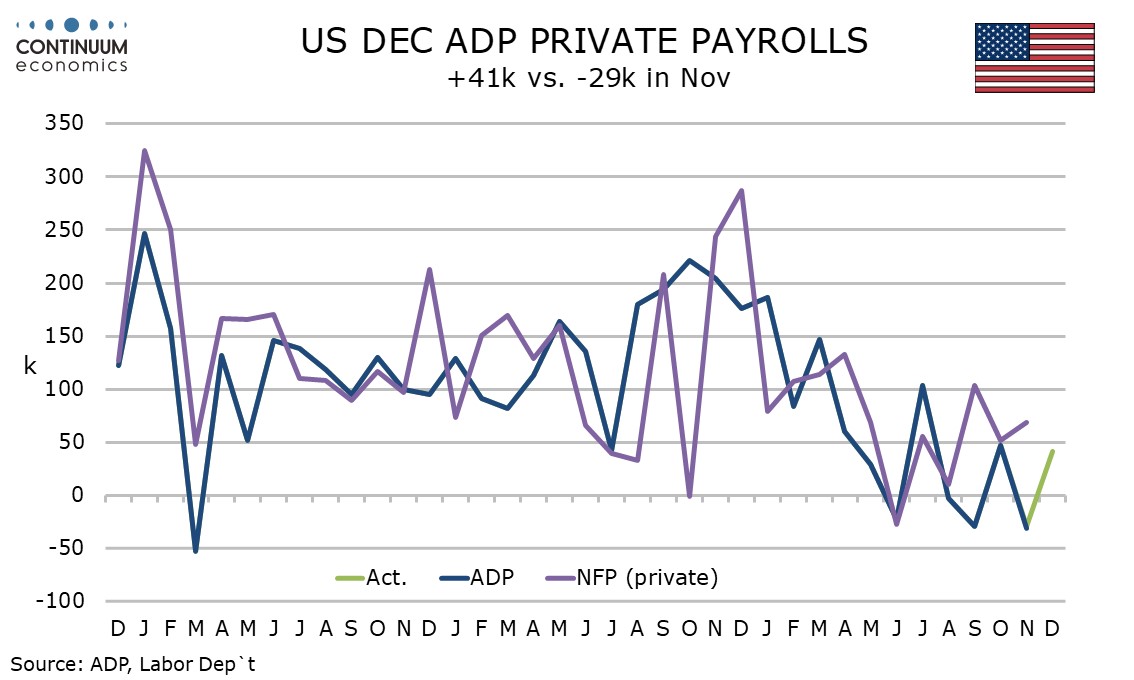

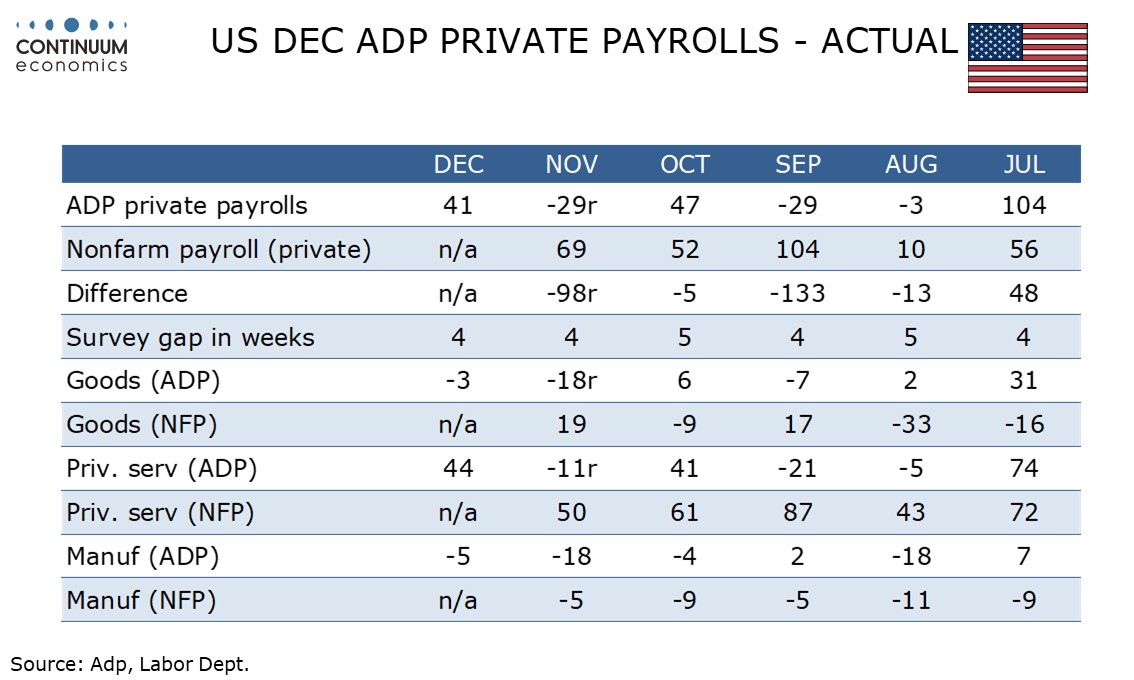

ADP’s December estimate of private sector employment of 41k falls slightly short of expectations but confirms the recovery from the negative November (revised to -29k from -32k) that weekly ADP data had been signaling. Now that we have weekly ADP data, surprises in the monthly ADP reports are generally likely to be modest.

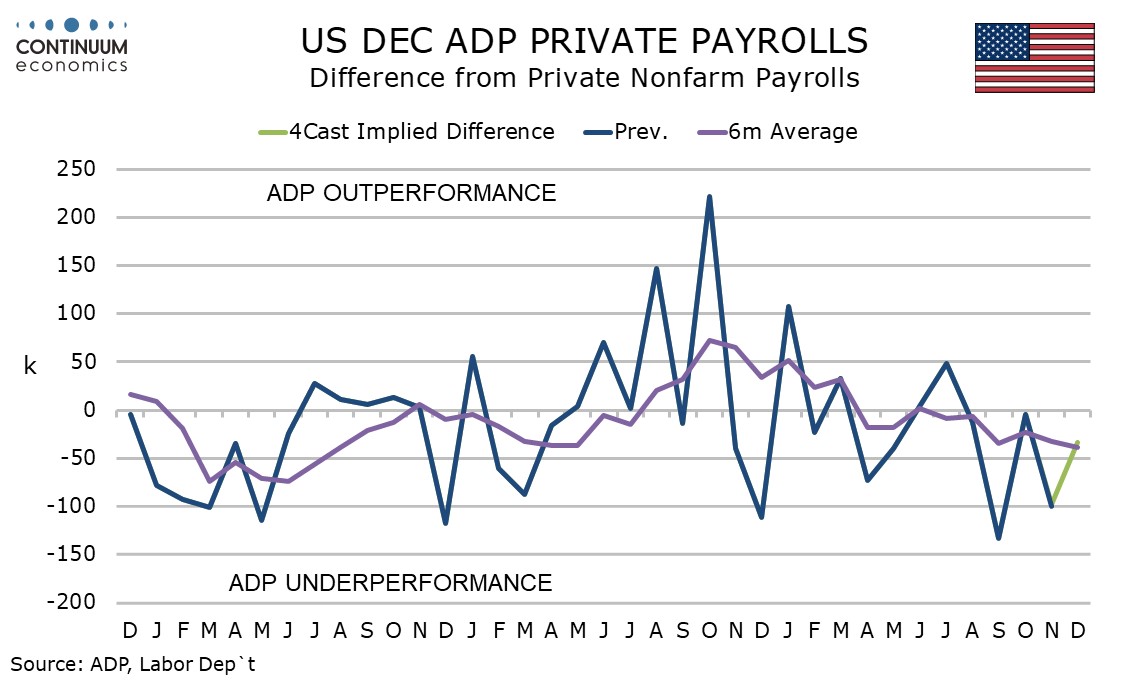

While a 41k increase in the ADP data is a clear improvement from November, it is still a little below a consensus estimate of 73k for private sector non-farm payrolls. ADP data has however underperformed payrolls in the last four months, marginally in August and October but sharply (by near 100k) in September and November. It sees reasonable to expect a modest ADP underperformance in December. At the last FOMC meeting, Chairman Powell stated that he believed recent non-farm payroll data was overestimated.

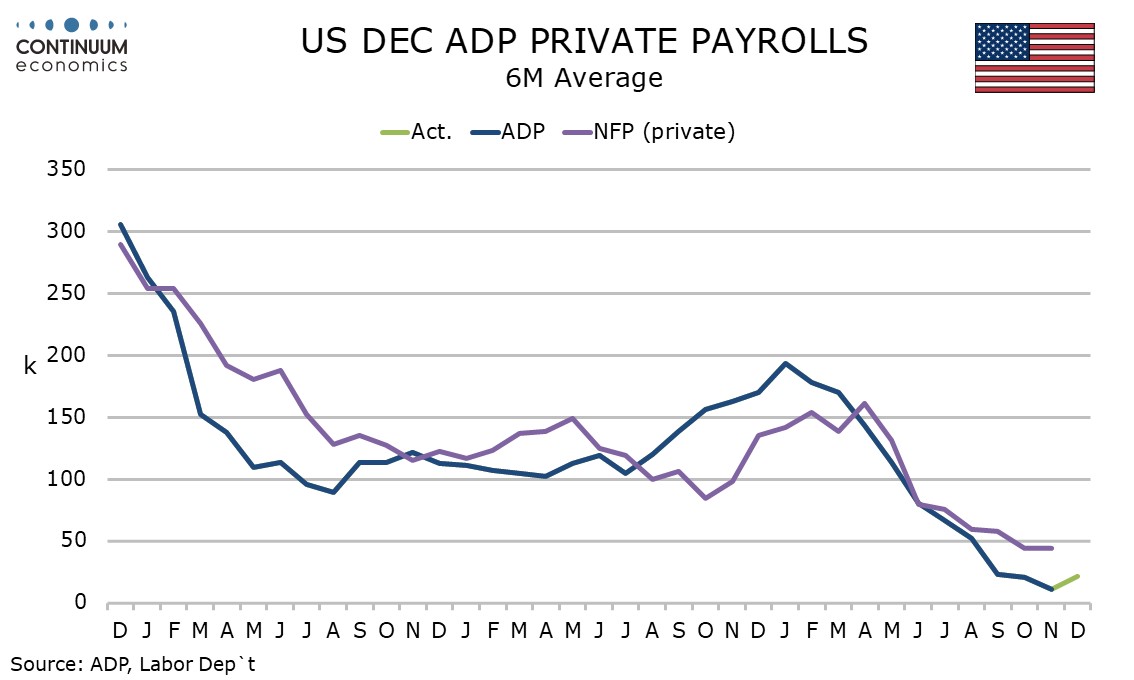

The picture from ADP and probably non-farm payroll data is of a labor market that is now delivering only marginal growth in employment, probably not enough to prevent rising unemployment unless the immigration environment generates a sharp slowing in labor force growth.

ADP detail shows goods employment down by a marginal 3k on a 5k loss in manufacturing, but services up by 44k. Services was led by education and health at 39k. This sector has led most recent growth in payrolls and is generally stronger still in payrolls, largely explaining the its tendency to outperform. Leisure and hospitality was also firm at 24k, and we feel this is an area of upside risk for December payrolls. The man source of weakness in services was a 29k decline in business and professional.

ADP wage data showed yr/yr growth of 4.4% for job-stayers, unchanged from December, and a surprising rise for job changers to 6.6% from 6.3%, though this does back a message that the labor market in December is a little improved from November. That is also the message coming from initial and continued claims, even when taking into account probable holiday seasonal adjustment issues.

.