AUD, EUR flows: AUD recovers, EUR slips further

AUD up on strong Australian employment report. EUR/USD hits lowest since July

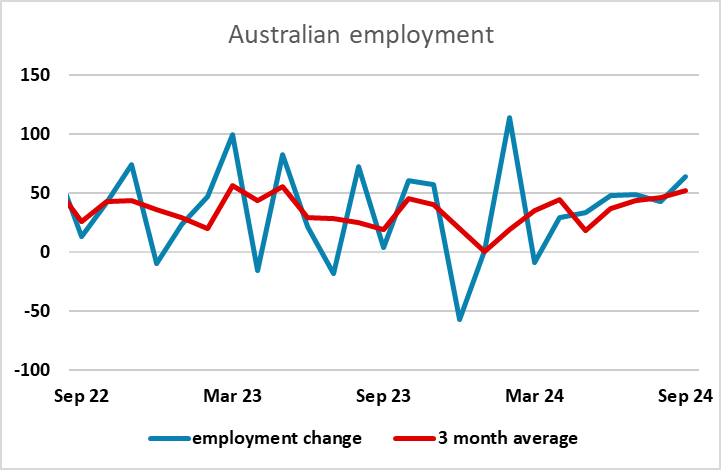

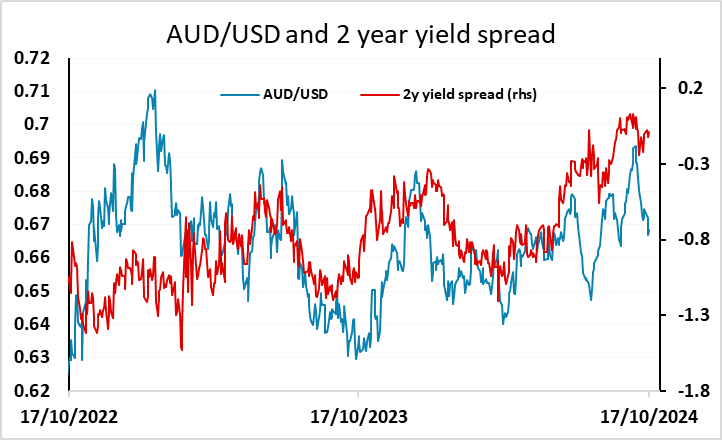

It’s looking like a quiet day ahead of the ECB meeting later. There hasn’t been much action overnight, with the main move being some modest gains in the AUD following a strong Australian employment report. In truth, the gains look too modest given the strength of the report, the relative hawkishness of the RBA and the better tone to Chinese equities in recent weeks. The decline in AUD/USD from the highs above 0.69 at the end of September looks substantially overdone, and today’s data should help to trigger a recovery back towards those highs by year end.

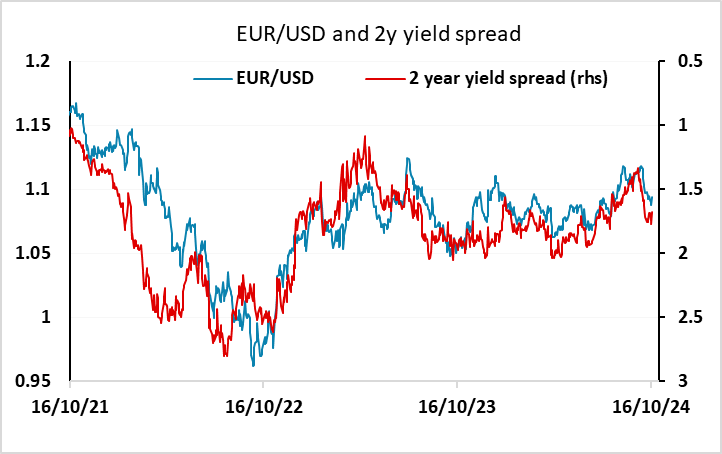

EUR/USD slipped further overnight hitting a low of 1.0851, its lowest since July, but has now broadly caught up with then move in yield spreads seen over the last couple of weeks, and should find support in the 1.0800/35 area. The ECB meeting seems unlikely to lead to any further declines in EUR yields, so while there may be scope for some further tests lower, we are likely to find some longer term buyers on dips from here.