Canada March Employment - A weak month after two solid ones

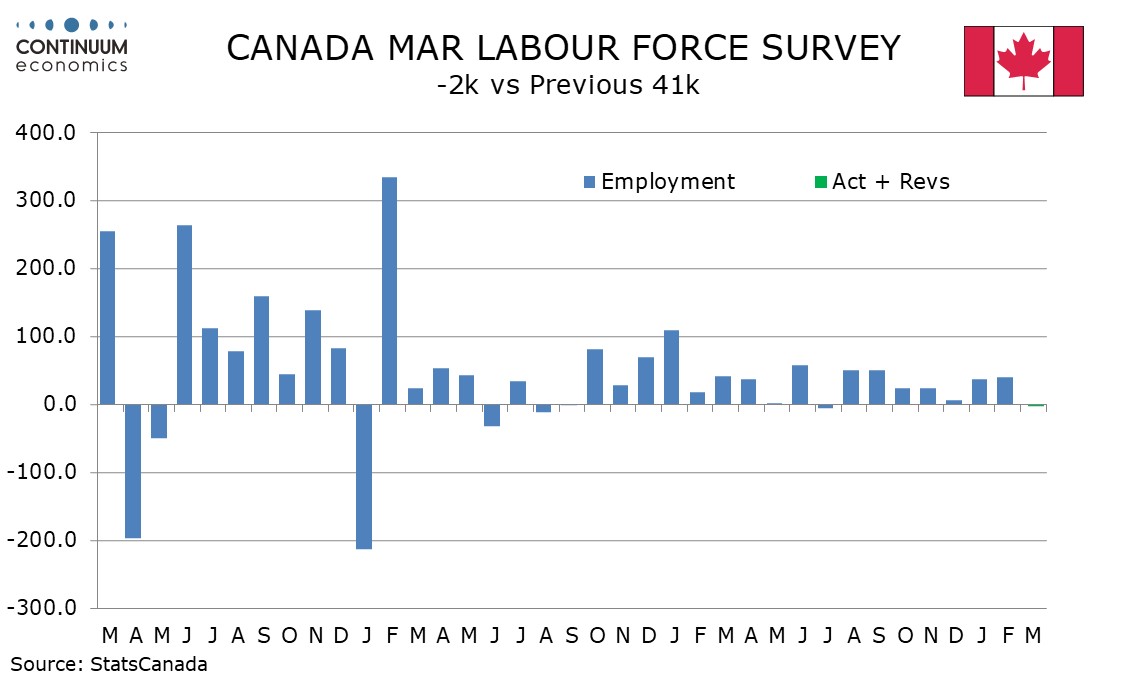

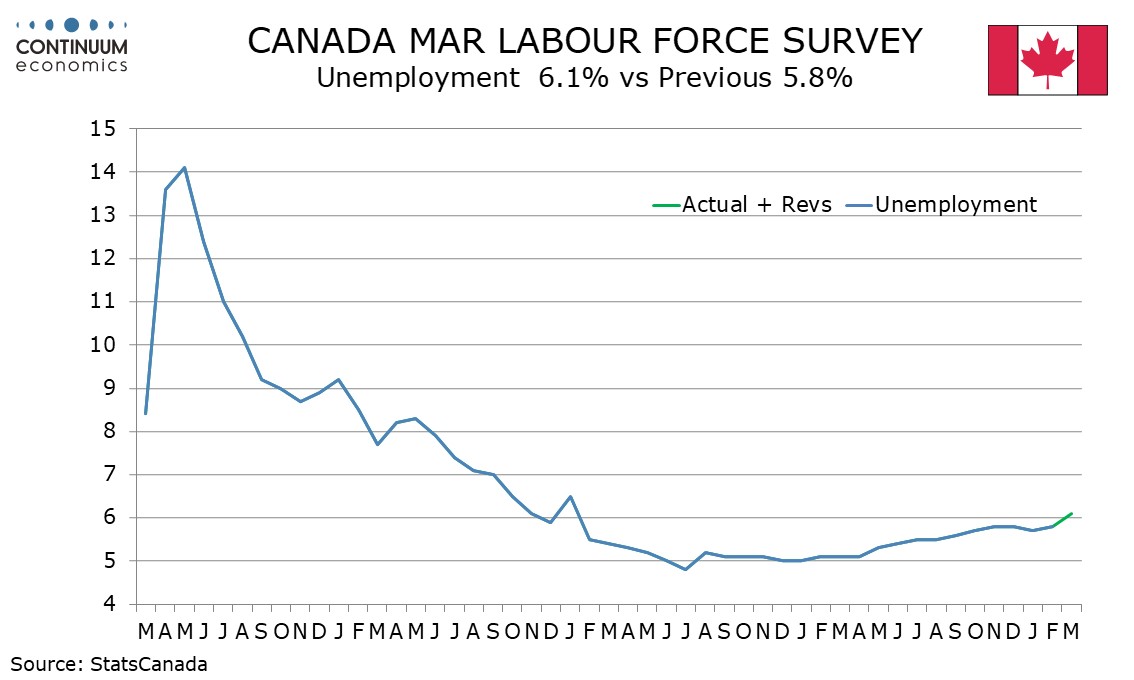

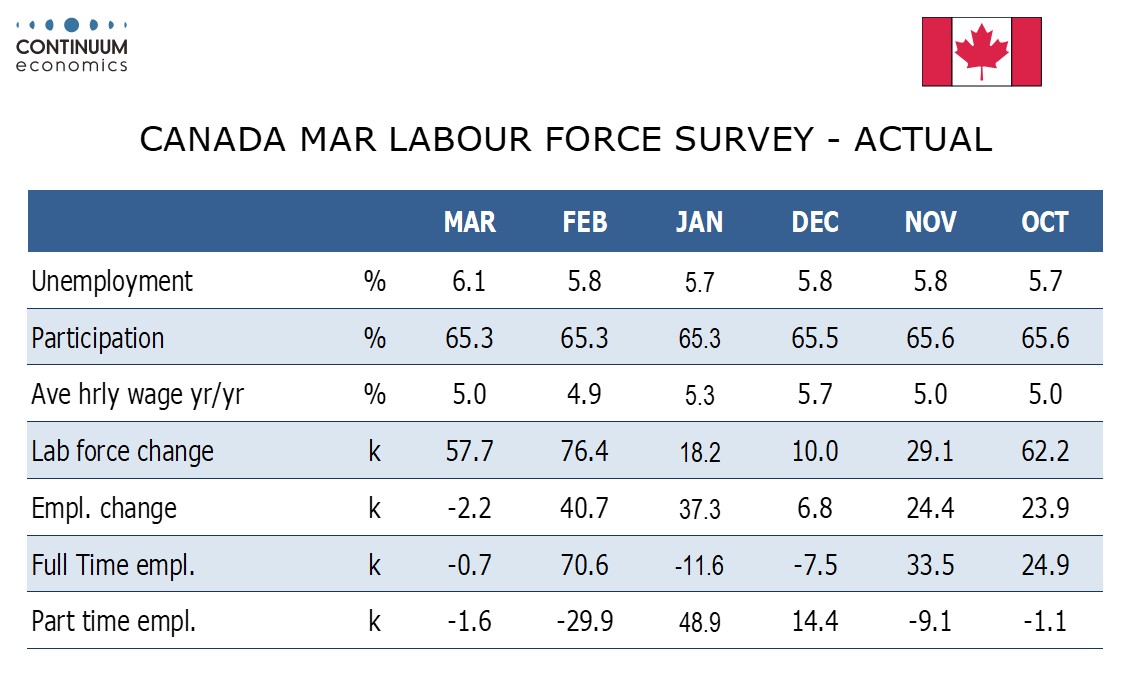

Canada’s 2.2k decline in March employment is weaker than expected though needs to be seen alongside strong gains of 40.7k in February and 37.7k in January. The 3-month average of 25k is above the 6-month average of 22k. However with the labor force rising unemployment is trending higher, March’s 6.1% rate from 5.8% in February being the highest since November 2021.

Wage growth of 5.0% yr/yr is up from 4.9% in February (hourly for permanent employees) and appears fairly stable around this level, a spike to 5.7% in December looking like an anomaly. The level looks somewhat high considering the rising trend in unemployment.

March’s unemployment rate rose on a 57.7k increase in the labor force. This is a strong gain but not sharply above trend, with the 3-month average being 51k and the 6-month average 42k.

Employment details showed full time work down by 1.6k and part time down by 0.7k. Gains of 11.9k in private sector employees and 15.2k in the public sector were offset by a 29.3k decline in self-employment. Goods employment rose by a strong 29.9k with manufacturing at 9.3k and construction at 15.3k. A 32.0k fall in services was led by declines of 23.1k in wholesale and retail and 26.6k in accommodation and food. Health care and social assistance was strong with a rise of 39.9k.

While the weak month probably does not change very much for the Bank of Canada it does suggest that strong signals from GDP in January and preliminary data for February may not carry through into March, and the economy may have limited momentum entering Q2.