U.S. October ADP Employment keeps trend marginally positive, if subdued

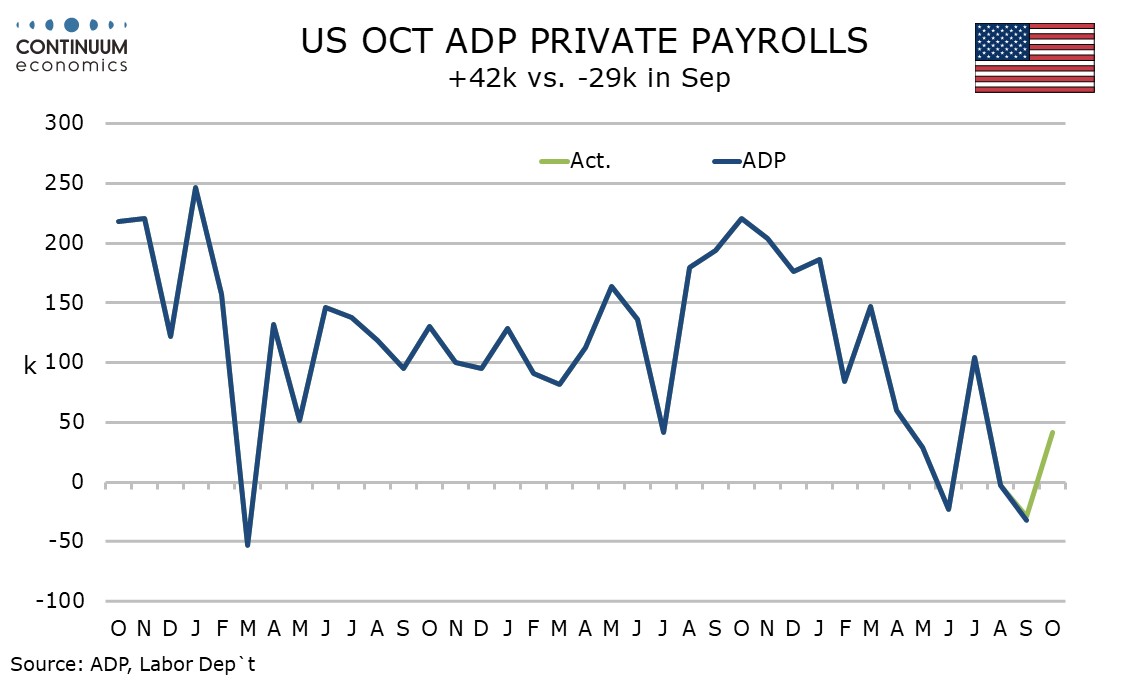

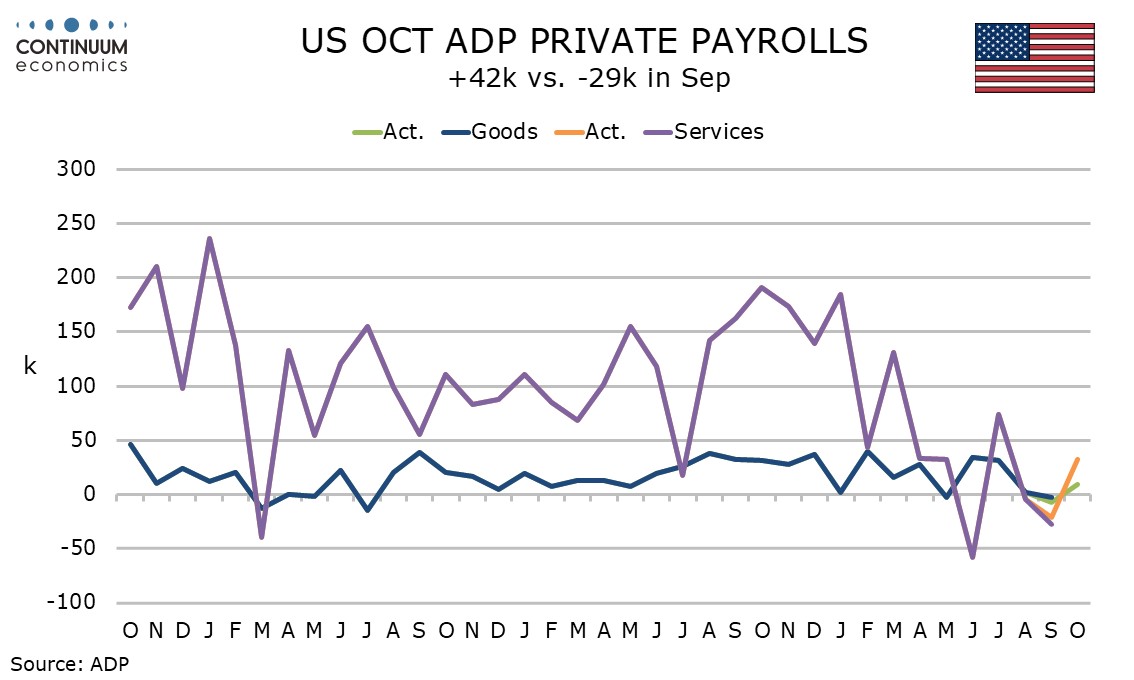

ADP’s October estimate of employment is slightly stronger than expected with a 42k increase, more than fully reversing September’s 29k decline (revised from -32k) to suggest that underlying trend in employment growth is still marginally positive, if unimpressive.

ADP data is getting more attention than usual given the absence of September’s non-farm payroll, with October’s non-farm payroll scheduled for Friday at risk of not being released at all with data collection not having taken place in October. ADP is not always a reliable guide to payrolls but performed reasonably well as a signal in the months through August and it is likely that the near flat picture that we are seeing from ADP data since than is similar to what payrolls would have shown.

It is unclear to what extent the slowing in hiring is due to weaker demand or weaker supply (particularly of immigrants). Both are probably playing a part, though most estimates are that the break even pace of job growth is modestly positive, and the labor market is marginally easing.

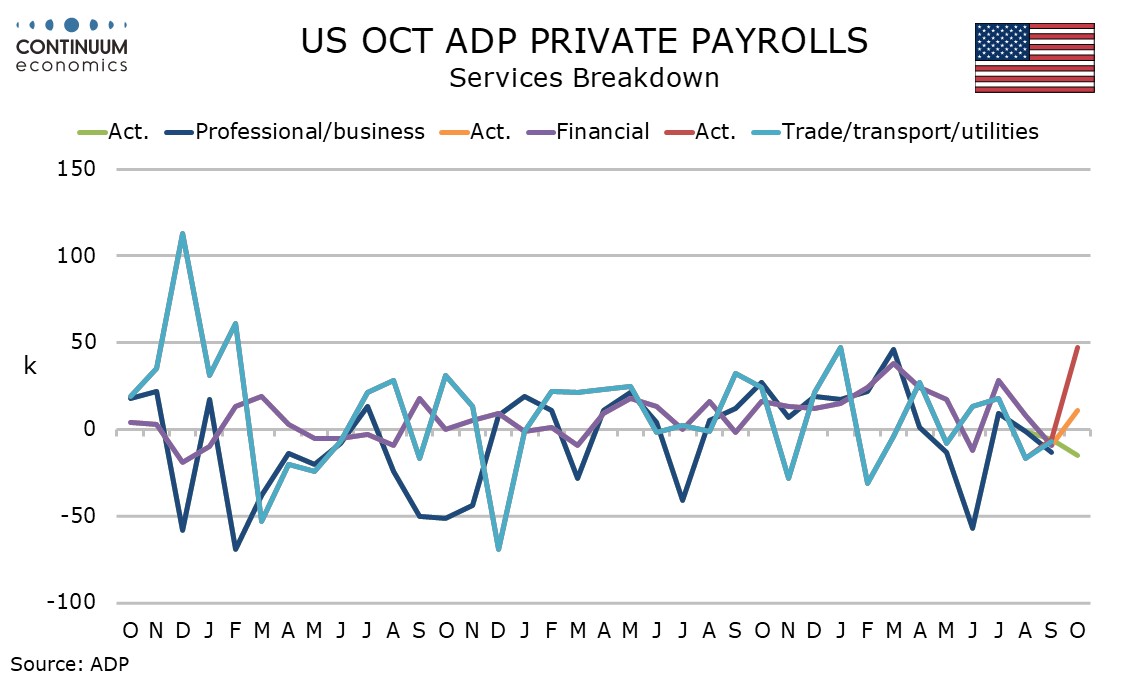

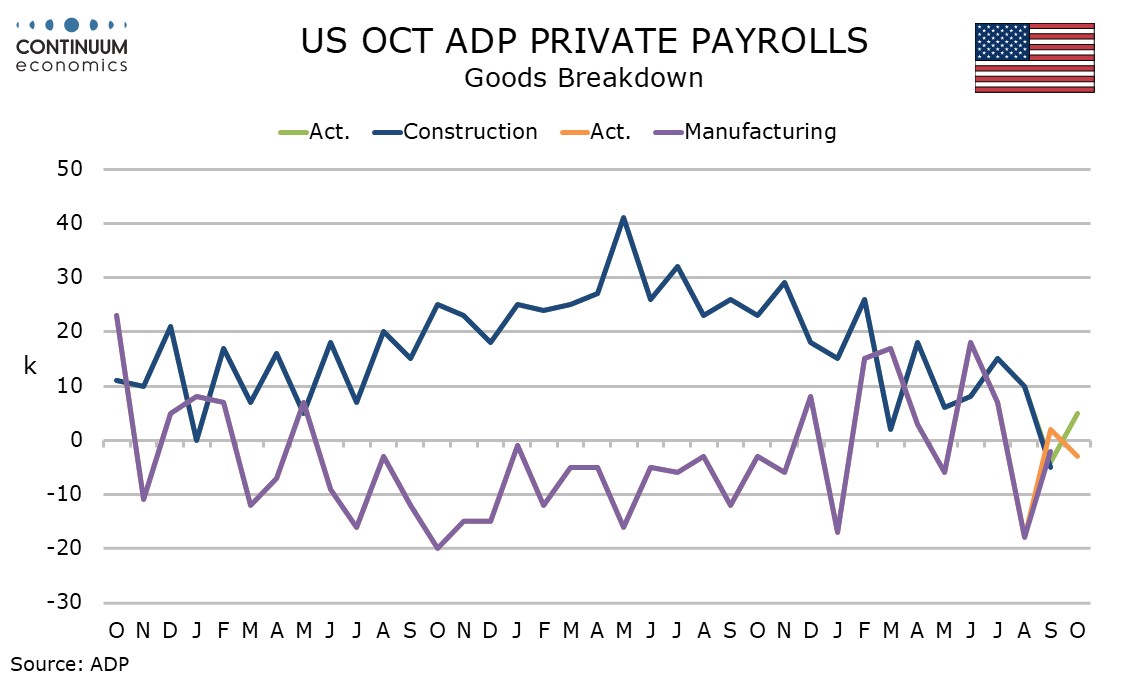

The ADP breakdown surprisingly showed a 47k increase in trade, transport and utilities leading the increase. Also positive were education and health, a sector that has tended to lead recent non-farm payroll but not ADP gains, at 25k, and financial at 11k. Information, professional and business and other services all saw declines of close to 15k. Manufacturing at -3k and construction with a 5k increase saw little change.

ADP added that pay growth has been largely flat for more than a year. October data showed wage growth for job starters at 4.5% and job changers at 6.7%, both unchanged from September.