U.S. January Empire State Survey - Extreme weakness probably erratic

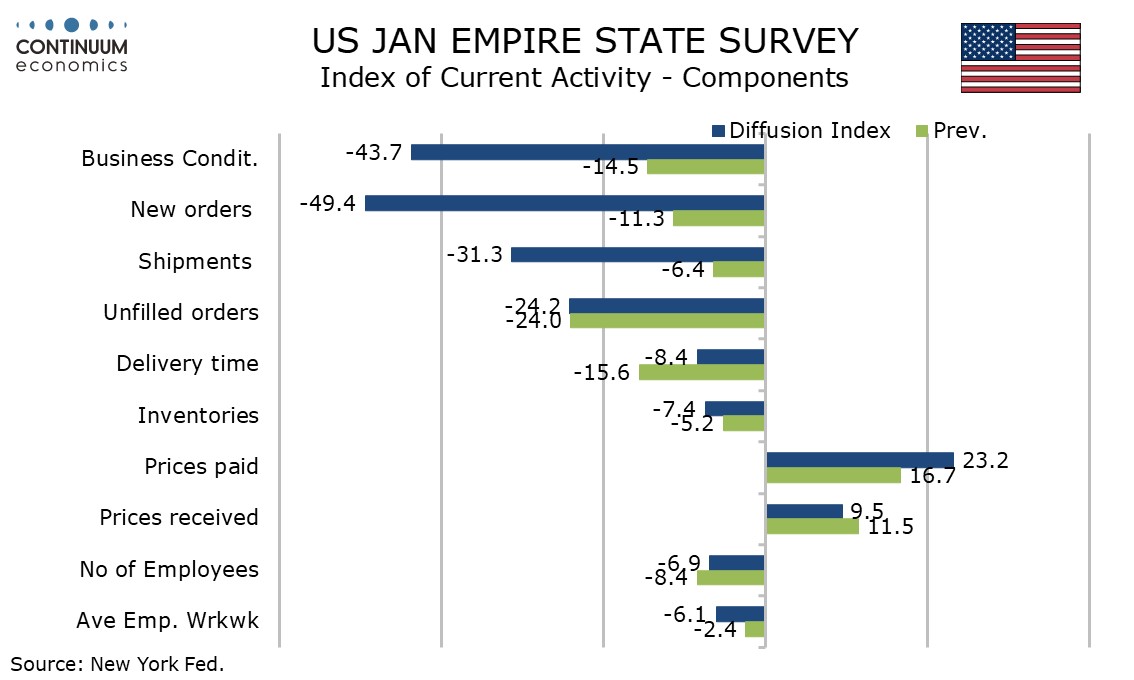

January’s Empire State manufacturing index of -43.7 from -14.5 in December is startlingly weak, and the softest since May 2020 at the height of the pandemic. There are no easy explanations for why the data is so weak and we suspect other surveys will be less so.

The Empire State index has been more volatile than most, alternating between positive and negative readings through 2023 with some of the negatives very weak, while most surveys were more stable with consistent modestly negative readings. January was particularly weak also in 2023 at -32.9, which proved erratic.

Details for January’s report show new orders even weaker than the headline at -49.4 and shipments very weak also at -31.3. However employment at -6.9 was slightly less negative than December’s -8.4 while the workweek slipped moderately to -6.1 from -2.4.

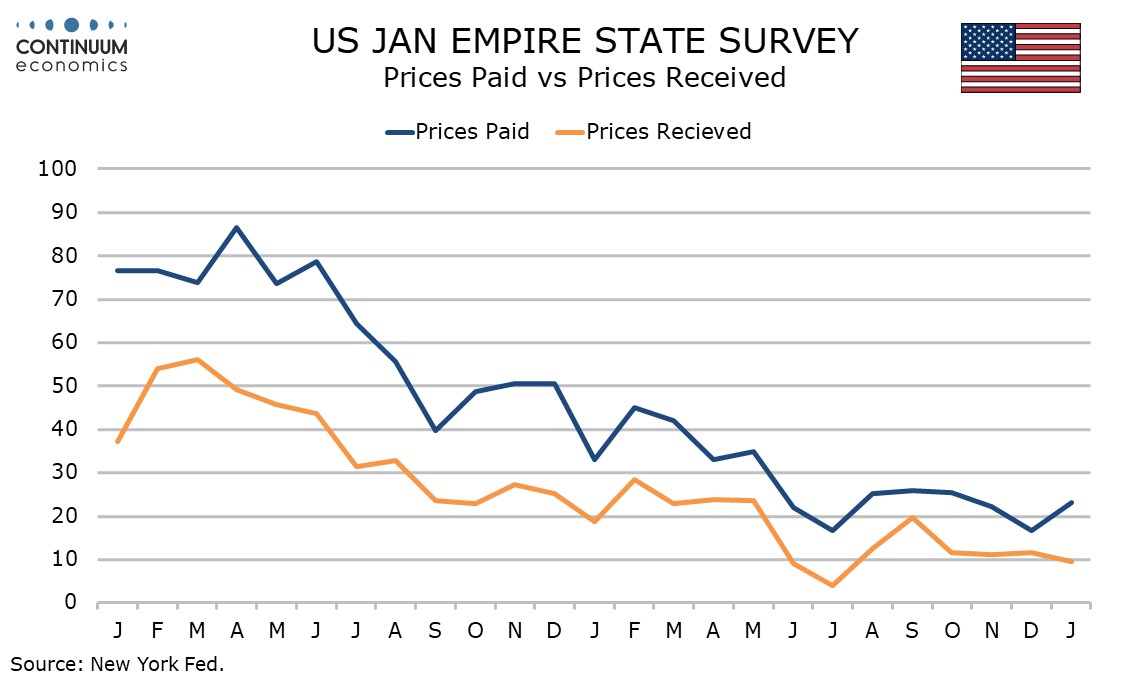

Price data was mixed, prices paid at 23.2 from 16.7 reversing a December lowing but prices received at 9.5 from 11.5 at a six month low.

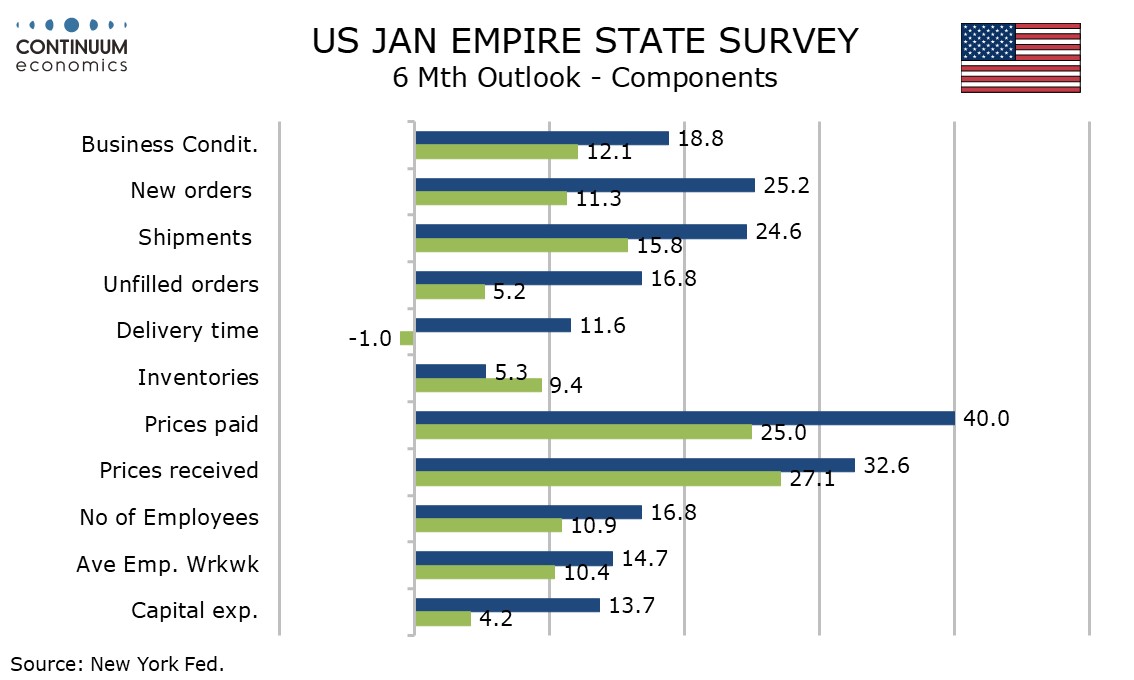

Six month expectations saw stronger price indices, while six month expectations on activity picked up to 18.8 from 12.1, a further sign that the current month weakness is unlikely to persist.