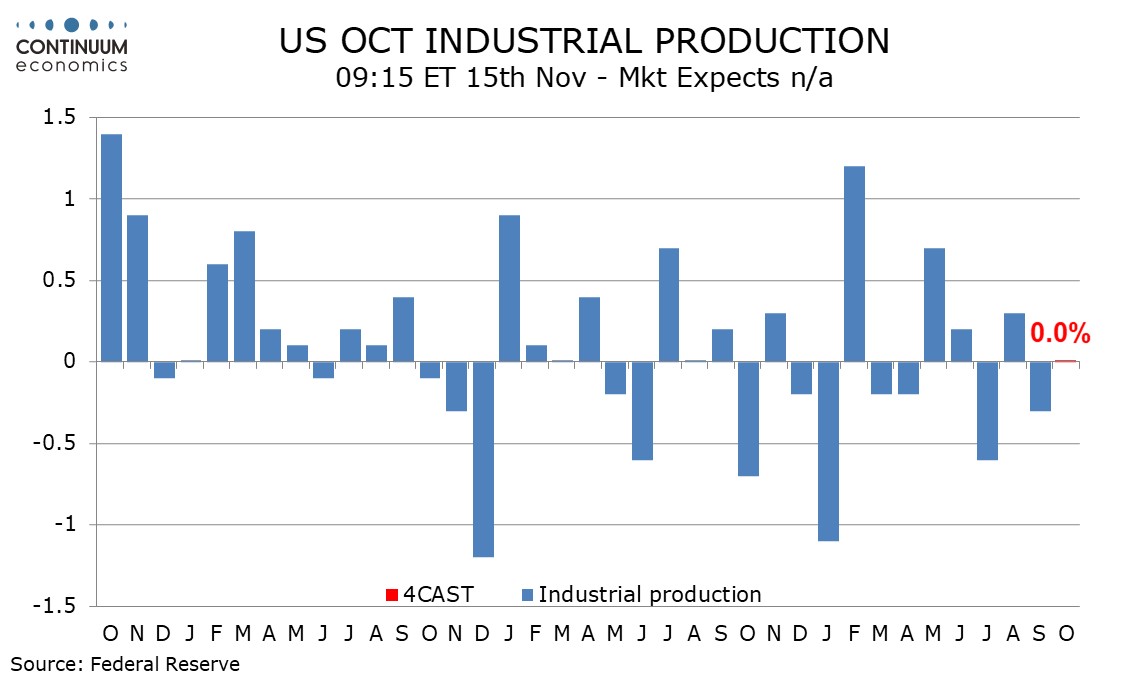

Preview: Due November 15 - U.S. October Industrial Production - Continued restraint from Boeing strike and hurricanes

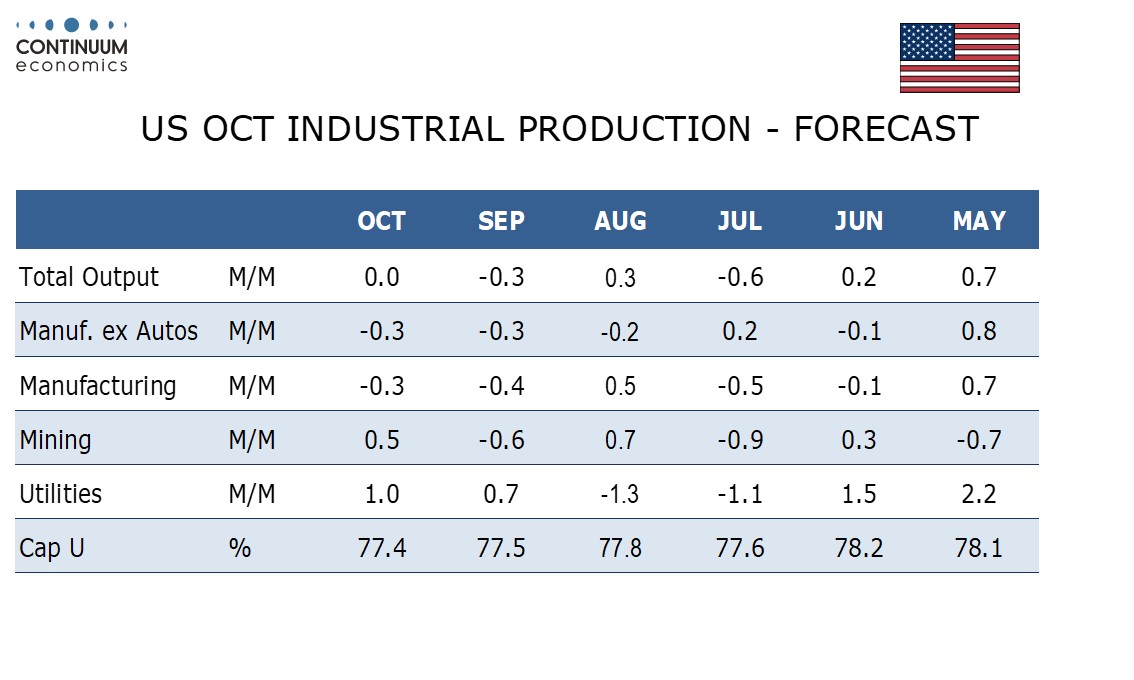

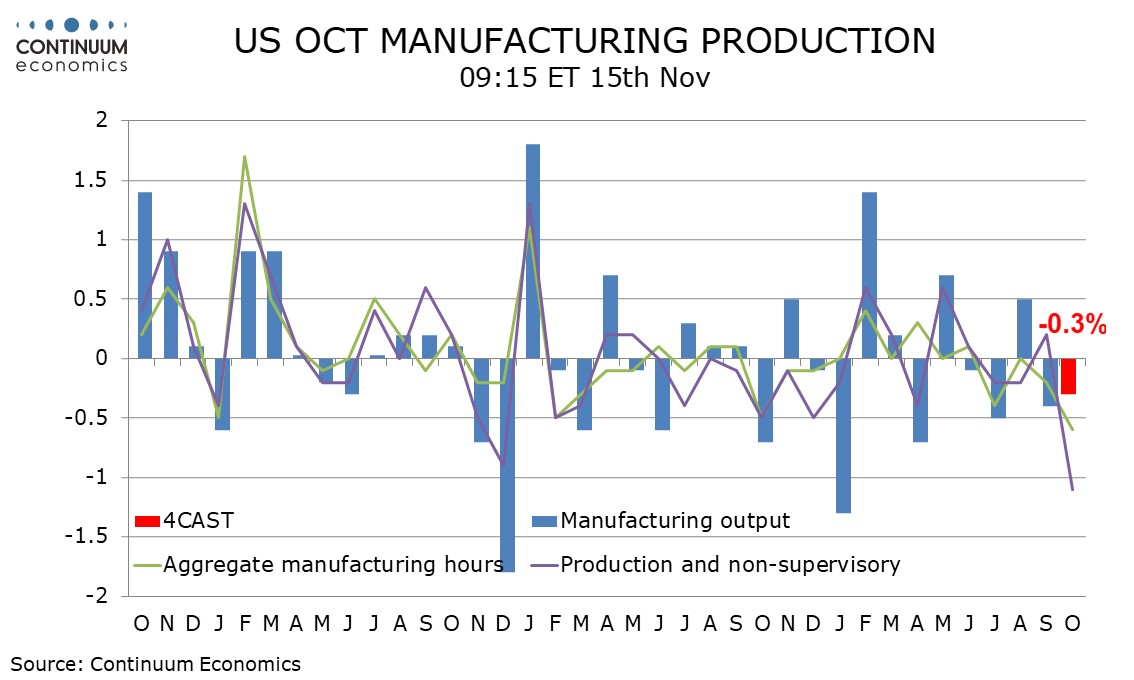

We expect unchanged October industrial production with a 0.3% decline in manufacturing. A strike at Boeing will be a continued negative while Hurricane Milton is another downside risk. However after September data in which the Boeing strike and two hurricanes were both seen as having reduced output by 0.3% the negative impact of temporary factors may be less in October.

The Boeing strike started in mid-September and continued through all of October, so that implies an increased negative but the additional negative will probably be similar to that in September. The impact of Hurricane Milton is likely to be less than the impacts of Hurricane Helene and Francine, though Milton, like Francine, could have negative impacts on Gulf oil production.

Still, we expect a 0.5% rise in mining output after a 0.6% decline in September, with payroll data showing an increase in mining aggregate hours worked, while weekly electrical output suggests a rise of 1.0% in utilities. Aggregate hours worked were weaker in manufacturing. While most of a drop in manufacturing employment was attributed to the strike at Boeing the workweek was also lower, suggesting that manufacturing is will look subdued even outside the impact of the Boeing strike.

We expect capacity utilization to slip to 77.4% from 77.5% overall and to 76.3% from 76.7% in manufacturing. These will be the lowest since May 2021 and April 2021 respectively.