Preview: Due February 16 - U.S. January PPI - Some components may bounce, but seen subdued overall

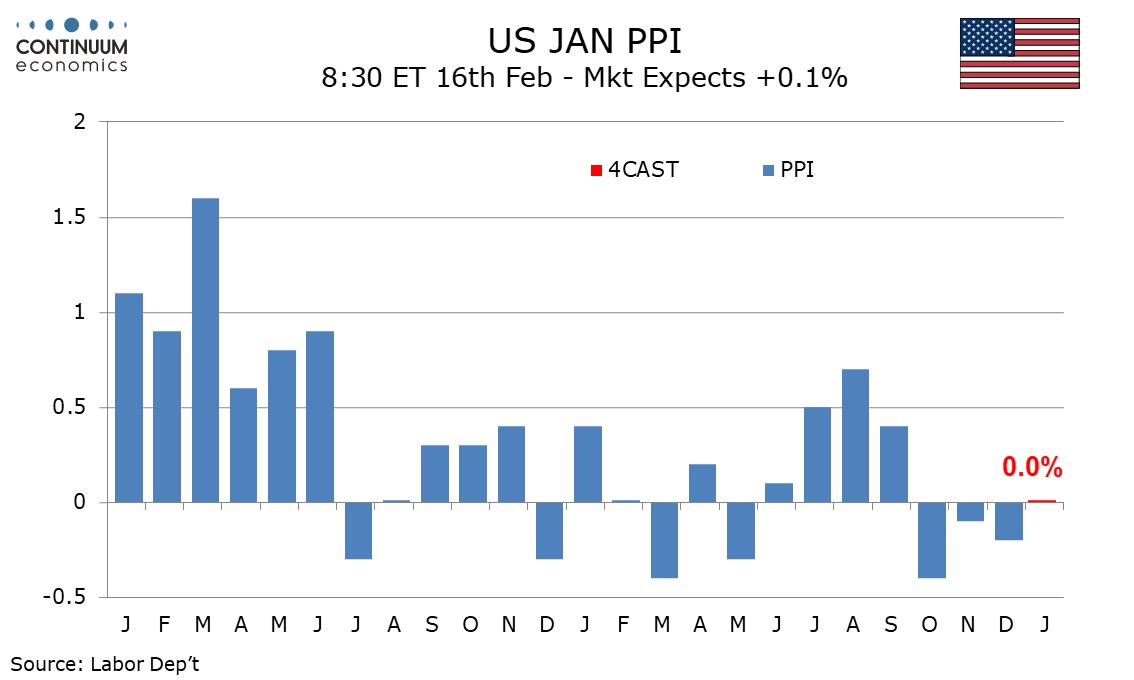

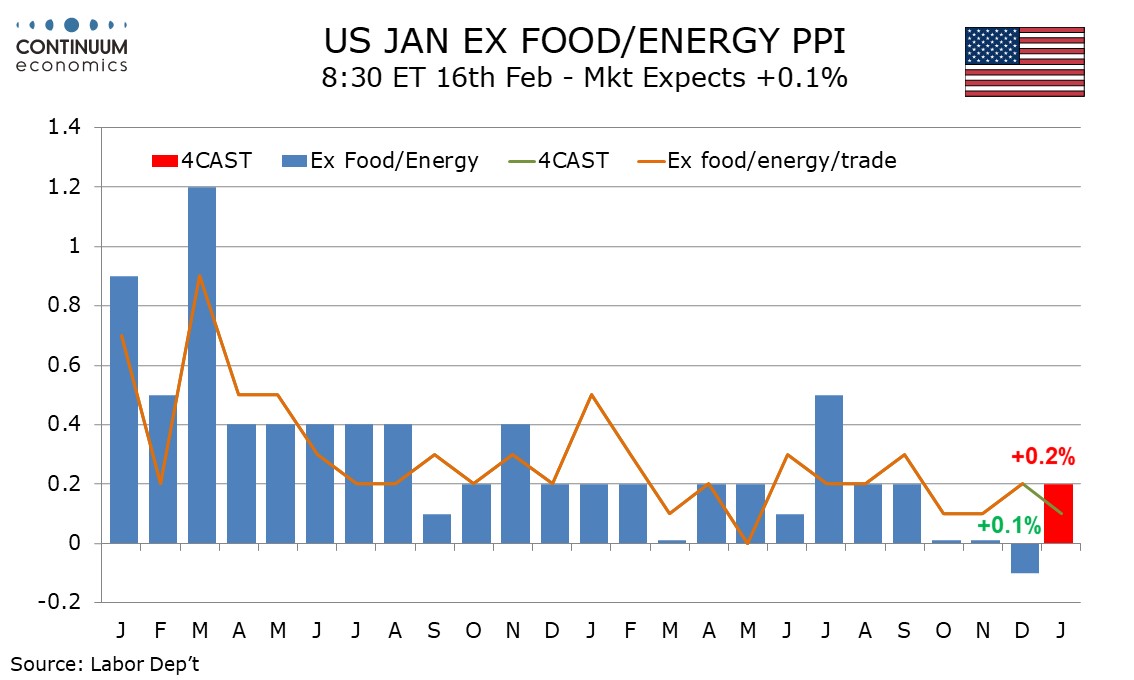

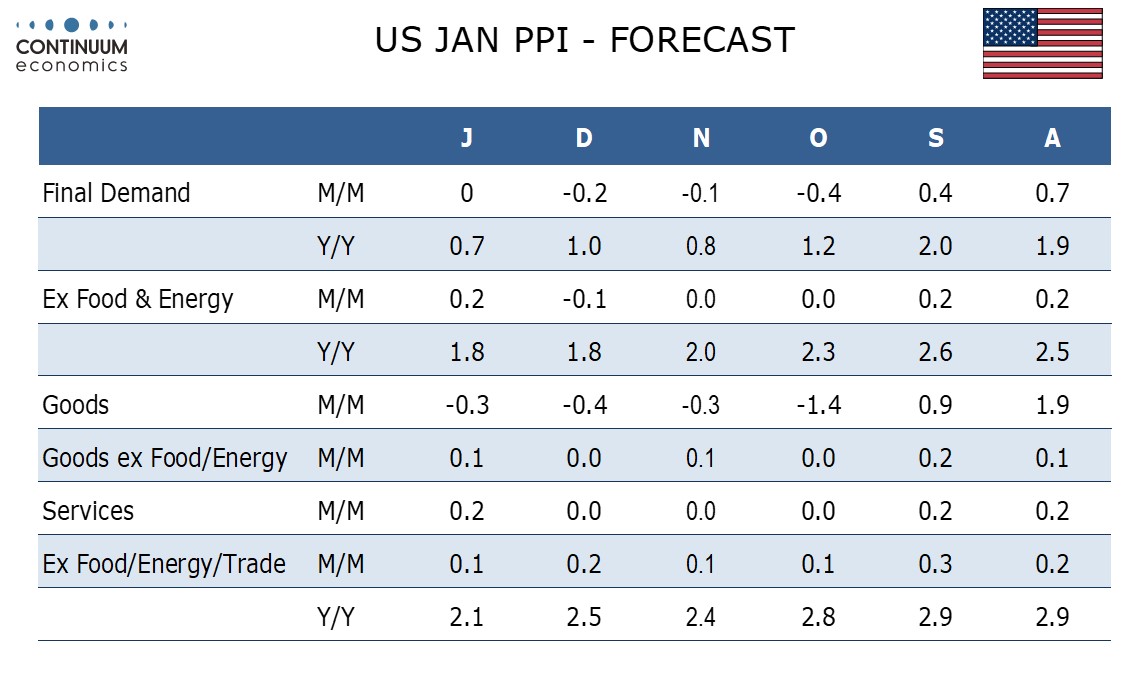

We expect an unchanged outcome from January’s PPI to follow three straight declines, and a 0.2% increase ex food and energy to deliver the first ruse since September. Ex food, energy and trade we expect a 0.1% increase, to confirm the underlying picture remains subdued.

Annual revisions to seasonal adjustments on February 14 changed little though December data was revised marginally lower, with ex food and energy data unusually negative at –0.1%. While negative core rates are unusual, the underlying picture has been subdued for over a year.

January data sometimes sees some volatility, with January 2023 having seen strength in core goods and trade prices. Both of these see some upside risk in January 2024, with potential corrections from a sharp 3.0% fall in December passenger car prices and four straight declines in trade prices, of which December’s 0.8% decline was particularly steep. However, New Year price adjustments are likely to be more subdued in 2024 than 2023 with inflationary pressures having fallen significantly through 2023.

We expect a 0.1% rise ex food, energy and trade, slower than December’s 0.2% but matching October and November, even with a modest correction in autos, and trade adding only 0.1% to the ex food and energy rate. We expect a negative from energy and a flat contribution from food. Food sees some risk of a correction from a weak December but intermediate food price data was weak through Q4.

Under our forecast yr/yr data would fall to 0.7% from 1.0% overall, with ex food and energy remaining at 1.8% yr/yr. We expect the yr/yr pace ex food, energy and trade to fall to 2.1% from 2.5%.