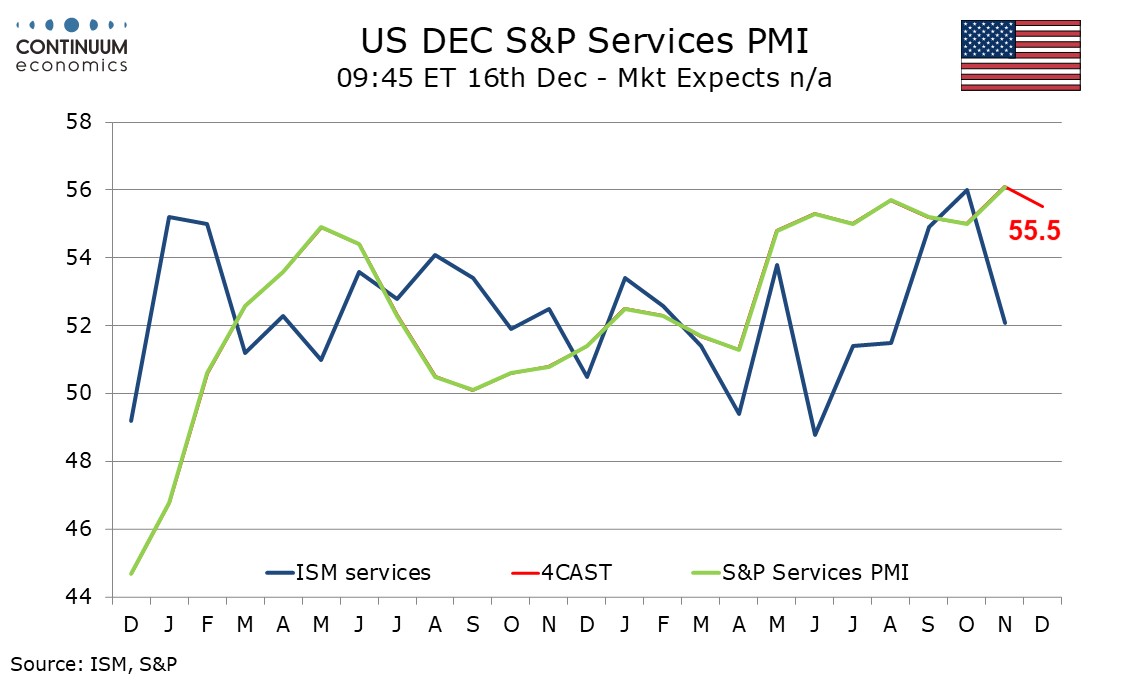

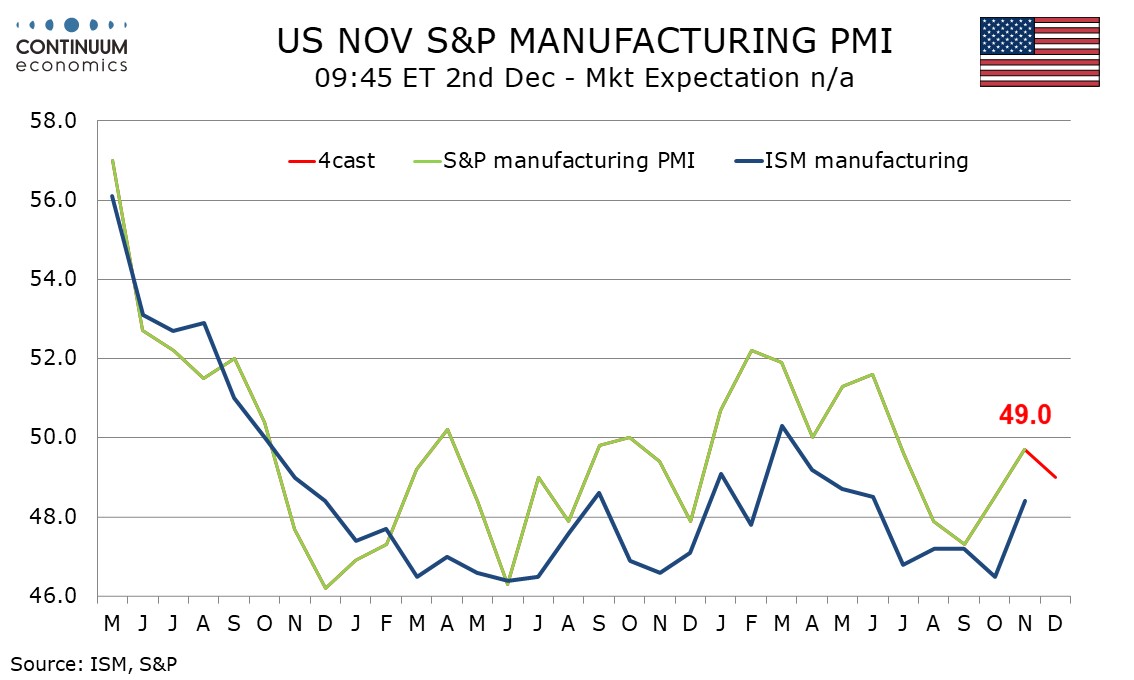

Preview: Due December 16 - U.S. December S&P PMIs - Correcting November improvements

We expect December’s S and P PMIs to show a marginal slippage, manufacturing to 49.0 from November’s 5-month high of 49.7 and services to a still healthy 55.5 from 56.1, which was the highest monthly reading since March 2022.

The manufacturing index has picked up in the last two months and the message was supported by a stronger ISM manufacturing index in November. The S and P manufacturing index in November saw its final reading significantly improved from a preliminary 48.8. This may have been assisted by the end of strikes at Boeing and East Coast ports. Tariff threats, particularly against Canada and Mexico, could however cause some concern in December.

The S and P service indices has now been stable around 55 for seven straight months and even accelerated in November, though the final reading was not as strong as the 57.0 preliminary. That ISM services data slipped in November after two stronger months is not a reliable signal for the S and P data, and tariffs are unlikely to be a major concern for services. December’s index is likely to maintain a solid picture, but perhaps not quite as strong as in November.