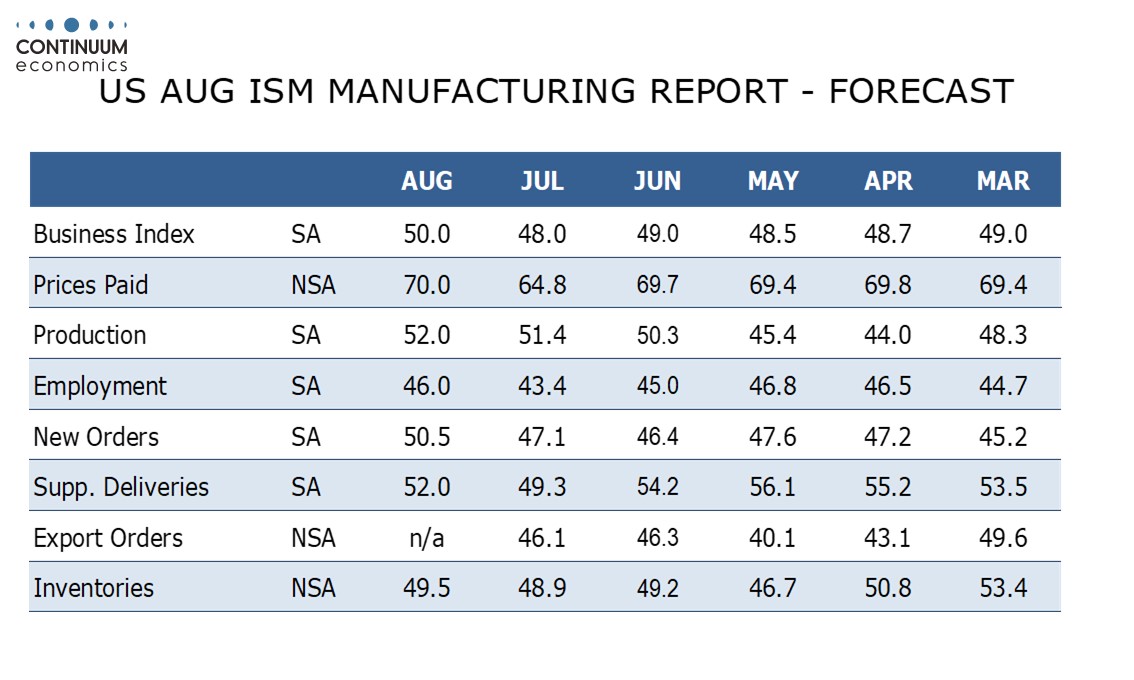

Preview: Due September 2 - U.S. August ISM Manufacturing - Back to neutral with firmer prices

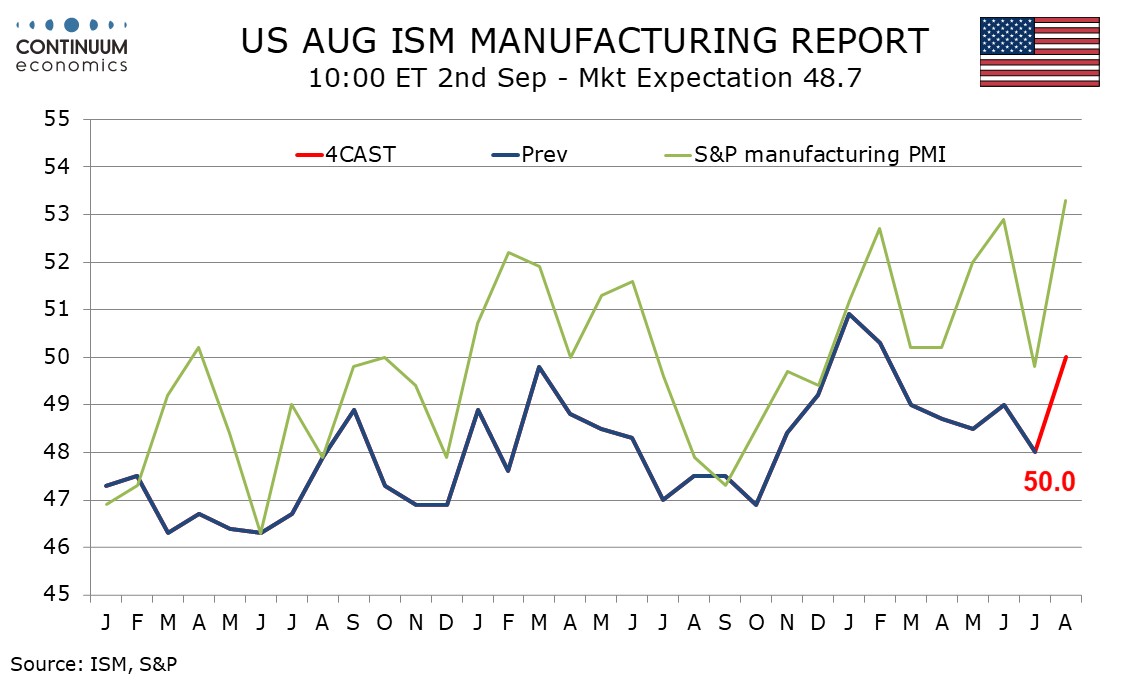

We expect August’s ISM manufacturing index to rise to a neutral 50.0 more than fully reversing a dip to 48.0 in July from 49.0 in June. This would be the strongest reading since January and February edged above neutral for the first time since October 2022.

July’s dip had a mixed breakdown with improvements in new orders and production but slippage in inventories, deliveries and employment. We expect the improvement in new orders and production to continue and the other three components to recover from their July dips.

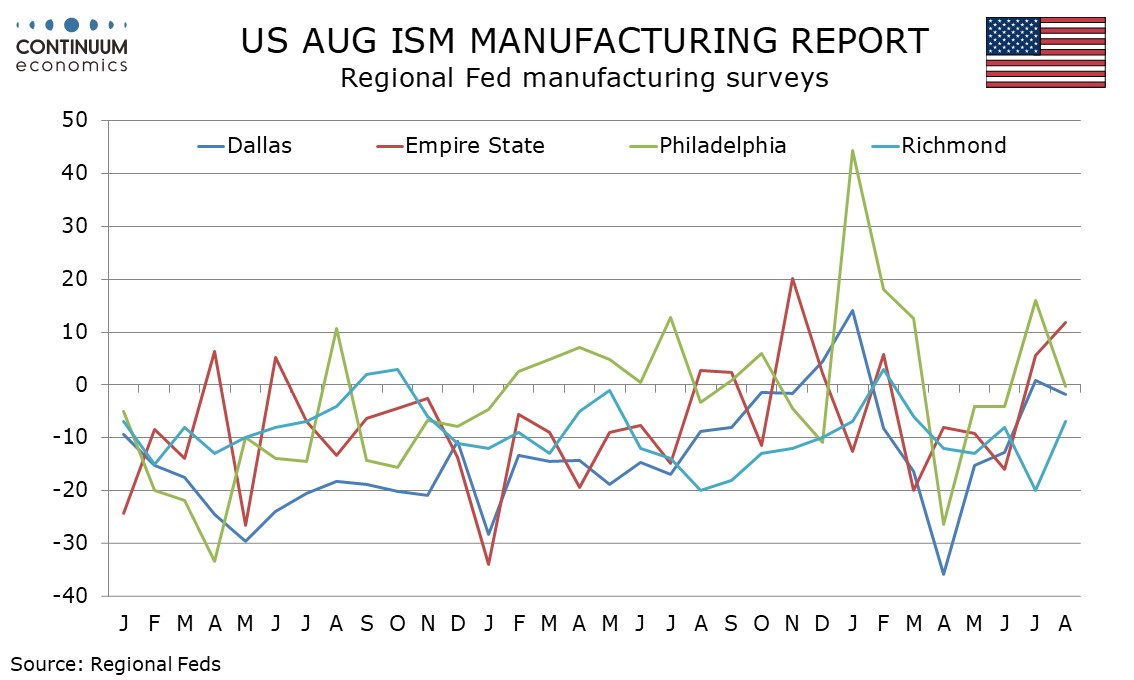

August’s S and P manufacturing PMI at 53.8 rebounded from a weaker July reading to reach its highest level since May 2022 at 53.3. Regional manufacturing surveys are mixed relative to July but mostly improved from June and averaging near neutral.

Prices paid do not contribute to the composite but also saw a dip in July, to 64.8 after four straight readings slightly above 69. We expect renewed growth in August following increased certainty over the persistence of tariffs, with a rise to 70.0. This would be the highest reading since June 2022.