U.S. June New Home Sales - Sharp May drop marginally extended

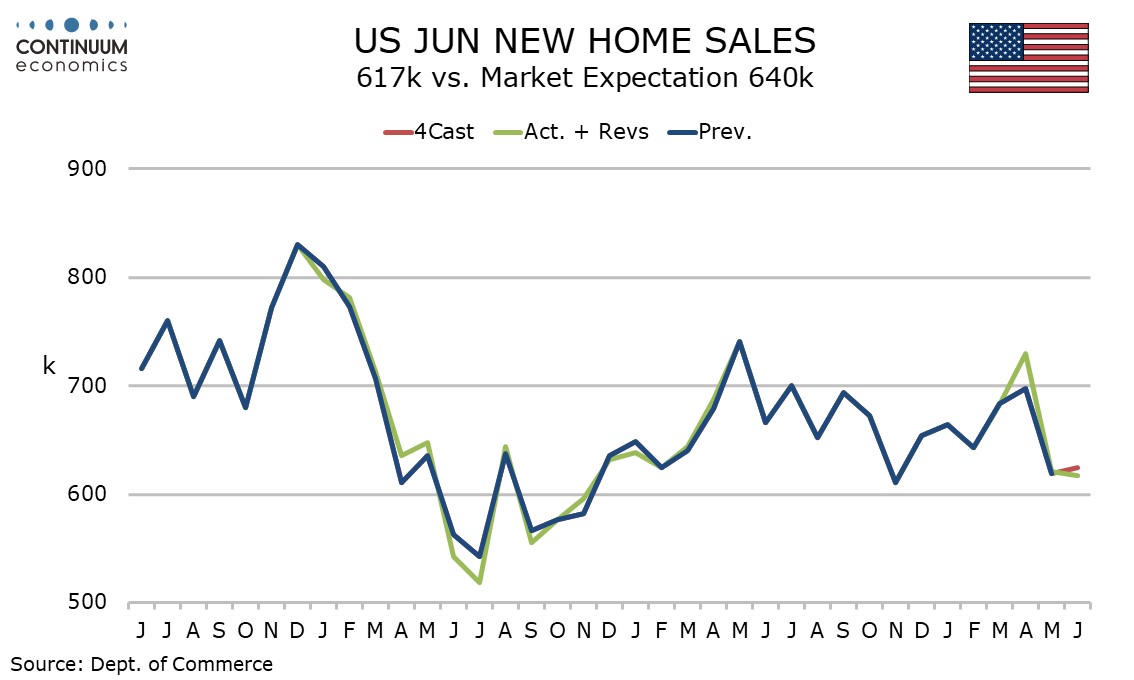

June’s 617k total for new home sales is weaker than expected, and while down only a marginal 0.6% from May extends a sharp 14.9% May decline suggesting that housing demand has lost momentum, as other data has also suggested.

Slippage has been seen in recent data from both pending home sales for May, which fell below its pre-pandemic lows, and yesterday existing home sales for June, which fell to their lowest level since December. Survey data from the MBA and NAHB has also softened. The latest new home sales total is the lowest since November.

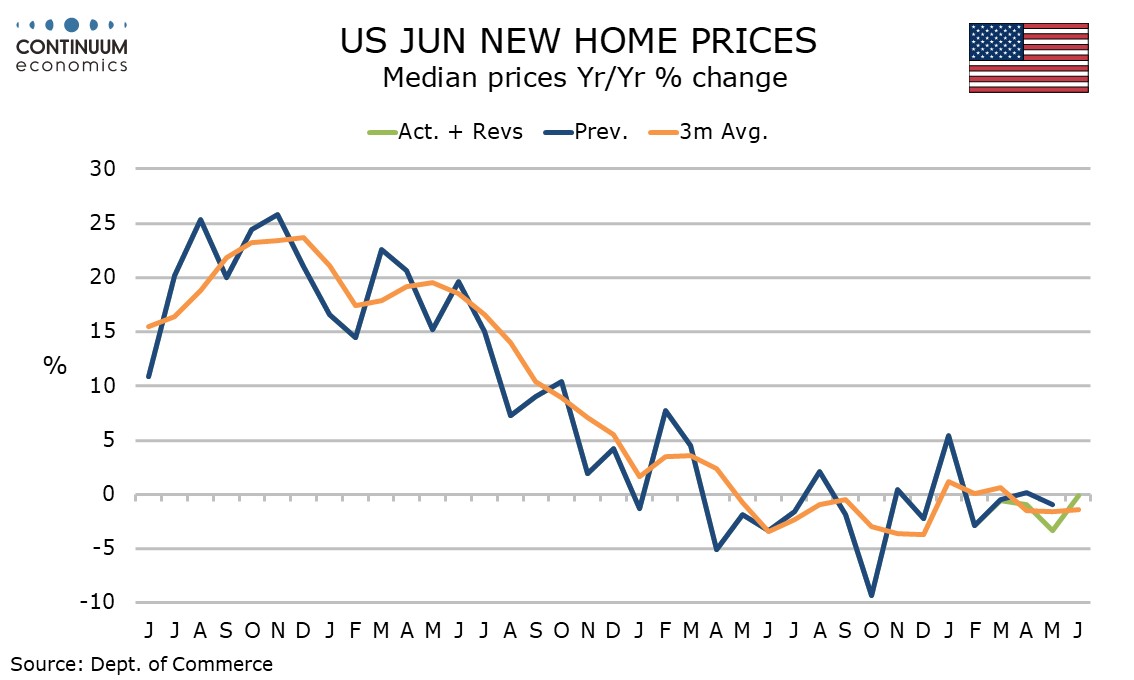

Monthly sales data showed sales down in the Northeast and Midwest but up modestly in the South and West. The median prices with a 2.5% monthly rise corrected two straight declines but is still quite soft at -0.1% yr/yr.

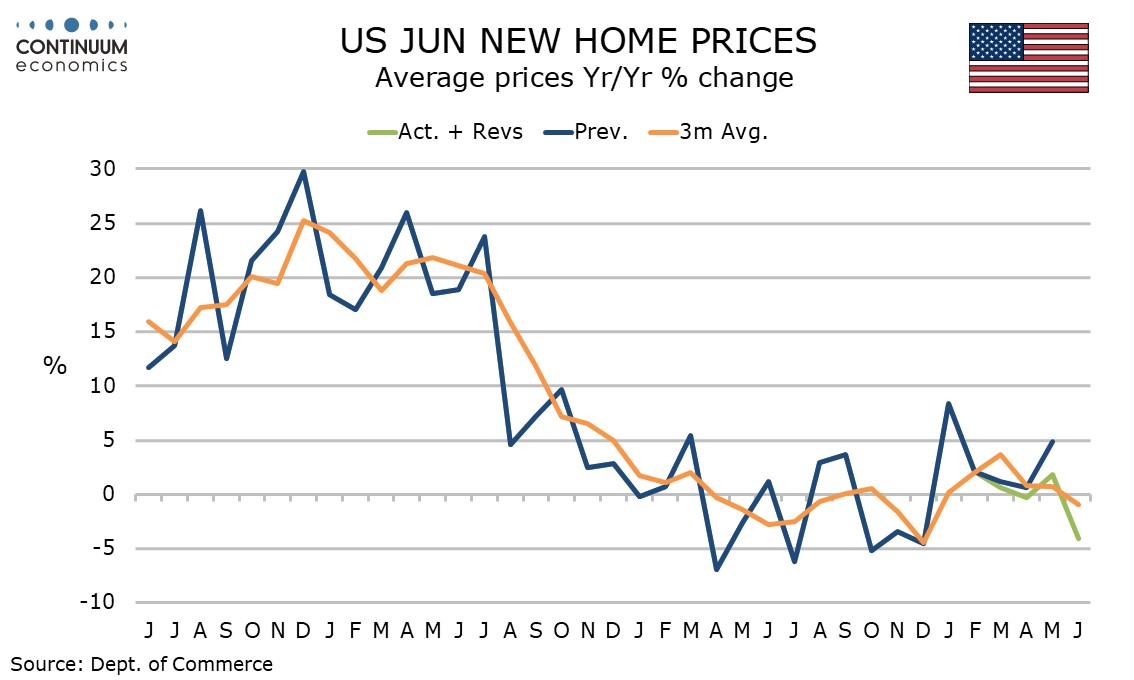

The average price more than reversed a 1.1% monthly rise in May, falling by 3.4%, and yr/yr data is weak at -4.1%.