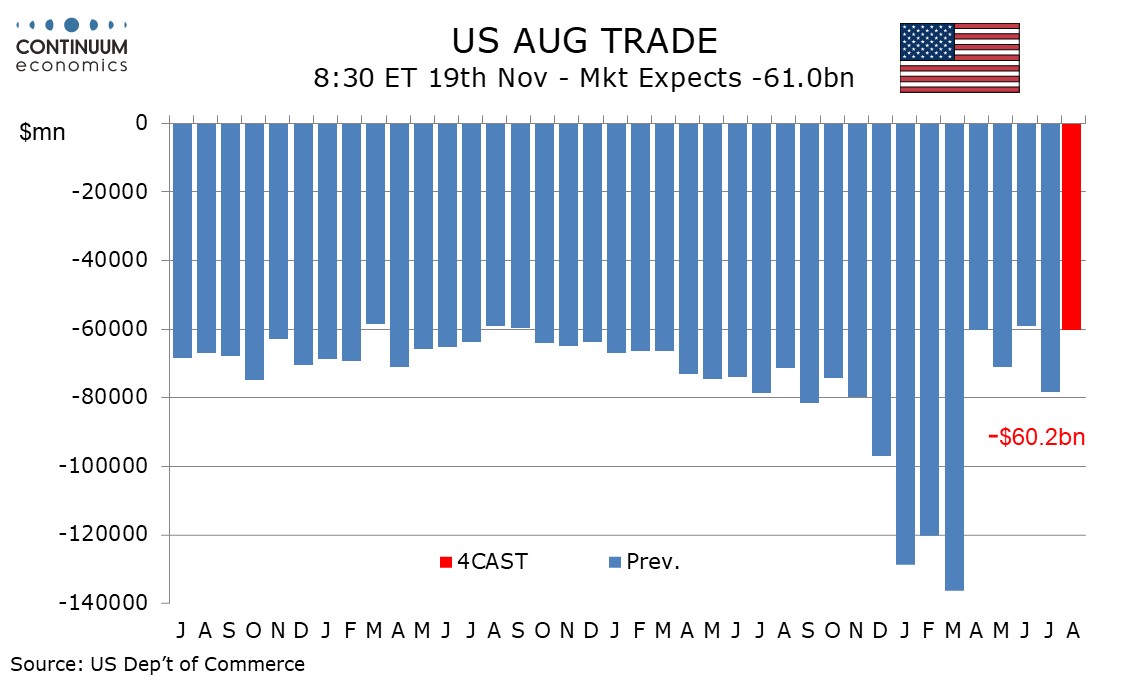

Preview: Due November 19 - U.S. August Trade Balance - Deficit to reverse most of a July increase

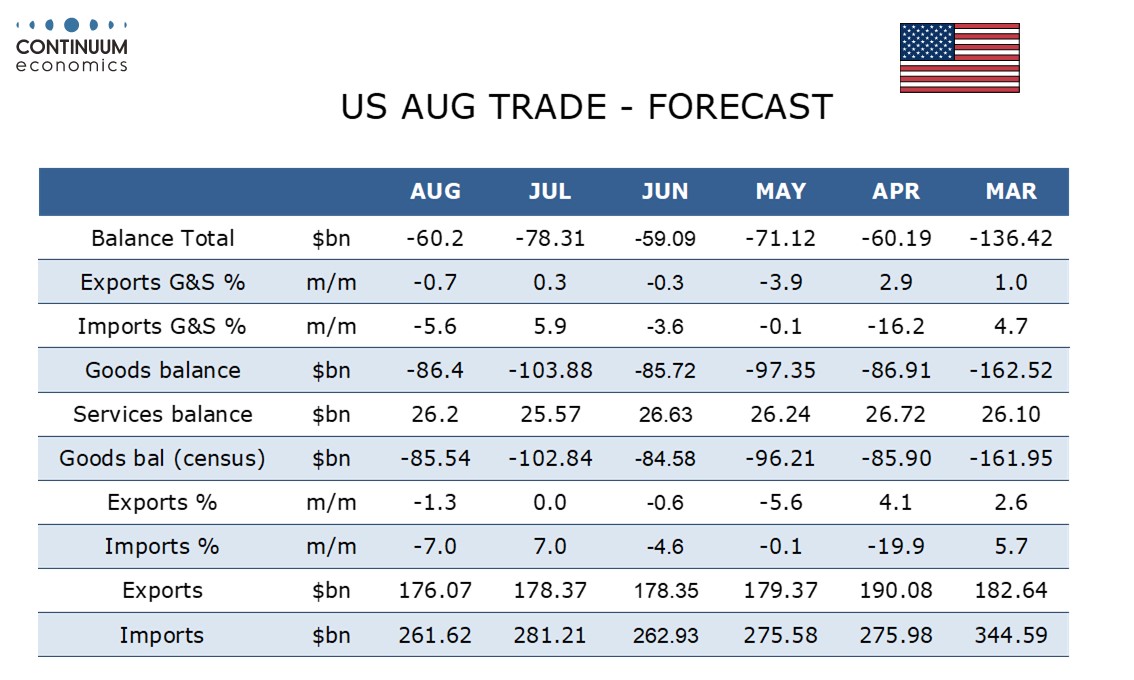

We expect an August trade deficit of $60.2bn, down from $78.3bn in July but slightly wider than June’s $59.1bn deficit that was the narrowest since March 2023. The deficit remains in a correction from elevated pre-tariff levels that brought a record high of $136.4bn in March. This release was originally due on October 7 but postponed due to the government shutdown.

Advance goods data (released back on September 25) showed a 1.3% decline in exports after a flat July and a 7.0% decline in imports to reverse a 7.0% increase in July. Industrial supplies led the decline in imports after leading July’s increase. We expect similar outcomes in this report, leaving a goods deficit of $86.4bn, down from $103.9bn in July. Canadian trade data for August showed a narrowing of its surplus with the U.S. after an increase in July. September Canadian trade data has been delayed due to an absence of data that is usually provided by the U.S. to Canada, but not during a government shutdown.

We expect the services surplus to rise to $26.2bn after falling to $25.6bn in July from $26.6bn in June. We expect service exports to rise by 0.3% after a 0.6% increase in July but service imports to correct lower by 0.5% after a 2.3% increase in July. This will leave overall exports down by 0.7% and overall imports down by 5.6%.