USD, EUR, JPY flows: USD a little weaker after employment report

The employment report was marginally weaker than expected, and the USD has slipped lower in response, but we doubt we will see USD weakness extend further today

The US February employment report is marginally on the soft side of expectations at 151k, with average earnings revised down in January and net employment revisions -2k. The unemployment rate is a touch higher at 4.1%. While marginally softer, this is very close to consensus so the market impact should be mild, especially given that the focus is much more on the consequences of current policy going forward than the current position of the economy.

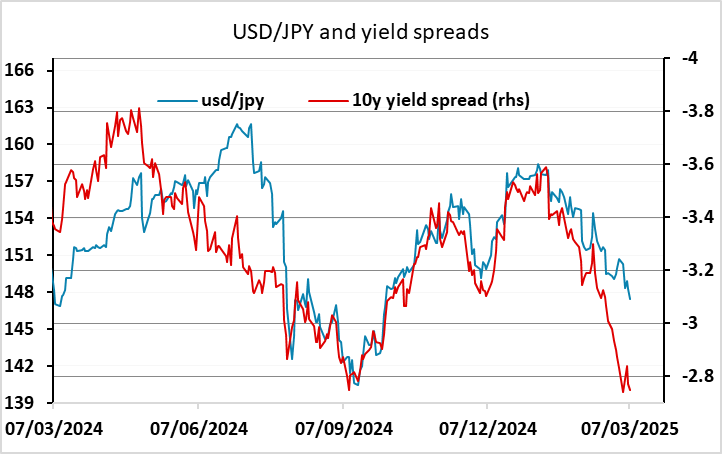

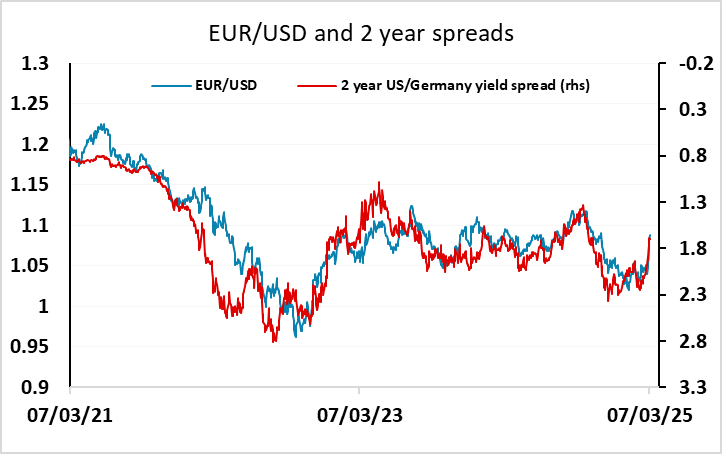

After a brief initial blip higher the USD is generally lower on the news, losing around 0.25 across the board, but there isn’t much movement in yields and with European yields lower on the day thanks to weaker European equity markets, we wouldn’t expect EUR/USD to extend this advance. There is still a strong case for a lower USD/JPY, but after the comments from Japanese Finance Minister Kato overnight noting that USD/JPY has been very one way since December, this trend may also pause for now.