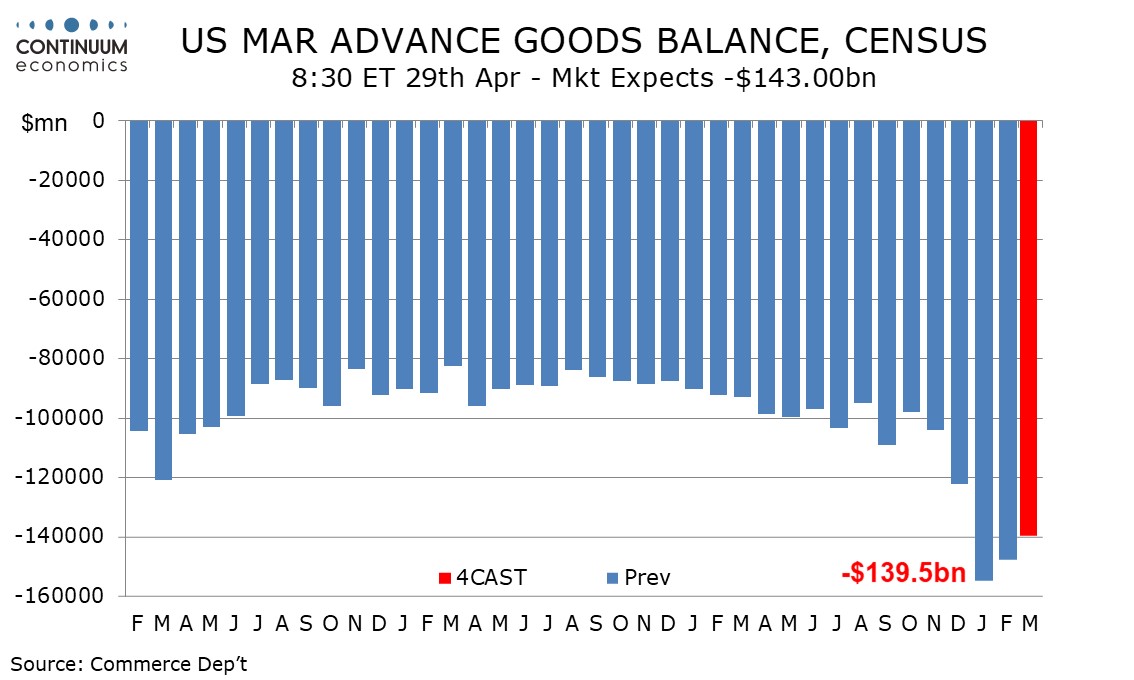

Preview: Due April 29 - U.S. March Advance Goods Trade Balance - Deficit to correct further, but remain very high

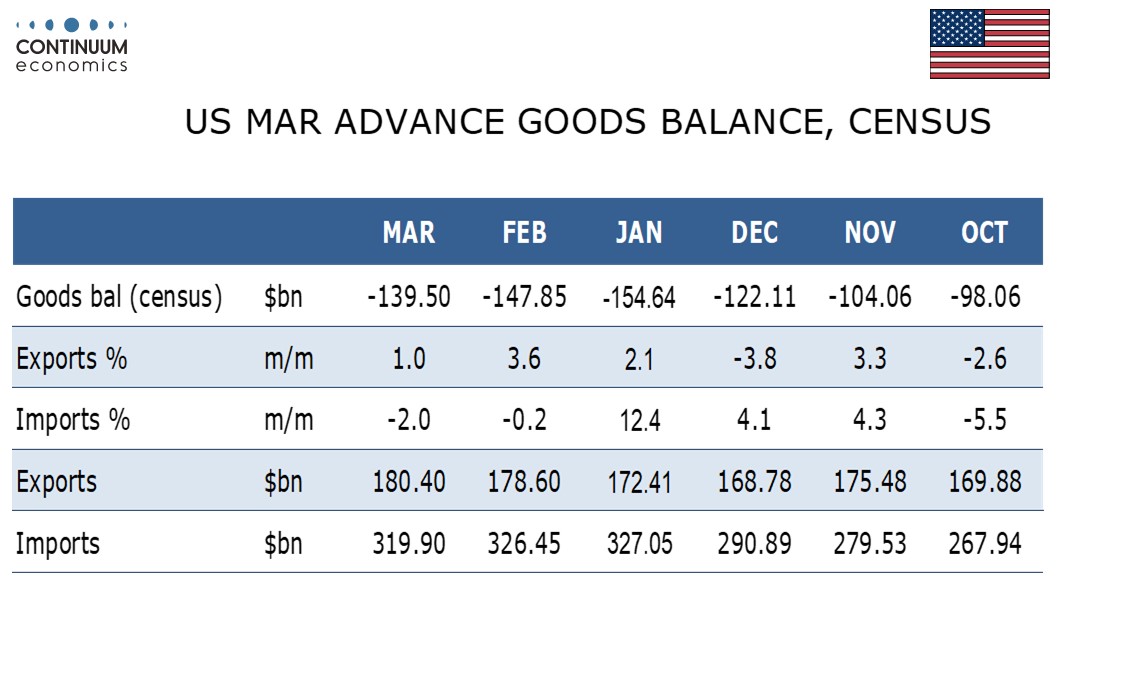

We expect an advance March goods trade deficit of $139.5bn, down from $147.8bn in February and a record $154.6bn in January, but still above December’s $122.1bn, which itself was a record high before the Q1 data was seen. Importers were still trying to beat the tariffs imposed in April.

We expect exports to rise by 1.0% after gains of 3.6% in February and 2.1% in January. We expect imports to fall by 2.0% after a 0.2% fall in February followed a 12.4% surge in January. The changes will be in volumes. Price data showed minimal changes for both imports and exports in March.

Around half of the surge in imports in the year to date comes from finished metal shapes and nonmonetary gold. These components edged off their January highs in February and we expect them to do so further in March. However we expect imports elsewhere to remain strong. There may be some correction lower in imports from Canada and Mexico but imports elsewhere are likely to accelerate ahead of the April tariff announcement. Chinese data shows exports from China accelerated in March.

Advance March wholesale and retail inventory data will be released with the advance March data. Both the inventory and trade data will have an impact on expectations for Q1 GDP data which is due on April 30, and could prove partially offsetting if strong imports are reflected in higher inventories.