This week's five highlights

Iran and Israel Seems to be Taking it Easy

U.S. Initial Claims stay low and stable

UK CPI Fall Further

China Q1 GDP Upside Surprise

Canada March CPI a little firmer

Market participants attention has been on Israel and Iran after Iran retaliate on Israel's previous strike. Most fear such tit for tat retaliation will lead to a further escalation in geopolitical tension but so far both sides are looking likely to take it easy by sending symbolic strikes towards unimportant target. Iran's drones and missiles have been intercepted by Israel and its allies and the last retaliation from Israel led to a few explosion in Syria and Iran, but official comment from Iran continues to downplay with denying any direct hit and there are no plans for immediate retaliation.

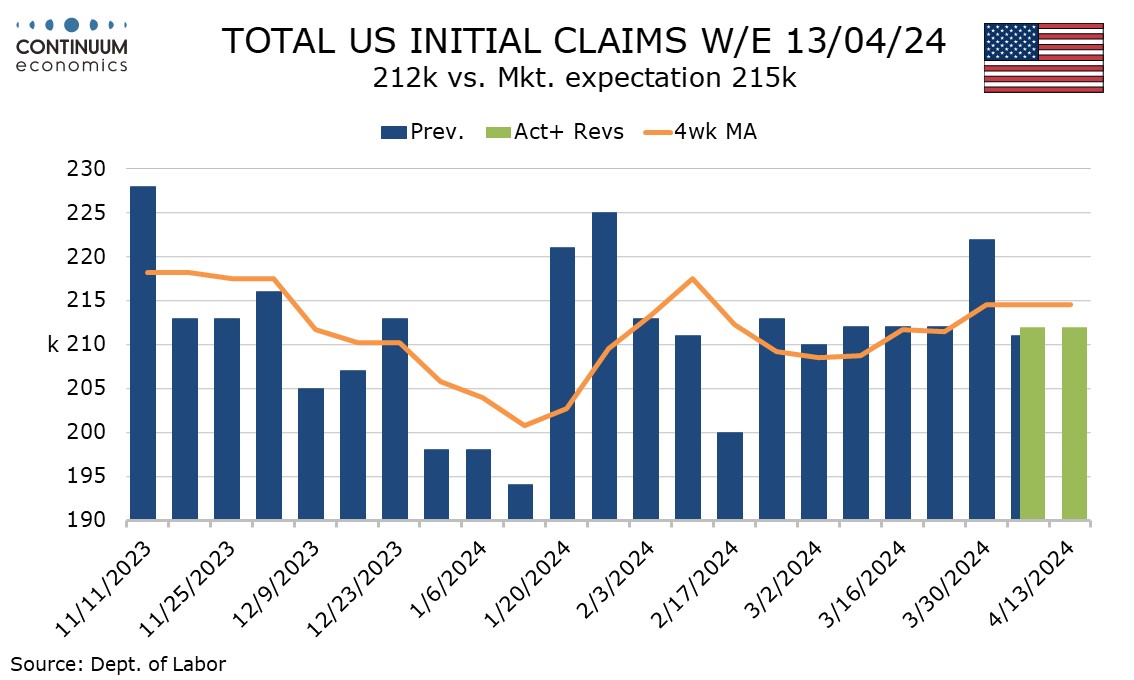

Initial claims are unchanged at 212k, still suggesting a tight labor market in the April non-farm payroll survey week. April’s Philly Fed manufacturing survey at 15.5 from 3.2 is the highest since April 2022 and does follow recent signs of improvement in the ISM and S and P national manufacturing surveys. Initial claims are showing exceptional stability at a low level, with five of the last six weeks coming in at 212k, the exception at 222k two weeks ago possibly a consequence of it being Easter week.

Continued claims, which cover the week before initial claims, also showed little change, a 6k decline to 1.812m. The 4-week average has been very close to 1.8m since early February. Prices paid saw quite a sharp rise to a 4-month high of 23.0 from 3.7 while prices received saw a modest rise to 5.5 from 4.6, still below February’s 6.2 and most recent months.

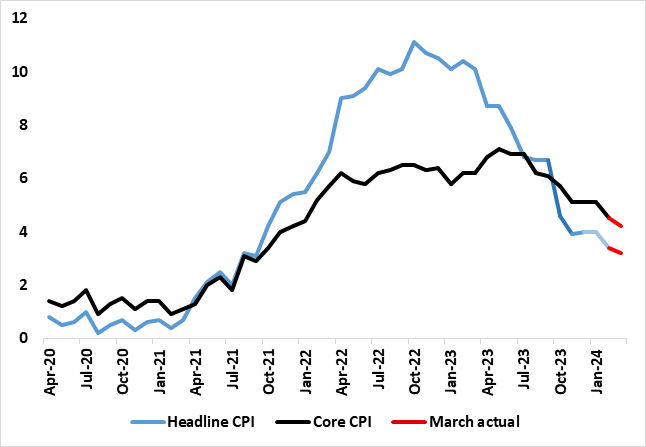

Figure: Headline and Core Inflation Drop Continues

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearly so (Figure), despite higher petrol prices, with food acting as a major offset. Moreover, it continued in the just-released March CPI data, albeit with more signs of resilient services inflation alongside additional hints that core inflation is also showing some resilience, at least in adjusted m/m numbers. Even so, the headline CPI rate fell 0.2 ppt to 3.2% y/y, the lowest in 33 months while the core fell a notch more significantly to 4.2%, albeit both readings a touch above consensus and BoE thinking. We think the data still leaves open the case and momentum for a BoE rate cut this quarter. This partly reflects BoE Governor Bailey choosing to underscore that (more supply-side) UK inflation dynamics are different enough to those in the U.S. to allow a possible cut before anything made by the Fed and thus chime with ever-clearer ECB policy leanings.

Any such BoE decision will be close and is already openly debated. Three MPC members (most recently Megan Greene) have lingering concerns about price pressures, something that is evident in core inflation. These CPI numbers arrived a day after mixed labor market figures, which revealed slightly higher-than-expected wage outcomes but alongside clearly weak job dynamics, where a perturbing fall in participation is being offset by a clear recovery in overall hours worked (Figure 2), all indicative of a less tight labor market.

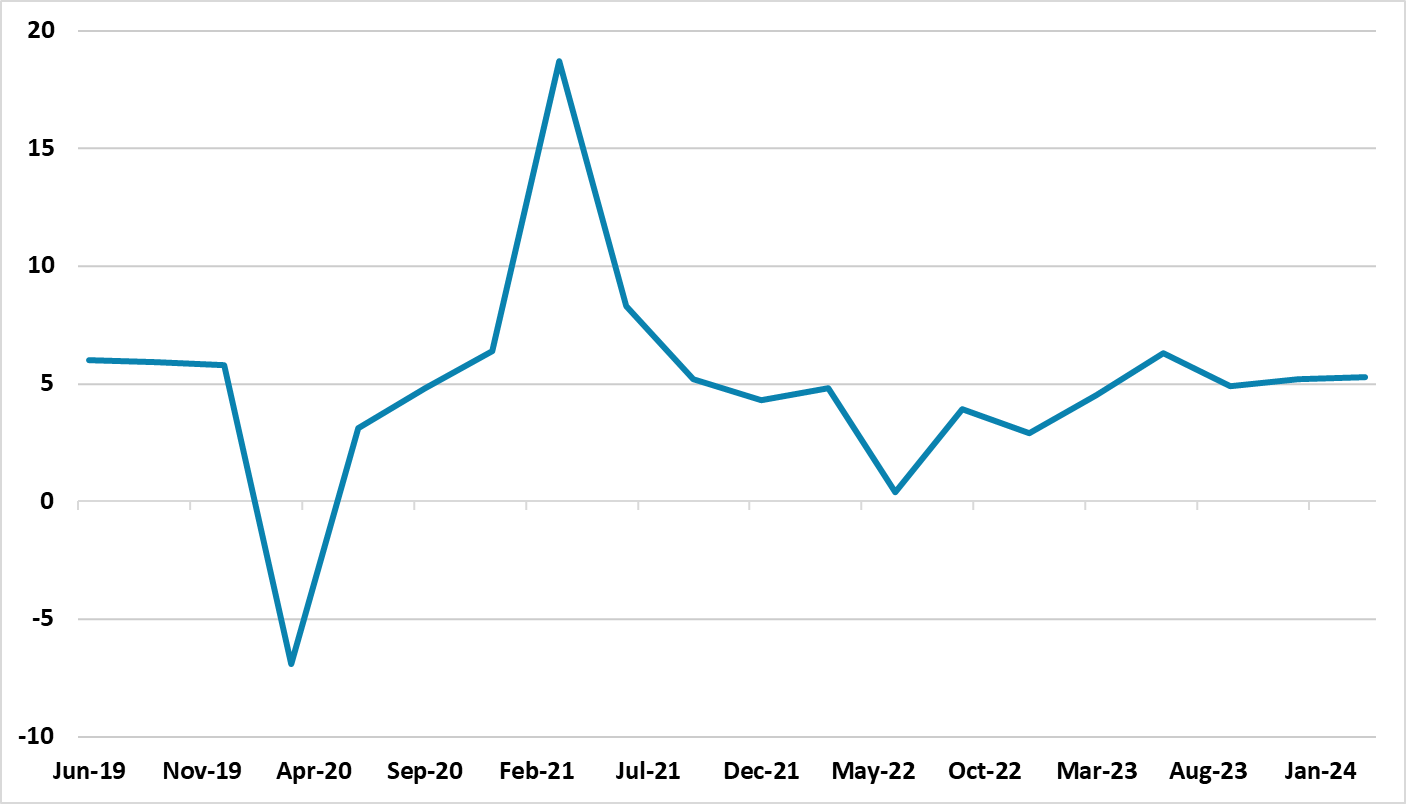

Figure: China Quarterly GDP (Yr/Yr)

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail sales continues to slow and spread to a catering slowdown, while residential property investment remains a negative drag on GDP. The 1.1% decline in the GDP deflator also means a mere 4.2% nominal GDP growth, which will restrain aggressive fiscal action. Overall, we are revising 2024 real GDP growth to 4.6% from 4.4% and keep 2025 at 4.0%.

The Q1 China GDP at 5.3% Yr/Yr was much better than expected. The main reason was that public investment surged by 7.8% Yr/Yr, which produced an upside surprise to fixed investment and GDP. Some of this is the feedthrough of the Yuan1trn flood defense infrastructure build, but the data suggests it also reflects the March decision to set a larger budget deficit.

However, the breakdown of the March monthly data, suggest that momentum faded at the end of Q1. Retail sales grew 3.1% in March Yr/Yr and was well below consensus. The breakdown was also a concern as previously buoyant catering slowed to 6.9% Yr/Yr from 12.5% in Jan/Feb, with consumer appearing to be more cautious after the lunar New Year celebrations. Auto sales were also worrying at -3.7% Yr/Yr versus +8.7% Yr/Yr in January/February. Meanwhile, industrial production at +4.5% in March Yr/Yr also surprised on the downside. The residential property sector remains a drag on growth meanwhile, with a fall of 9.5% YTD Yr/Yr and property sales down 30.7% on the YTD Yr/Yr.

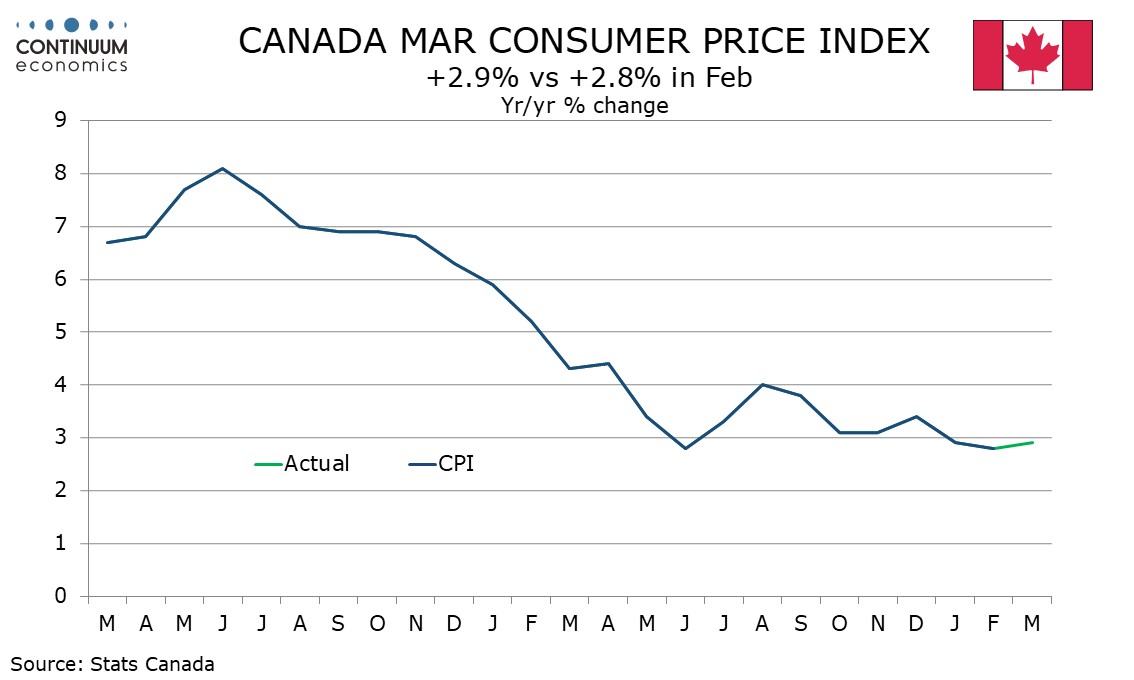

March’s Canadian CPI has seen an as expected increase to 2.9% yr/yr from February’s unexpectedly softer 2.8%. On the month the seasonally adjusted data is a little firmer after two soft months but the Bank of Canada’s core rates continue to fall. On the month CPI rose by 0.6% overall and 0.7% ex food and energy, and though some of this strength is seasonal we saw seasonally adjusted gains of 0.3% both overall and ex food and energy. The seasonally adjusted ex food and energy gain comes after two straight gains of only 0.1%. The Bank of Canada can still see this as representing progress in Q1 though more soft data is likely to be needed before it feels ready to ease policy.

The relative strength of March’s data relative to January and February comes to a large extent from clothing and footwear seeing a 1.4% seasonally adjusted increase after two straight sharp declines. Shelter remains relatively firm with a 0.4% rise while recreation, education and reading rose by 0.6%. Household operations, furnishing and equipment however fell by 0.5%. Each of the latter three components were similar to their February outcomes, illustrating the importance of the swings in clothing.