This week's five highlights

BoJ Intervened Twice

And see sentiment turned lower in USD/JPY

FOMC Notes Lack of Further Inflation Progress

U.S. Non-Farm Payrolls Still strong if a little less so

Canada Q1 GDP looking less positive than previously projected

The USD/JPY rallied on Monday after market participants digested the absence of support from the BoJ on the previous Friday. Ueda's remark of "It is possible for pro-longed weakness in the JPY" seems to have set the green light for USD/JPY bidders after suggesting the BoJ is in no rush to further tighten. The high reached 160.20 and forced the BoJ to be back in office from their Japanese holiday. The BoJ intervened at least twice on Monday, once in Asia session and once in London session with a the last one suspected to be in New York session. The first intervention sees USD/JPY moved five big figures down to 155 and subsequent magnitude are less at around two to three figures. The BoJ intervened again on Thursday, in a thin liquid session, when only the New Zealand market is open and beat the pair down by almost another five figures from 157.6 to 153. There was no confirmation from the BoJ nor MoF but from price action and the BoJ changes of current account released on Tuesday, one could believe it is very likely an intervention from the authorities.

Nothing changes sentiment more than price and after two intervention from the BoJ, long speculators seems to be taking a break for now and may have turned to sellers as we see the pair stay depressed after the initial rebound from intervention. No none would like to be caught by the BoJ in the NZ hours again. Even when the BoJ is read to be preserving their foreign reserve, the uncertainty in next intervention is keeping USD bidders at bay while the fundamental shift is yet to come. On the chart, the pair is back to pressure the 153.00 low after corrective bounce was checked at the 156.00 level. Negative daily studies suggest scope for break here to turn focus to the strong support at the 152.00 congestion and extending to 151.95/151.90, the 2022/2023 year highs. Break here will see room for deeper pullback to correct strong rally from the 140.25, late-December low. Meanwhile, resistance is lowered to the 154.51/155.00, Monday's low and congestion area. This is expected to cap and sustain losses from the 160.20 high.

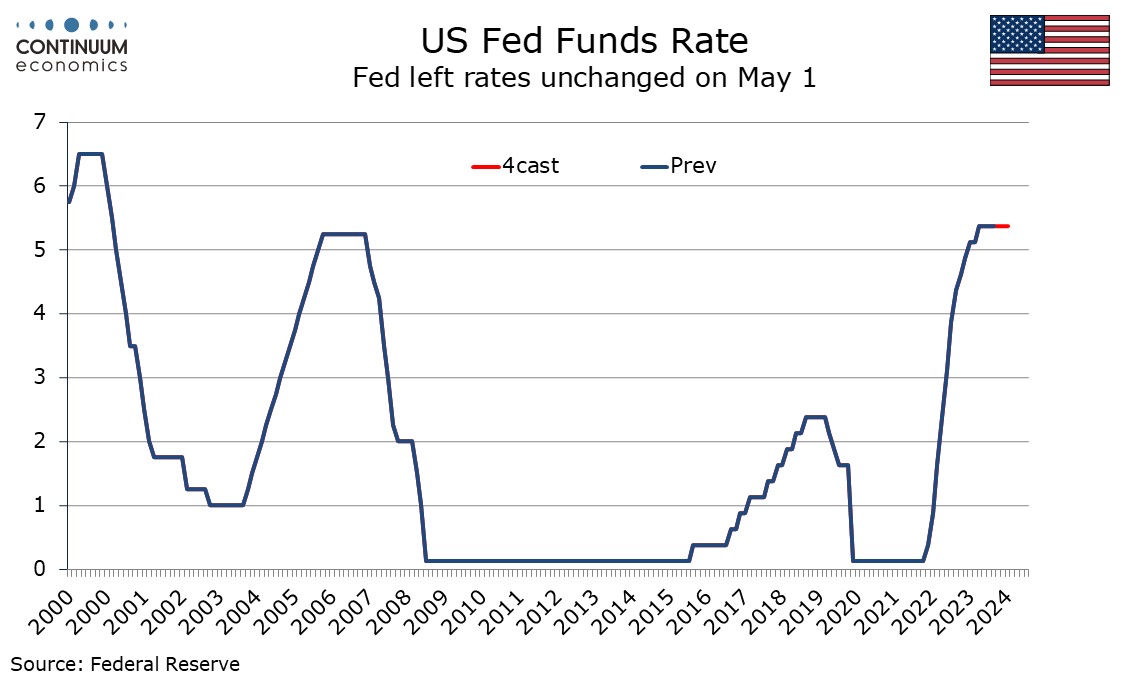

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet reduction, the monthly cap for USTs to be cut starting in June to $25bn from $65bn, though that for agencies will be left at $35bn. The minutes from the last meeting had suggested that the pace of QT would be cut by around half, and for USTs and agencies combined the cap has come down by a little less than that, to $60bn from $95bn. The decision on the balance sheet does not come as a major surprise though some may have expected the tapering to be phased in a little more slowly.

The other most notable change in the statement was to state that risks towards achieving the employment and inflation goals are judged to have move towards better balance over the past year rather than stating in the present tense that they are moving into better balance, thus emphasizing the point that progress has not continued given recent inflationary disappointment. There were no dissenting votes.

By changing the statement more through addition rather than removal the FOMC has avoided signaling a strong pivot in its stance while noting inflationary disappointment. The key phrase, not expecting to reduce the target range until there is greater confidence that inflation is moving sustainably towards target, is maintained. The implication is that the next move is still expected to be an ease, but improved data on inflation will be needed before that happens, and there is no signal as to when that is expected. Easing will decided according to data rather than the calendar.

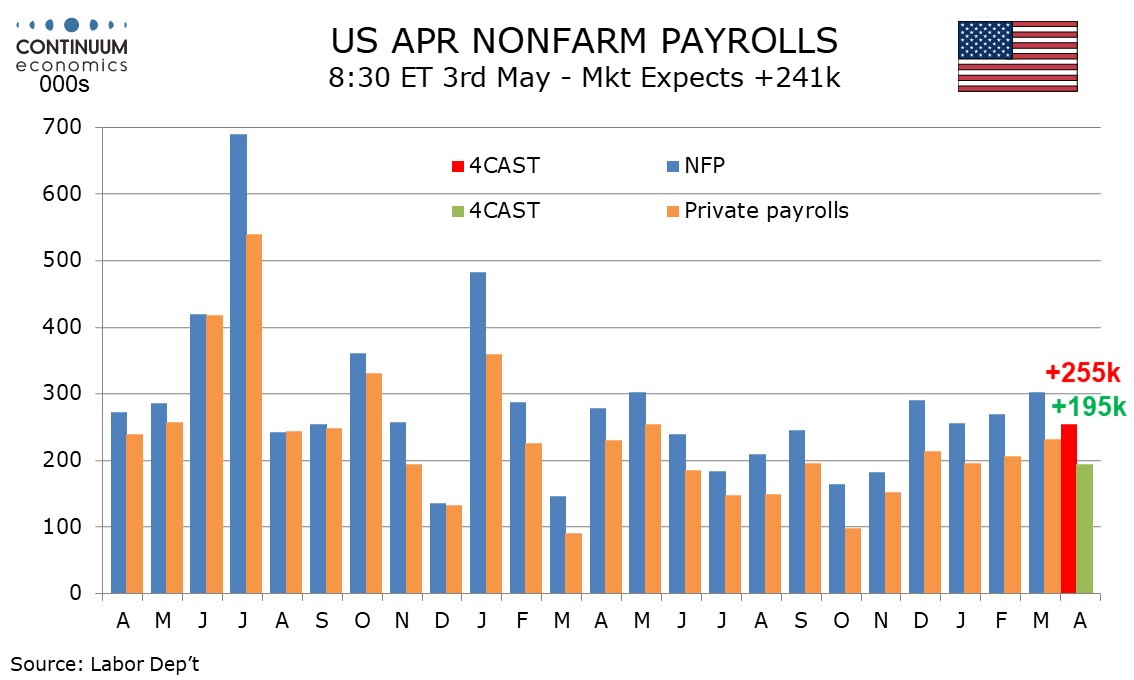

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in California. Non-farm payroll trend had been gradually slowing until November 2023, when the 3-month average reached 198k and the 6-month average was 205k. They have since risen to 276k and 244k respectively, putting our 255k forecast in between. Our forecast would be only marginally above January’s 256k rise overall and 196k in the private sector, a month where bad weather may have provided some restraint.

Initial claims give no hint of labor market slowing, but a few surveys have softened in April. April payrolls could see some restraint from tougher seasonal adjustments, though probably not a large one, as improving labor supply allows the creation of seasonal jobs. Construction may take a small hit from rising mortgage rates but manufacturing signals are picking up. A 60k positive contribution from government would be in line with recent trend. Average hourly earnings trend seems to be around 0.3% per month, if a little above rather than below. This month could come in above tend due to a large increase in the minimum wage for fast food workers in California. This would see yr/yr growth correct higher to 4.2% from 4.1%. We expect unemployment to be unchanged at 3.8% as the labor force comes close to matching a healthy rise in employment. March data did see the household survey, which calculates the unemployment rate, outperforming non-farm payroll growth, but trend in household survey employment has been a little softer than that of non-farm payrolls.

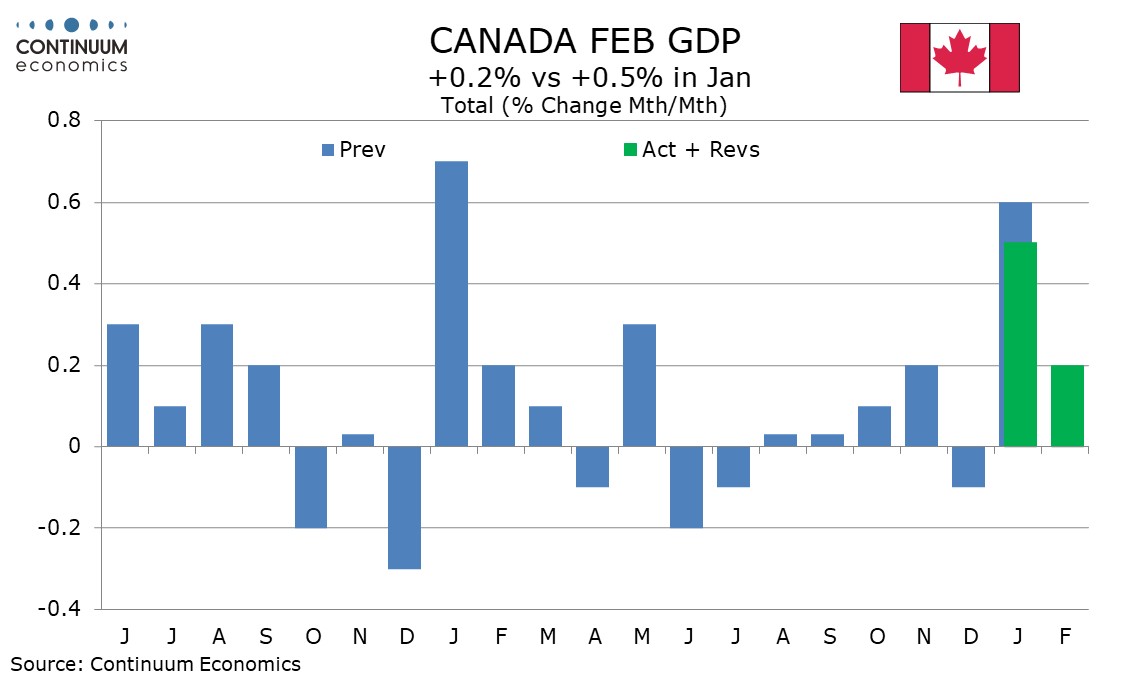

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1. Such a quarterly increase would be slightly below a 2.8% annualized estimate made with the Bank of Canada’s April Monetary Policy Report, and not very impressive given that Q1’s 1.0% annualized increase was restrained by public sector strikes in Quebec. These restrained November and December monthly data with their ending explaining much of the increase in January.

February data showed goods unchanged with mining reversing a large January decline and utilities reversing a large January increase. Manufacturing saw a modest 0.4% decline after a 0.5% January increase. Services rose by 0.2% led by a 1.4% rise in transport and warehousing. Yr/yr growth was stable at 0.8%. This is a subdued pace but fears that the economy might be slipping into recession that built during 2023 have faded.