U.S. May ISM Manufacturing - Still weak in most components

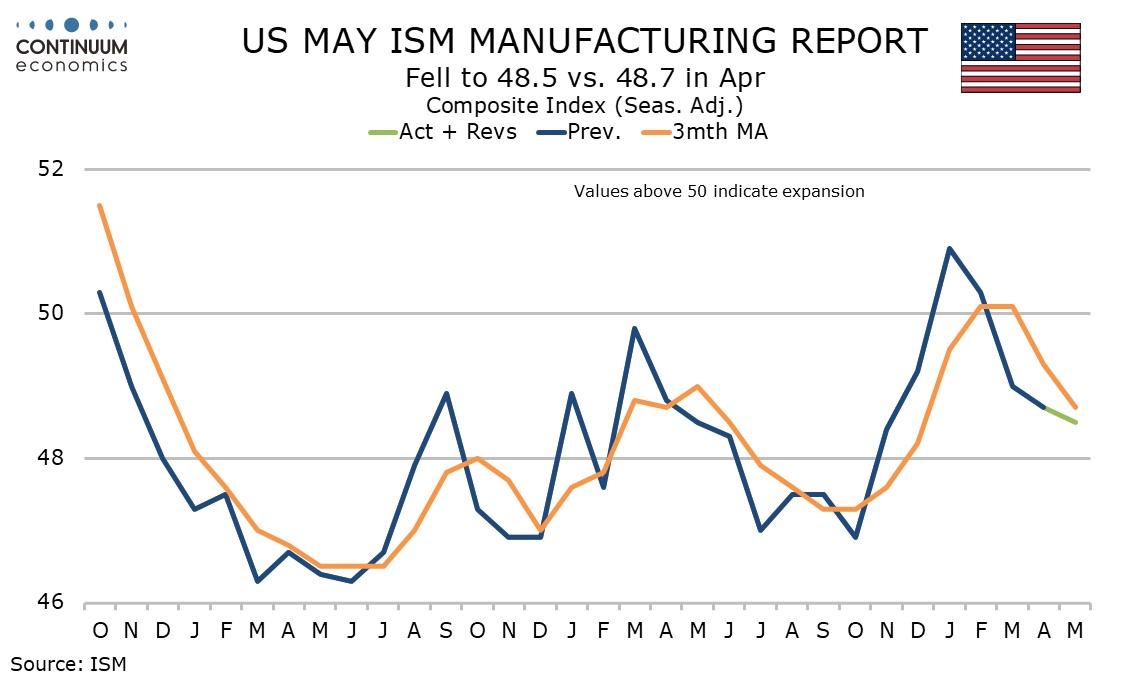

May’s ISM manufacturing index of 48.5 is slightly weaker than April’s 48.7 and that comes as a disappointment given improvements in some other surveys and a slightly less alarming tariff picture than was the case in April.

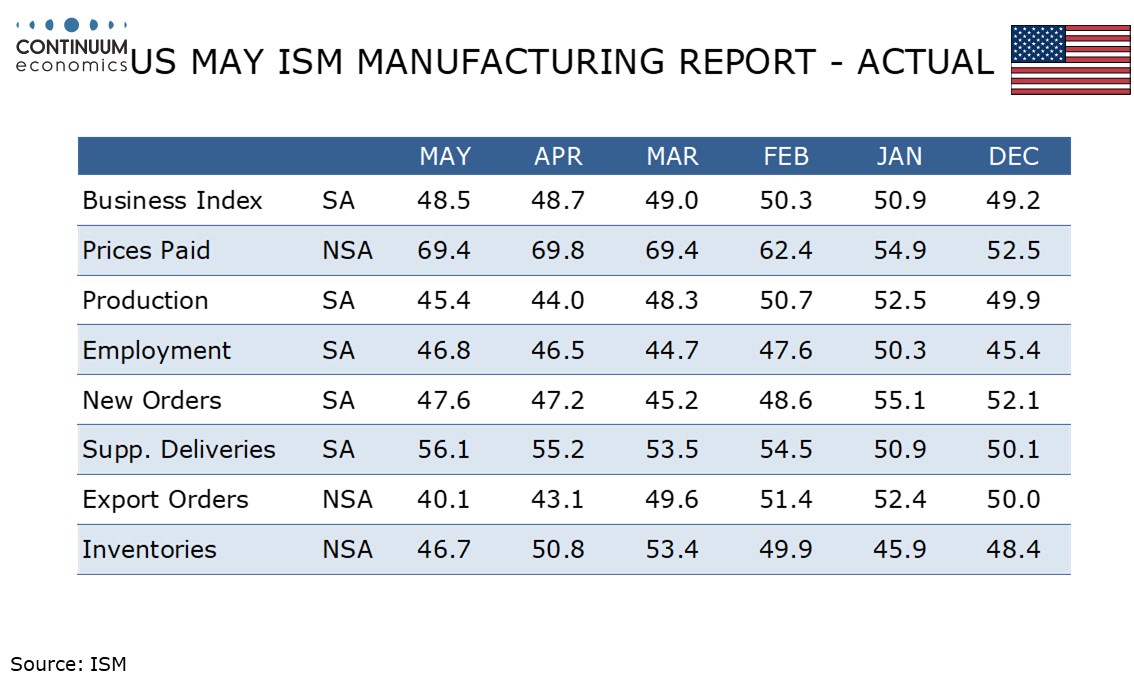

Four of the five contributors to the composite saw increases from April, though only deliveries at 56.1 from 55.2 look strong, and that could be a sign of supply chain problems. New orders at 47.6 from 47.2, production at 45.4 from 44.0, and employment at 46.8 from 46.5 all increased marginally but remain weak.

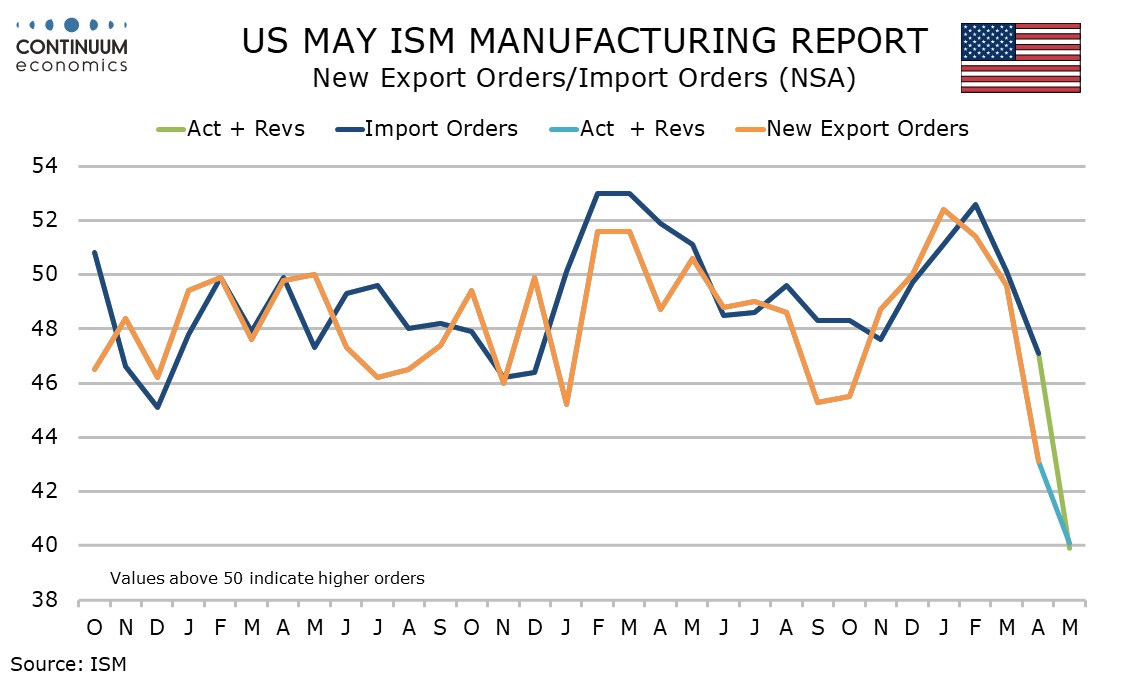

Dragging the composite lower was inventories, falling to 46.7 from 50.8. This may be connected to a fall in imports, to a very weak 39.9 from 47.1. Both inventories and imports are coming off elevated Q1 levels. Imports do not contribute to the composite. Nor do exports, which at 40.1 from 43.1 are also very weak.

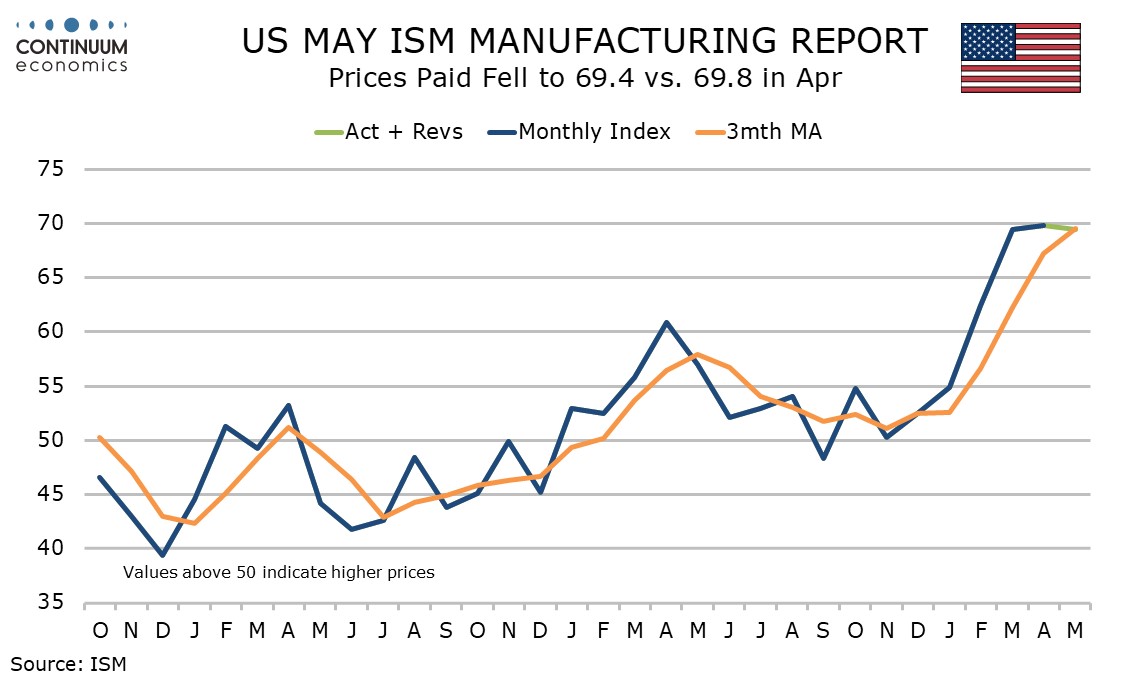

Prices paid do not contribute to the composite and slipped marginally to 69.4 from 69.8 but remain elevated. April’s reading was the highest since June 2022.

April construction spending with a 0.4% decline saw a third straight drop. The fall, as was the case in February and March, was led by private residential spending at -0.9%. Private non-residential fall by 0.1% and public construction increased by 0.4%.