U.S. September PPI - Subdued though core rates still a little too high on a yr/yr basis

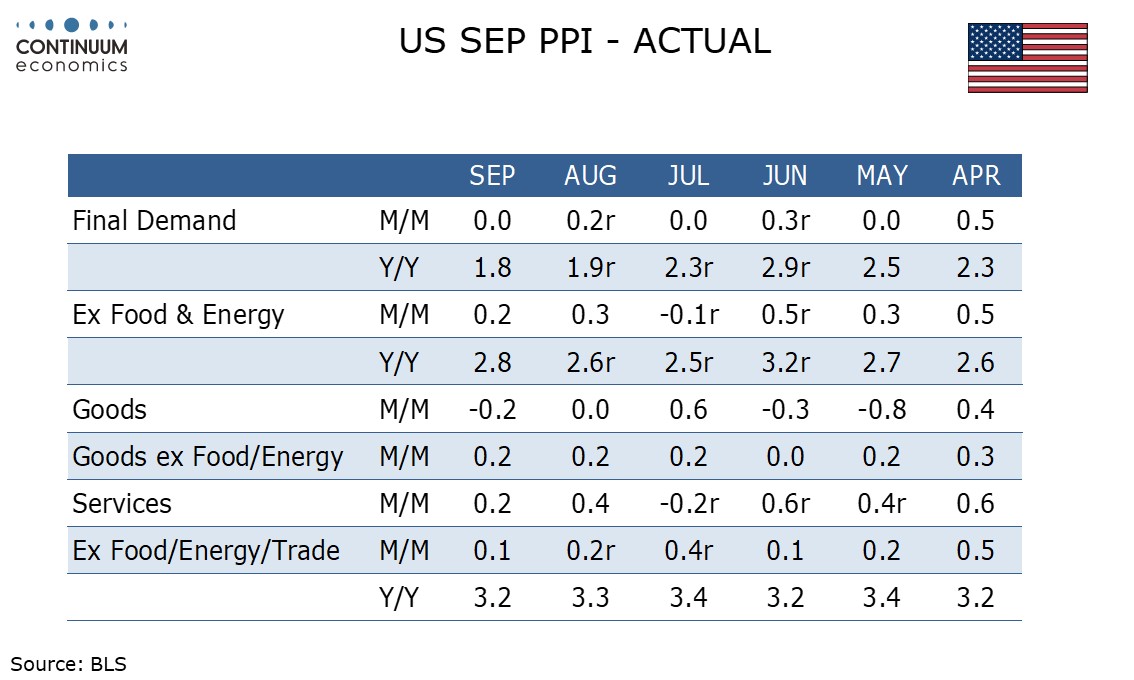

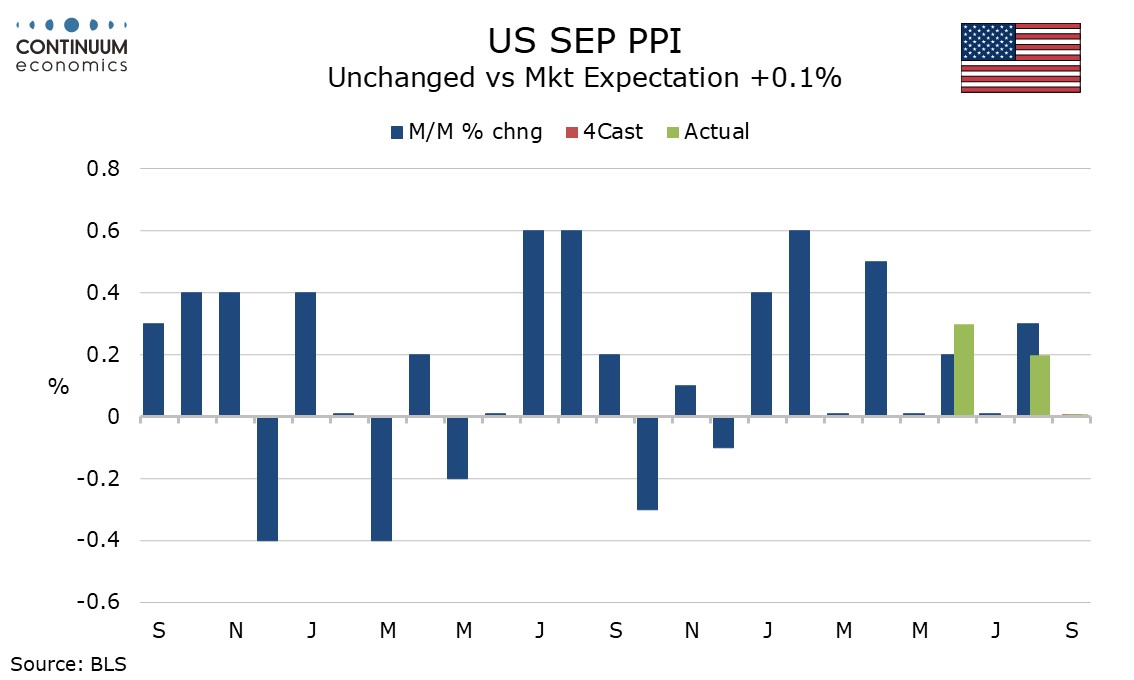

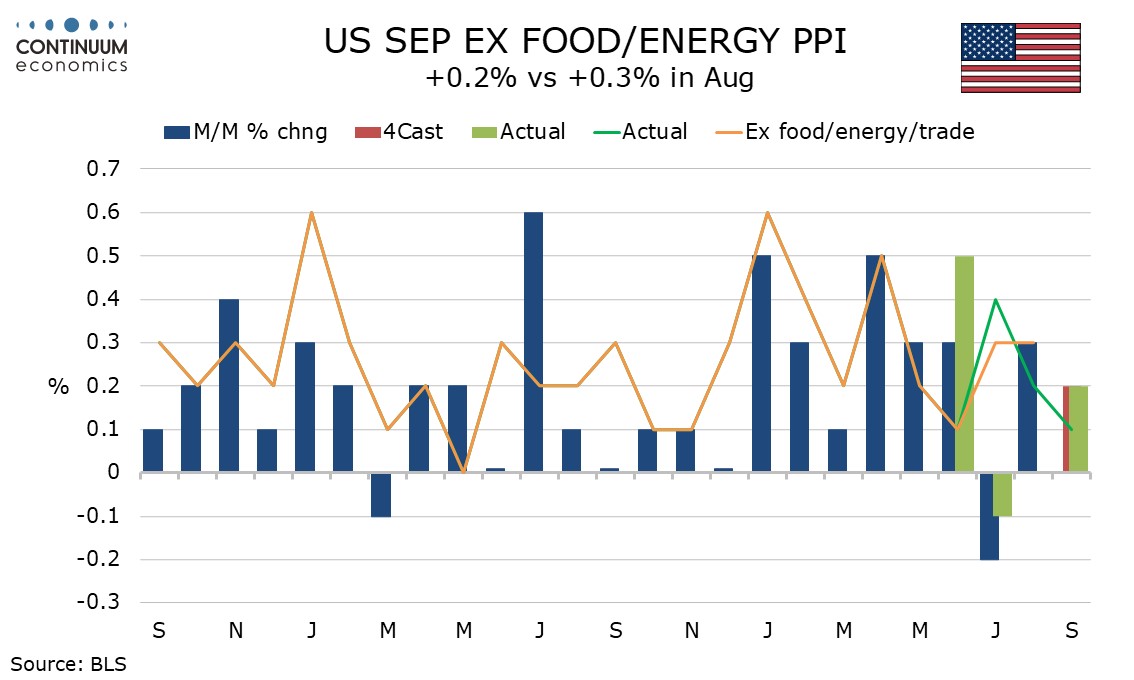

Contrasting the CPI, September’s PPI has come in on the low side of expectations at unchanged, with the ex food and energy pace slowing to 0.2% from 0.3% and ex food energy and trade below trend at 0.1%, with August revised down to 0.2% from 0.3%.

The headline was depressed by a 2.7% fall in energy that may be difficult to sustain given the situation in the Middle East, but food with a 1.0% increase saw its strongest rise since February.

Goods ex food and energy showed a third straight 0.2% increase while services also rioe by 0.2%, with trade also up by 0.2%. Transportation and warehousing rose by 0.3% and other services rose by 0.1%. The underperformance of PPI ex food energy and trade relative to ex food and energy was clearly marginal.

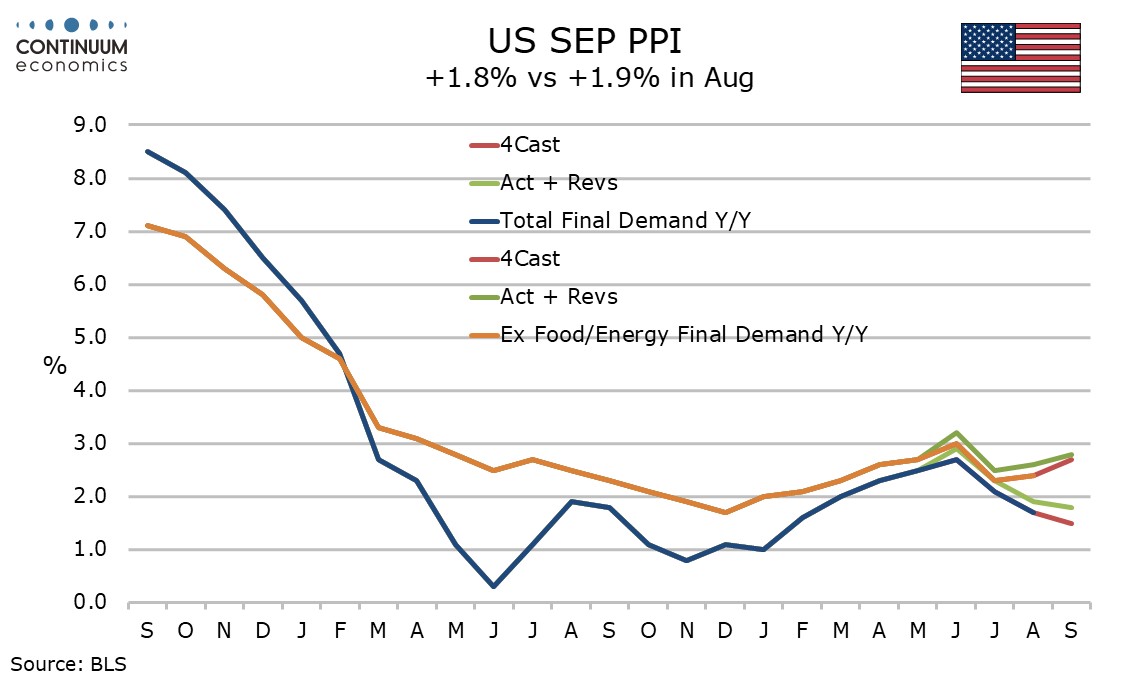

Yr/yr PPI fell to 1.8% from 1.9% and ex food, energy and trade fell to 3.2% from 3.3%. However ex food and energy PPI picked up to 2.8% yr/yr from 2.6%. While we saw a subdued month, yr/yr core data is a little higher than where the Fed would like.

Intermediate goods PPI saw processed goods down by 0.8% with a 0.1% decline ex food and energy, while unprocessed goods fell by 3.2% but with a 1.9% rise ex food and energy. Intermediate services rise by 0.2%. This is a mostly subdued picture.