Published: 2025-06-06T15:36:47.000Z

Preview: Due June 18 - U.S. May Industrial Production - Flat again overall, but manufacturing to correct higher

Senior Economist , North America

-

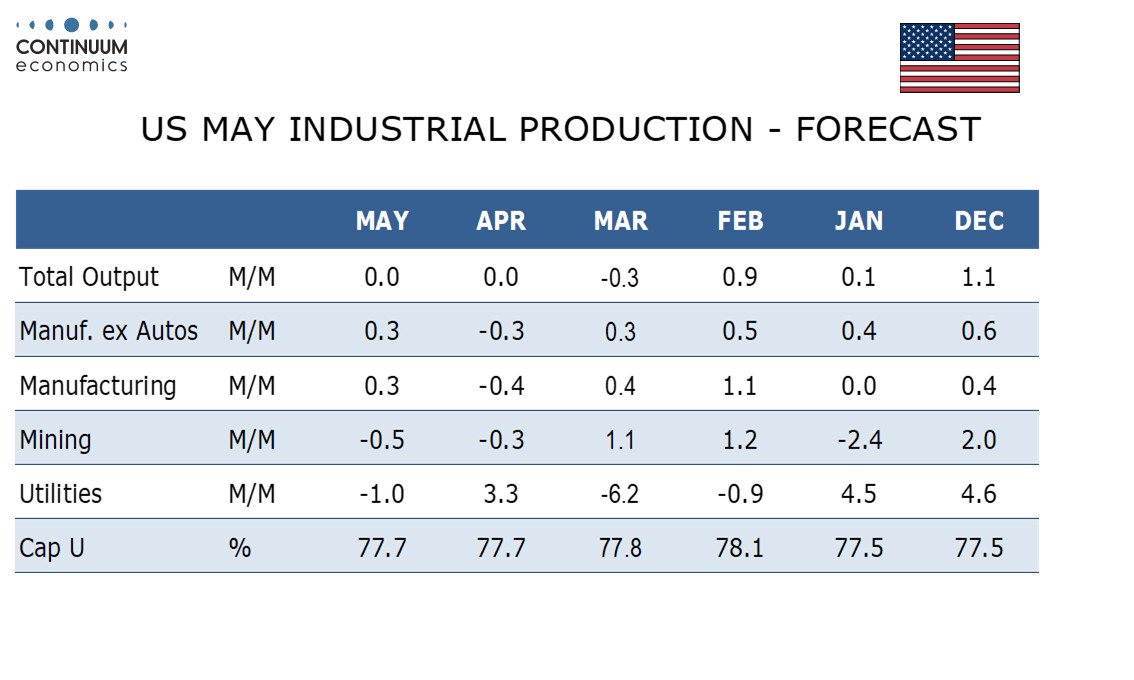

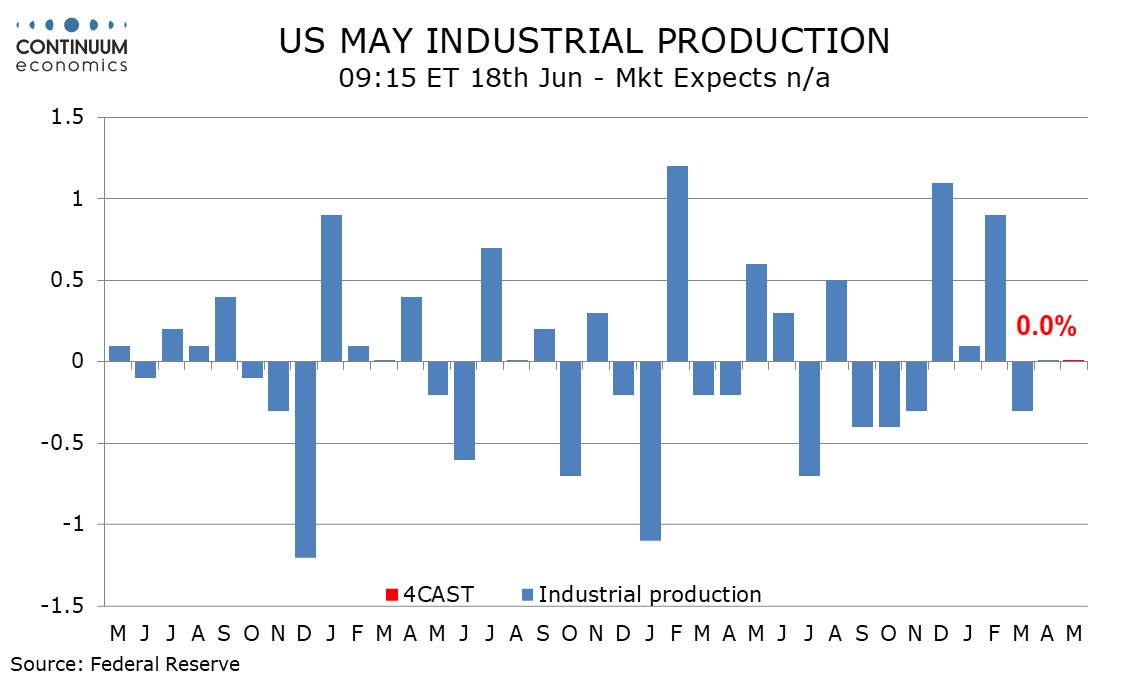

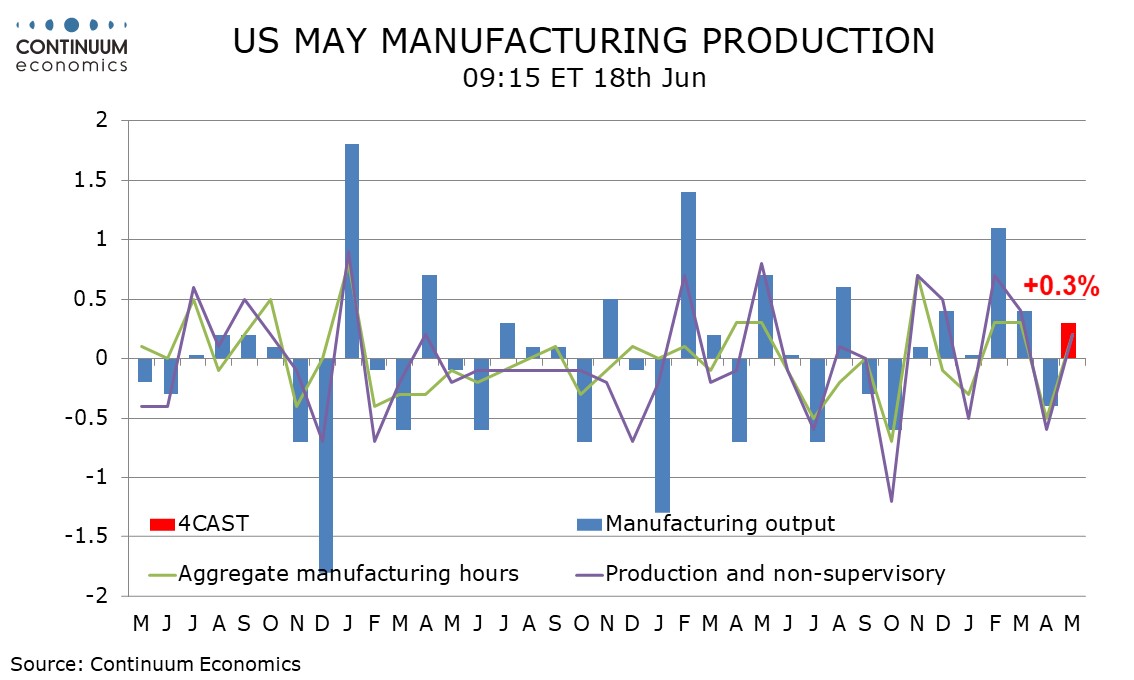

We expect May industrial production to be unchanged for a second straight month but we expect manufacturing to increase by 0.3% after a 0.4% decline in April, which was the first decline since September 2024.

May’s non-farm payroll showed a 0.2% increase in aggregate manufacturing hours worked after a 0.5% April decline. Productivity usually means output outpaces aggregate hours but a full reversal of April’s decline looks unlikely, with ISM manufacturing data remaining weak.

We expect a neutral contribution from autos after a negative of 0.1% in April. Payroll data suggests a second straight modest negative from mining while weekly electrical output suggests weather-sensitive utilities will correct from a 3.3% April increase.

We expect capacity utilization to be unchanged at 77.7% overall while manufacturing rises to 77.0% from 76.8%, only partially reversing a decline from 77.2% in March. Both series have seen little change over the past year.