SEK flows: Initially resilient to weak CPI

Swedish CPI is weaker than expected, mirroring weak Norwegian CPI earlier in the week, but the SEK has barely fallen. SEK downside risks seen, but patience may be required

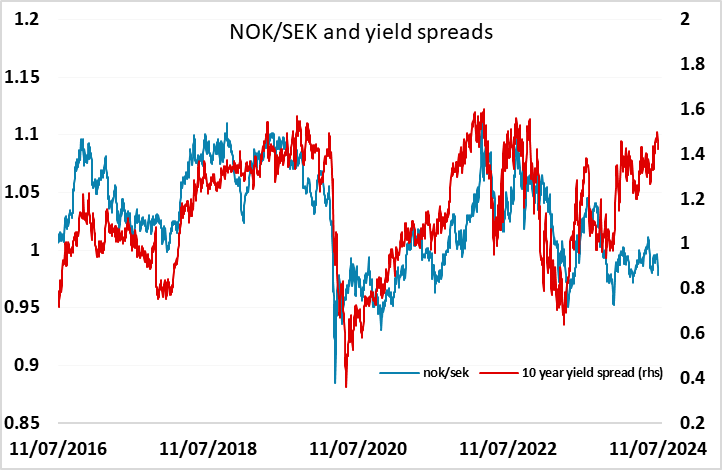

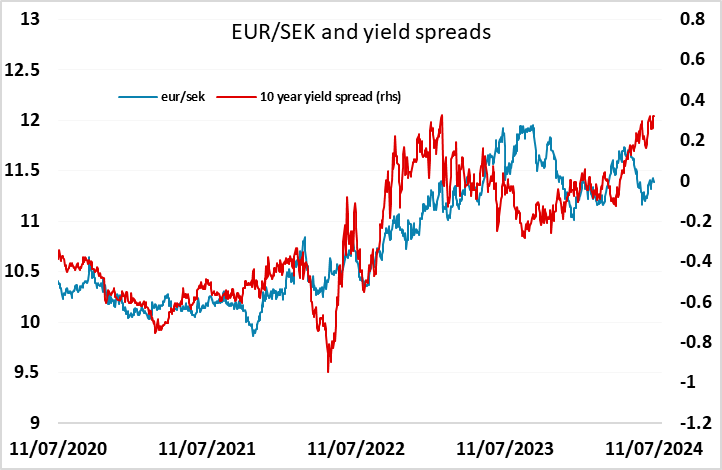

Like the Norwegian CPI data earlier in the week, Swedish June CPI has come in weaker than expected, with the headline y/y rate dropping to 2.6% and the core to 1.3%, well below market consensus of 2.8% and 1.6% respectively. The SEK has weakened in response, but much less dramatically than might have bene expected. While there was an initial surge from 11.43 to 11.47 in EUR/SEK, it has quickly settled back to 11.44, only marginally above opening levels. In comparison, EUR/NOK is up more than 1.5% since the weaker than expected Norwegian CPI on Wednesday. There should be scope for both EUR/SEK and NOK/SEK to rally further on this data, which makes earlier Riksbank easing more likely, especially since the SEK is starting from a level that looks strong relative to the usual yield spread correlation. But the SEK’s resilience this year, particularly against the NOK, will by now be discouraging sellers, so we may initially see another SEK rise before seeing further losses. Nevertheless, any SEK gains should be seen as a selling opportunity against the EUR and particularly against the NOK.