Published: 2024-04-01T14:24:27.000Z

U.S. March ISM Manufacturing - Seasonal adjustments assist improvement above neutral

Senior Economist , North America

2

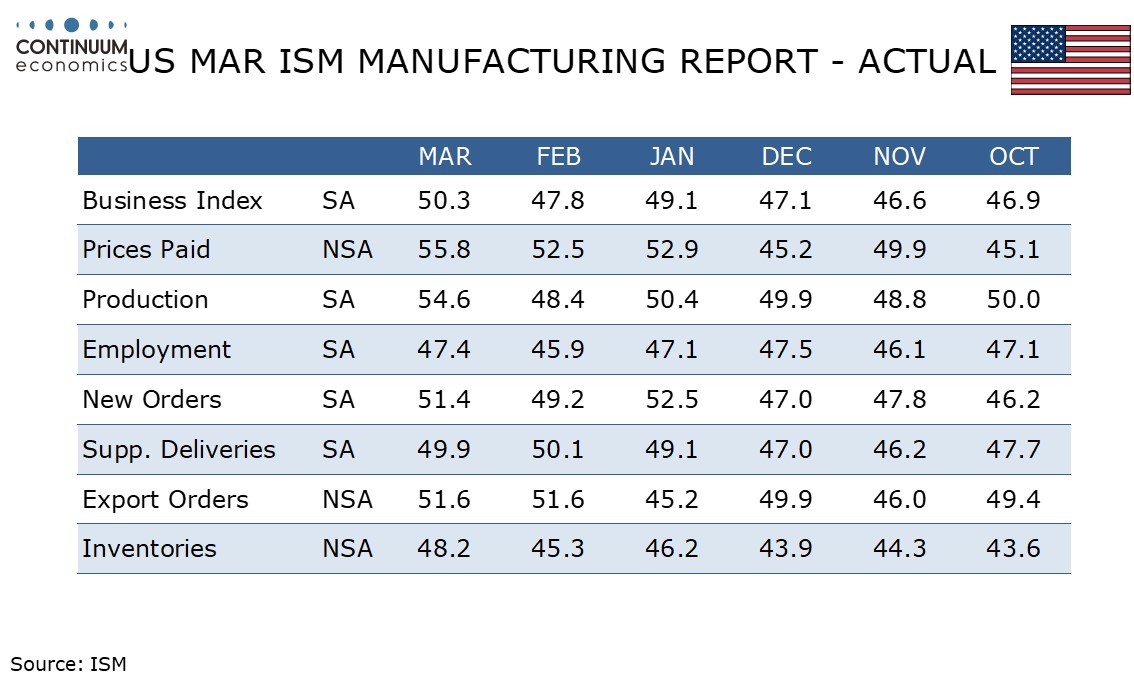

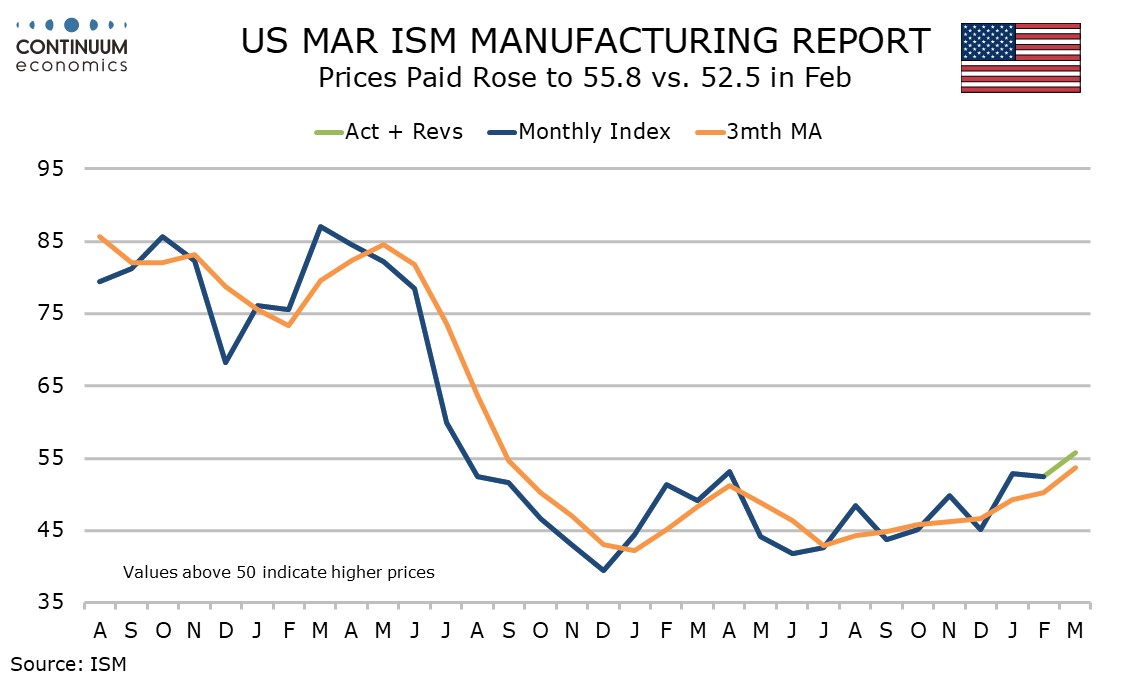

March’s ISM manufacturing index at 50.3 from 47.8 unexpectedly turned positive for the first time since September 2022, with the improvement from February’s unexpected slowing from 49.1 in January assisted by more supportive seasonal adjustments.

The positive reading is consistent with the March S and P manufacturing PMI, even if it was revised down to 51.9 from 52.5. Most regional Fed surveys slipped in March after improving on February, while generally remaining stronger than in January.

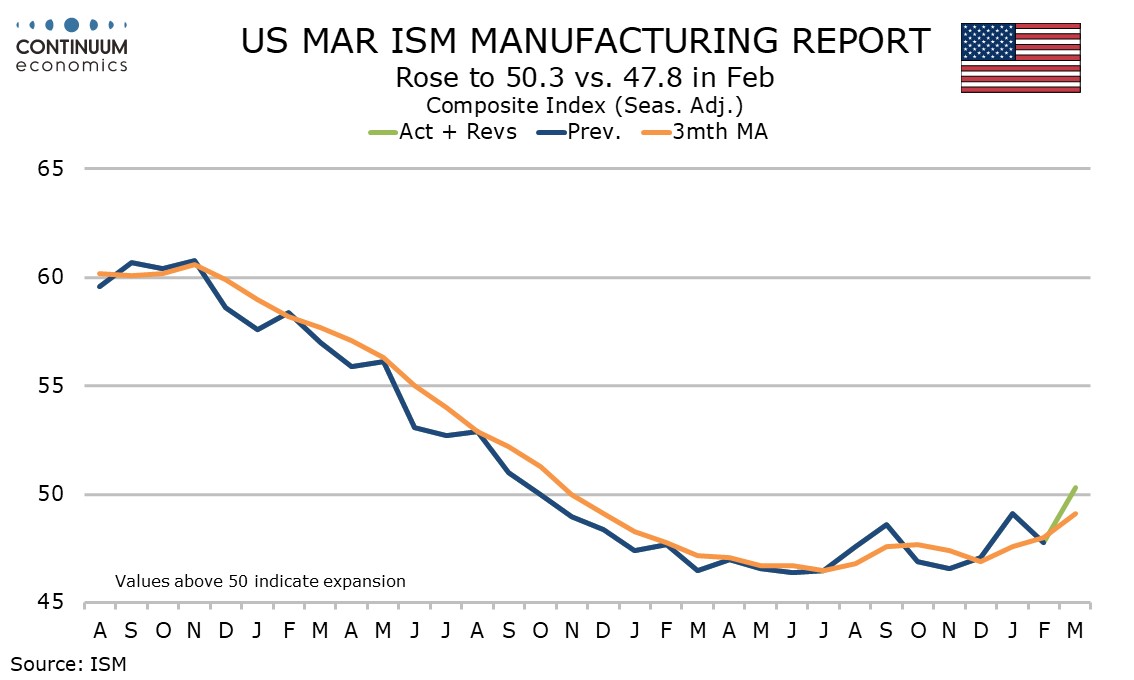

In the ISM detail the production index showed the largest improvement, to 54.6 from 48.4, while new orders rose to 51.4 from 49.2, still below January’s 52.5. Employment and inventories also improved but remain below neutral. Deliveries saw a marginal dip, to 49.9 from 51.1.

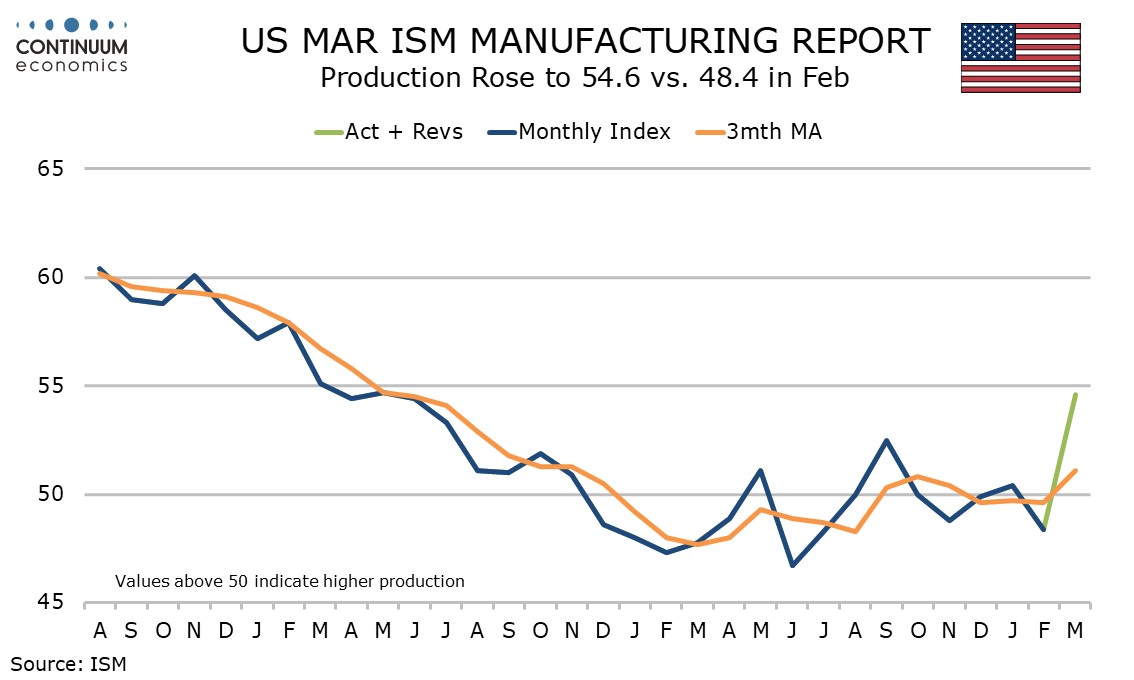

Prices paid, unlike the above five indices, do not contribute to the composite but at 55.8 from 52.5 are at their highest since July 2022.

Construction spending appears to be losing some momentum in Q1 with a 0.3% February decline flowing a 0.2% decline in January, after each month of 2023 recorded gains. Private residential spending remains positive, but dips have been seen in private non-residential and public construction in both January and February.