JPY, GBP flows: JPY under pressure, GBP/JPY to 17 year highs

JPY under pressure, risks of intervention rising, GBP/JPY hits new 17 year high.

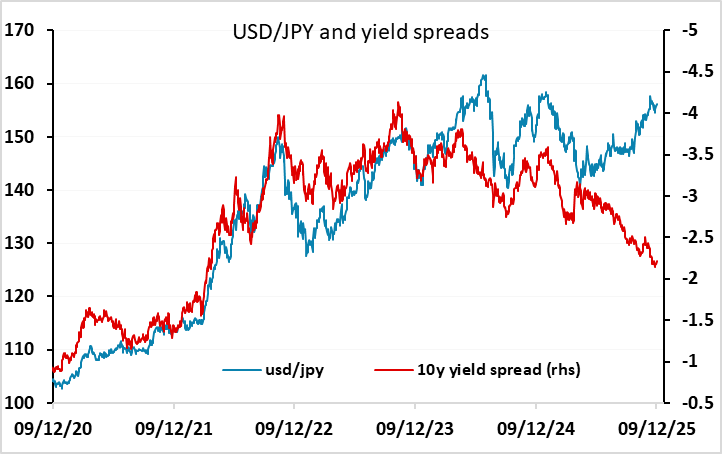

JPY weakness has been the main feature overnight, with most other pairs fairly steady. Higher US yields are part of the story, while some comments from BoJ governor Ueda saying that the recent rise in JGB yields was rather rapid and the BoJ were prepared to adjust bond buying to counter abrupt moves helped cap JGB yields. However, Ueda also said that real interest rates are significantly low and the labour market is tightening, suggesting a December rate hike is increasingly likely. This is now priced as a probability rather than a possibility, but the comments should nevertheless be mildly supportive. The marginal widening in the T-note/JGB spread overnight is of little significance given the sharp narrowing in the spread over the last 6 months. JPY weakness started yesterday on the reports of the Japanese earthquake, but while this caused some damage an injuries, it can’t be seen as important for the currency, with the warnings now downgraded.

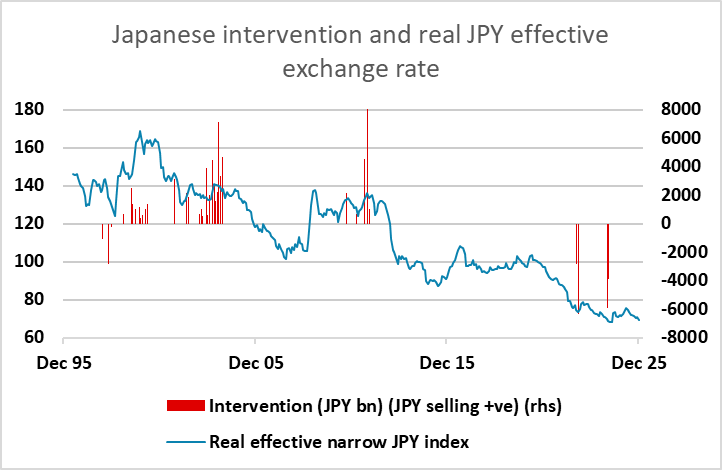

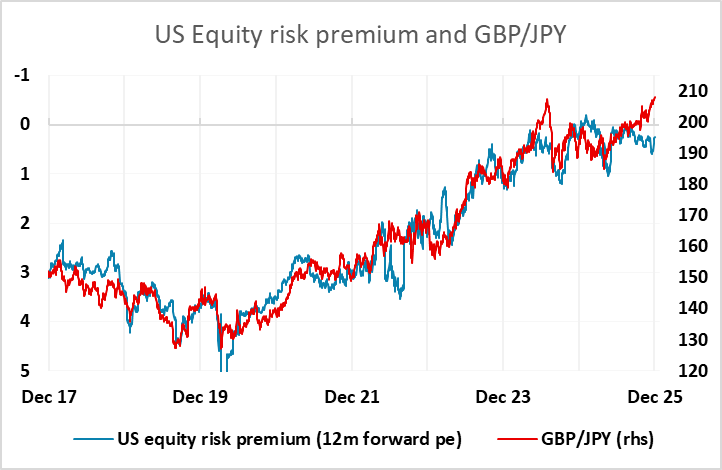

JPY weakness is therefore relatively hard to justify, although the rise in US yields does mean an implied decrease in the US nominal equity risk premium – a metric that has been strongly correlated with JPY crosses in recent years. While that correlation has broken down somewhat in the last couple of months as the JPY sold off on the election of Takaichi, declines in risk premia will still tend to be JPY negative. This morning has seen a break in GBP/JPY to its highest level since 2008, and to new all time highs in real terms, further underlining the extent of JPY weakness. As we have noted before, we would expect BoJ intervention on any further significant decline in the real effective level of the JPY, which is already sitting close to record lows, so JPY shorts from here become increasingly risky.