FX Daily Strategy: N America, October 16th

Geopolitics Keep Market on Edge,

UK CPI Below Target

USD/JPY Retreats From 150

The geopolitical tension surrounding Israel continues and will keep market on edge despite PM Netanyahu saying he will not strike Iran's oil and nuclear facilities. However, this does not rule out a large scale retaliation from Israel on military targets. Netanyahu announced he will decide the form of response alongside Defense Secretary Gallant and Chief of staff Halevi earlier today, which seems to suggest another round of operations is inevitable. The prolonged geopolitical tension will keep market participants on their toes despite the oil price's decline.

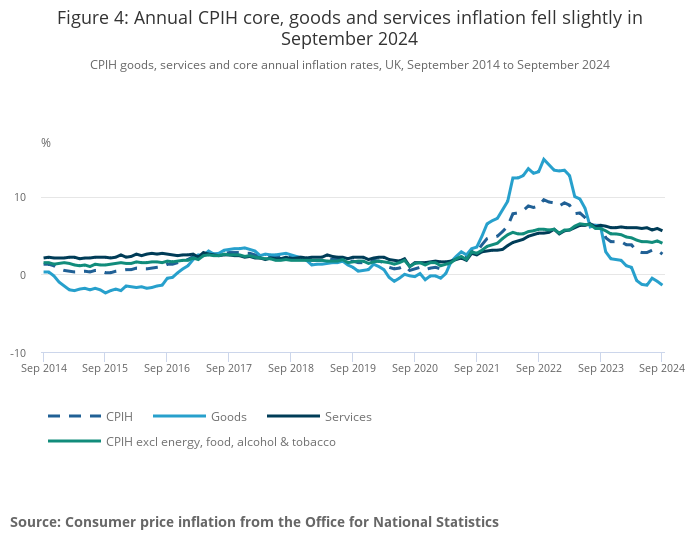

UK CPI came in well below expectations, spiking EUR/GBP higher by 30 pips, more than reversing yesterday’s decline after the UK labour market data. CPI was 0.2% below consensus in both headline and core. The largest downward contribution to the monthly change in both CPIH and CPI annual rates came from transport, with larger negative contributions from air fares and motor fuels. However, importantly the CPIH services annual rate fell from 5.9% to 5.6%.

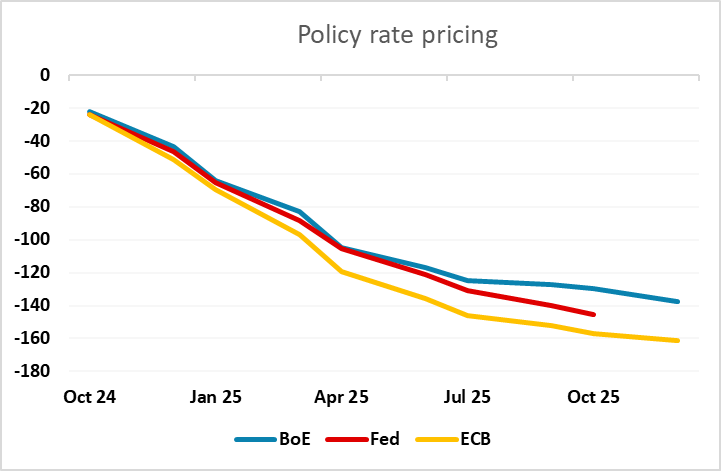

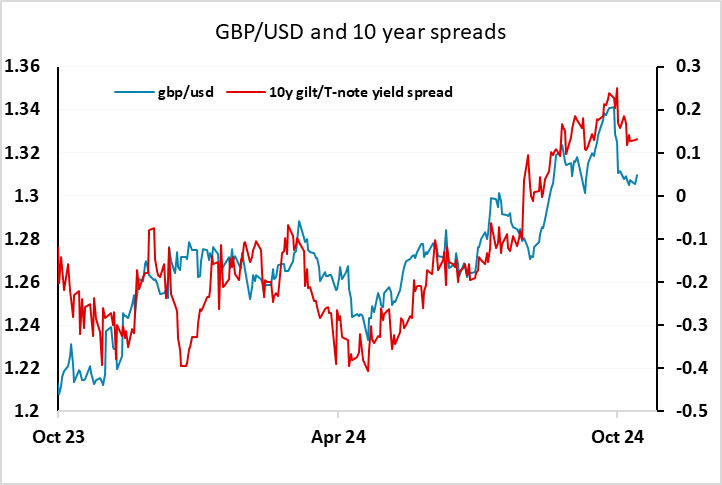

A November rate cut from the BoE is now priced as a 90% chance, but there is still scope for the market to price in more substantial cuts further out. Even so, it is likely to be hard to break above the 0.84 level unless we see a turn towards weaker risk sentiment in general. GBP/USD should still find some good support near 1.30, as it has already fallen further than might be expected based on the moves in yield spreads.

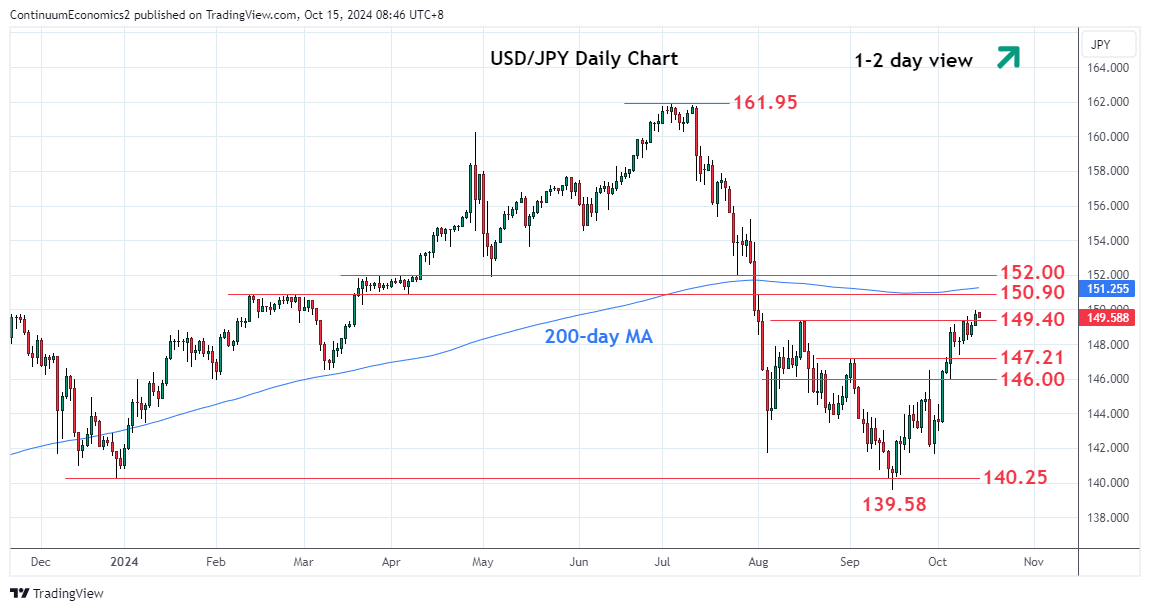

The USD/JPY has retreated from the 150 figure after the first attempt. The political headwind from new PM Ishiba seems to be calmed by now as he walks back from his previous comment. The inflationary dynamic also supports further BoJ action, unless we see a significant moderation in National CPI this Friday (which is unlikely). However, the slow pick up in consumption will remain a thorn by their side because it determines the height of trend inflation and could make the BoJ looks like they have made a policy error in the coming years. The pace of changes in price/wage setting behavior and the willingness of Japanese to consume at higher price will be critical. In a short to medium run, the JPY is likely to strengthen for the BoJ would most likely act before market participants anticipate.

On the chart, the consolidation below the 149.40 resistance has given way to break higher to extend gains from the September YTD low to reach the 150.00 figure. Pause here see prices unwinding the overbought intraday studies but further gains not ruled out. A later break will open up scope to the 150.75/150.90, 50% Fibonacci retracement and February high. Break here, if seen, will see potential to the 152.00 resistance. Meanwhile, support is at the 148.00 level which now underpin. Would take break here to turn focus lower to the 147.21 support then the 146.50/146.00 area.