EUR, USD, JPY flows: Focus on PMIs

The EUR was firmer overnight helped by a better general risk tone, but the focus is now on the PMIs

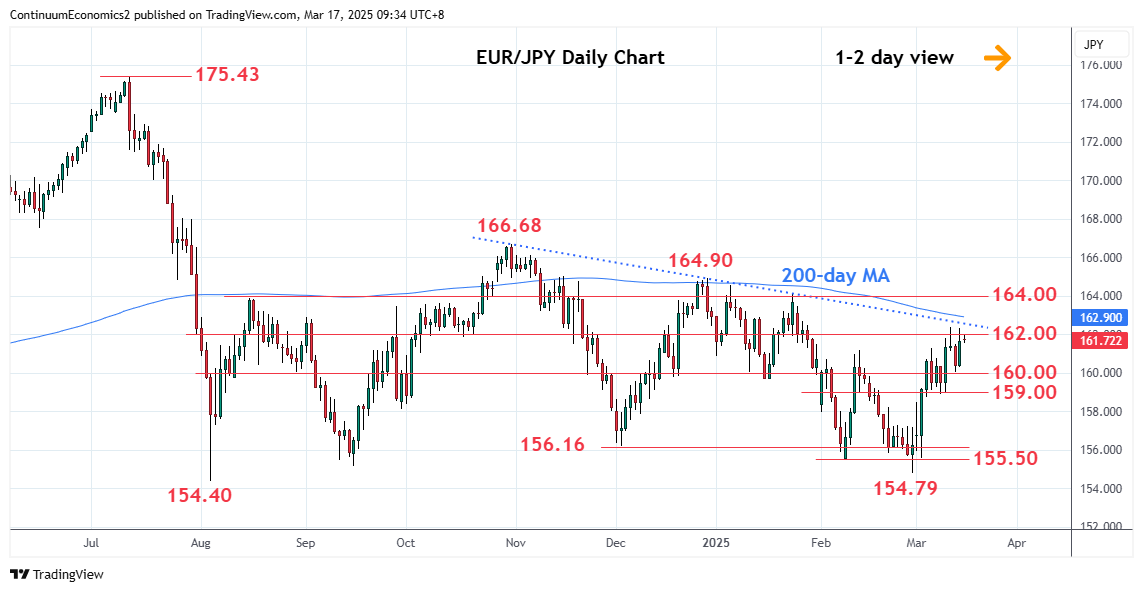

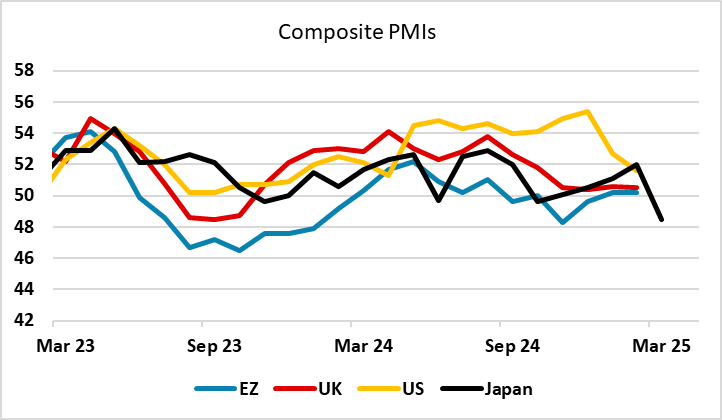

After a mildly risk positive Asian session, the focus for the rest of the day is likely to be on the PMI surveys in Europe and the US. The better tone overnight is related to somewhat more placatory statements from Trump on tariffs, and to some hopes of progress in Ukraine talks. But the better tone could be undermined if the Mis disappoint. There is some expectation of improvement in the European PMIs, particularly German PMIs, because of the proposed increase in defence and infrastructure spending. But with no money actually having been spent yet, and the timing still uncertain it isn’t clear that this will necessarily feed through into the survey just yet. The Japanese PMIs aren’t terribly well correlated with the US and Europe, and are not closely watched, but the decline in these in March reported overnight is slightly concerning. If the European PMIs do show an improvement, there is scope for EUR/USD to edge back up to the high 1.08s and EUR/JPY up towards the recent 164 highs, while we would see both EUR/USD and EUR/JPY downside risks if the data is soft.