U.S. Initial Claims, GDP revisions, Durables and Trade all stronger than expected

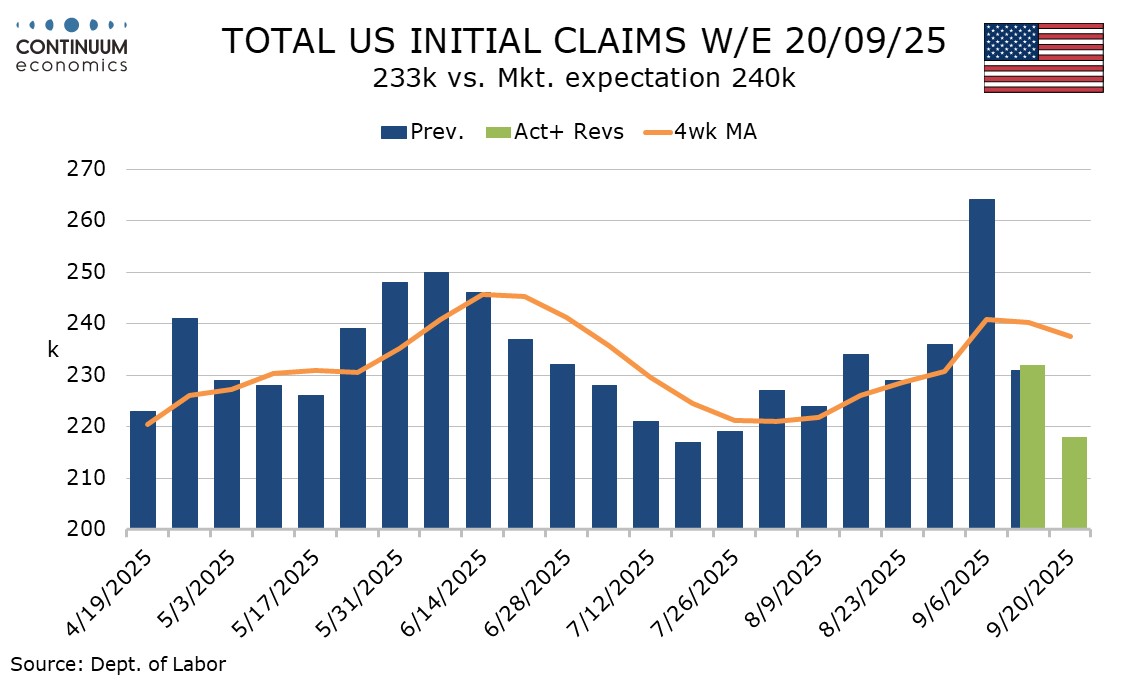

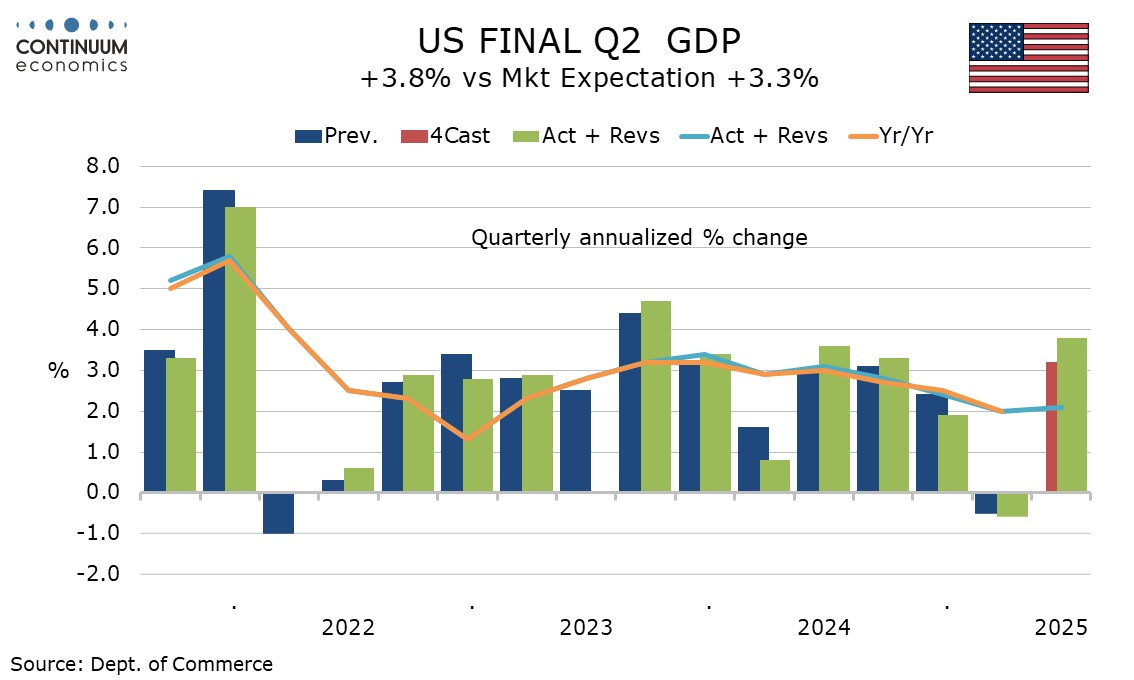

The latest set of US data is clearly on the strong side of expectations, with Q2 GDP revised up significantly to 3.8% from 3.3%, August’s advance trade deficit falling to $85.5bn from $102.8bn, August durable goods orders rising by 2.9% with a 0.4% increase ex transport, and initial claims falling to 218k from 232k.

The initial claims total is the lowest since July 19. The data covers the week after September’s non-farm payroll was surveyed, and the latest low figure can be seen as an offset for a high total of 264k two weeks ago in the week that included Labor Day.

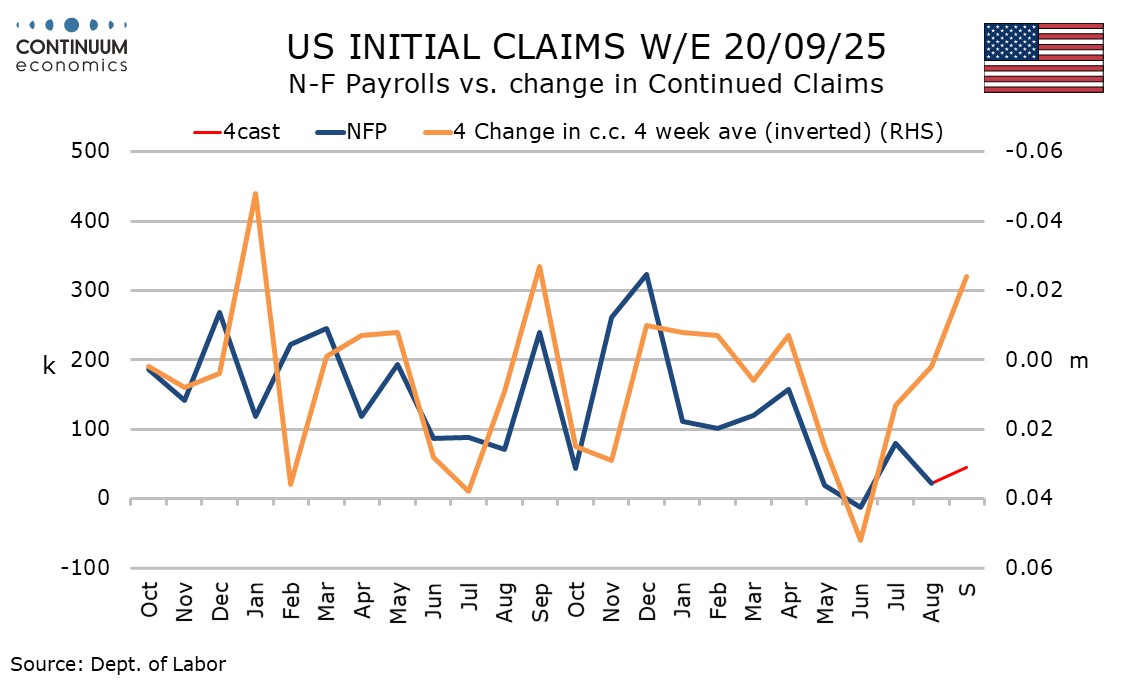

The 4-week average of 237.5k is down from 240.25k last week, the payroll survey week, but still above the 226k seen in August’s payroll survey week.

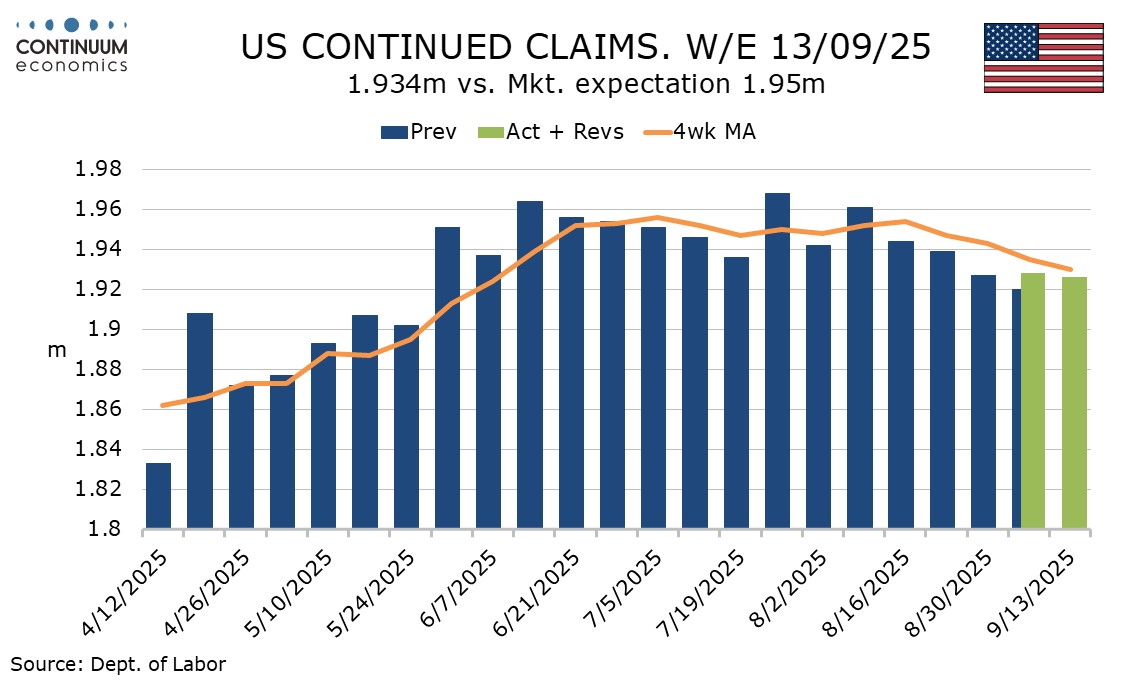

Continued claims are down by 2k to 1.926m after a 1k increase, though with last week’s marginal rise being the only one in the last five weeks the 4-week average of 1.930 is at its lowest since June and the latest continued claims data covers the September non-farm payroll survey week.

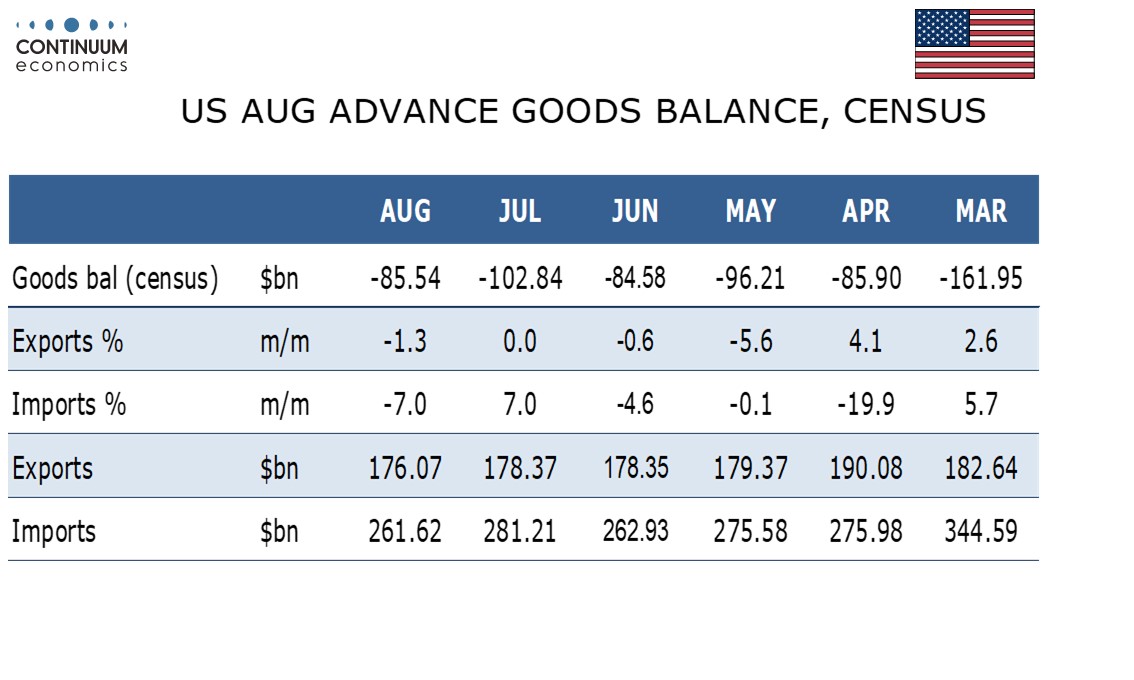

The August advance goods trade deficit of $85.5bn is sharply down from July’s $10-2.8bn and shows exports weak at -1.3% after a flat July but imports down by 7.0% to reverse a 7.0% July increase. This is supportive for Q3 GDP though advance inventory data at -0.2% for wholesale and unchanged for retail provide some offset.

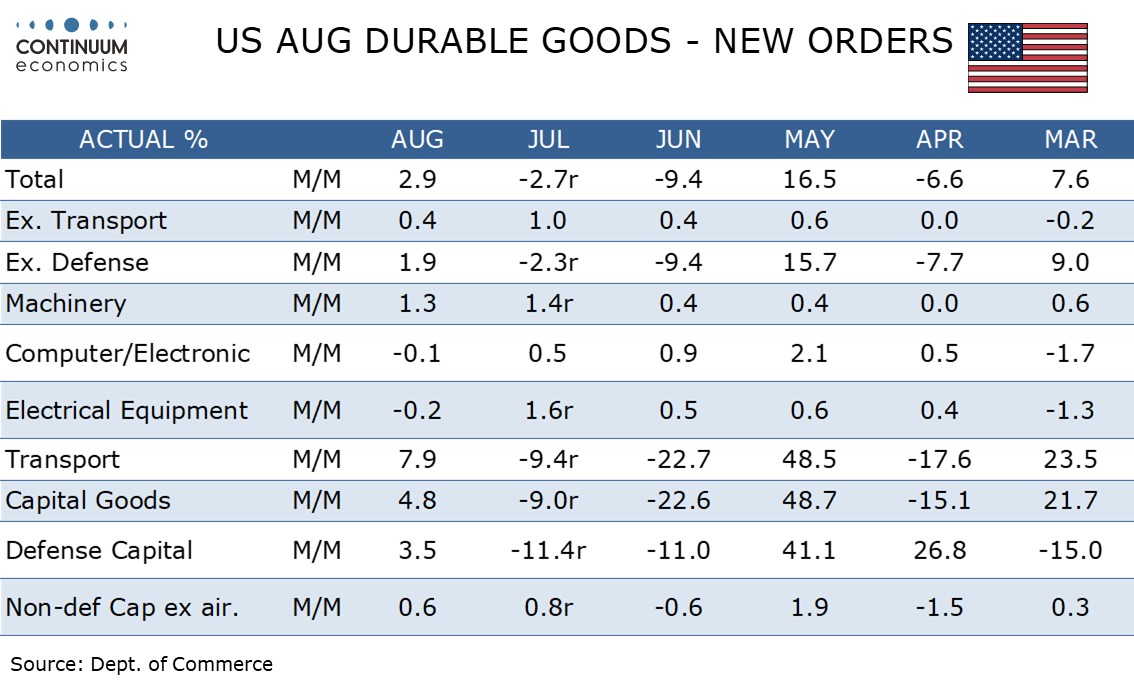

August durable goods orders with a 2.9% increase were lifted by an unexpected rise in civil aircraft and also a bounce in defense, with orders ex defense up by 1.9%. The ex-transport gain of 0.4% is also on the firm side of expectations and we have now seen four straight gains, showing trend is positive.

Non-defense capital orders with a 0.6% increase are a positive signal for business investment but shipments in the sector with a 0.3% decline and unchanged inventories for overall durable gods are less so in their GDP implications.

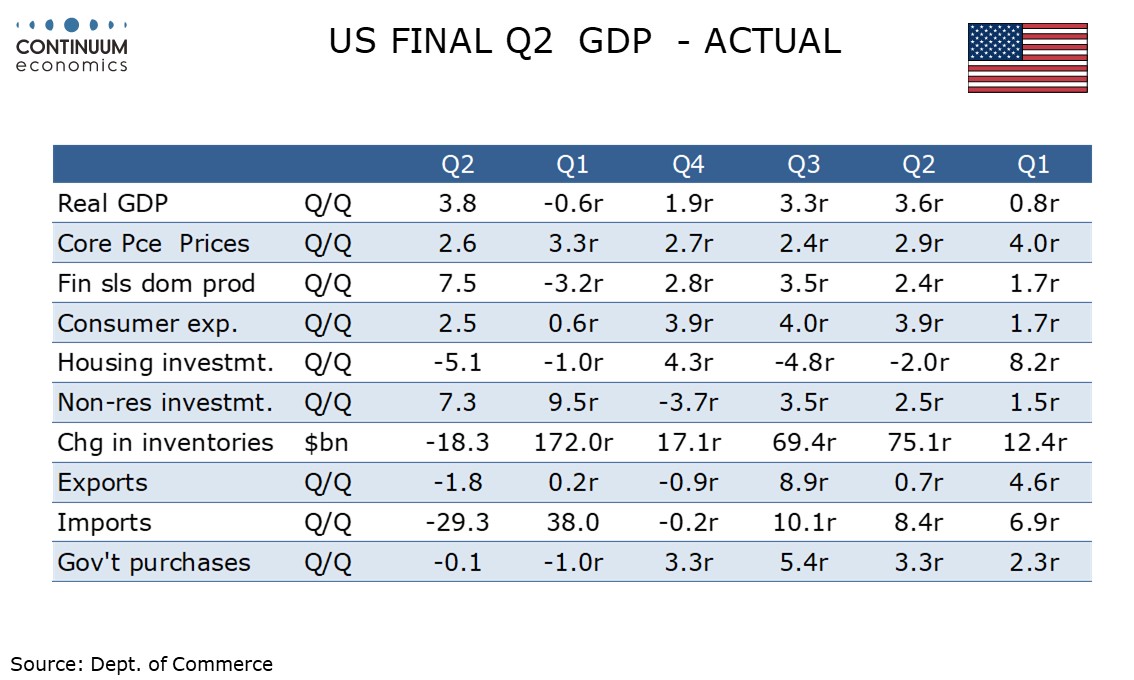

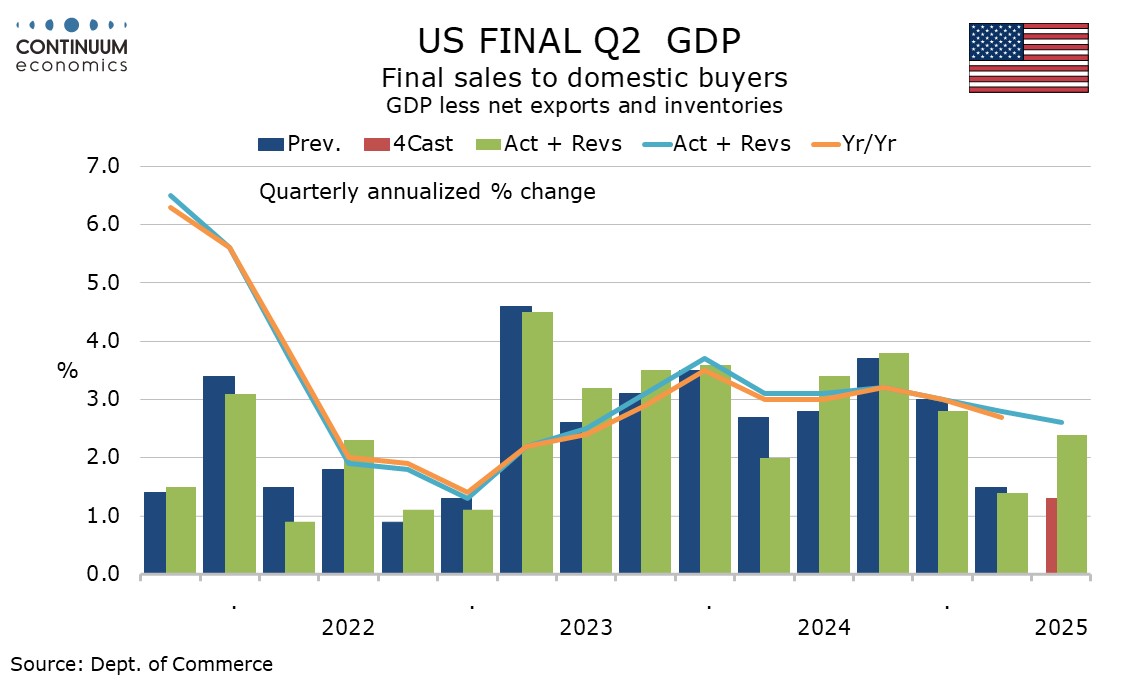

Q2 GDP saw an unexpected upward revision to 3.8% from 3.3% led by consumer spending which was revised to 2.5% from 1.6% and that by services which was revised to 2.6% from 1.2%. Final sales to private domestic buyers were revised up to 2.9% from 1.9%.

Core PCE prices saw a marginal upward revision to 2.6% from 2.5%. The release includes historical revisions which are not dramatic, on balance for both GDP and core PCE prices. Given that employment growth has been revised down through March 2025 this implies stronger productivity.