GBP flows: GBP edges higher after stronger than expected retail sales

GBP firmer after stronger than expected retail sales

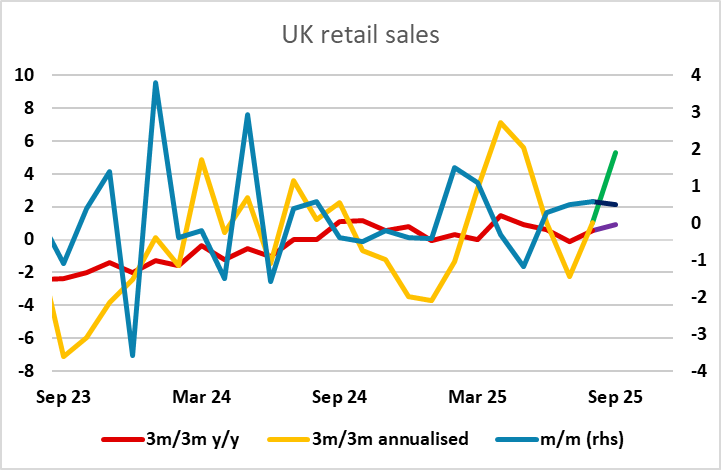

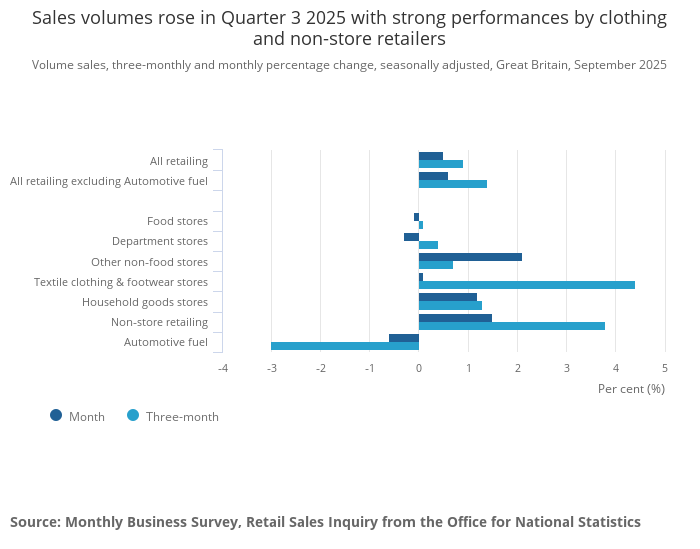

UK retail sales were stronger than expected in September, rising 0.5% m/m, and taking the 3m/3m trend to 3.4% annualised, the highest since May. While the monthly numbers saw strength in computers and online gold sales, the strength in the quarter was more broad-based, with most categories other than auto fuel seeing gains. GBP has moved modestly higher in response, but EUR/GBP remains above 0.87 after yesterday’s GBP weakness following the UK CPI data.

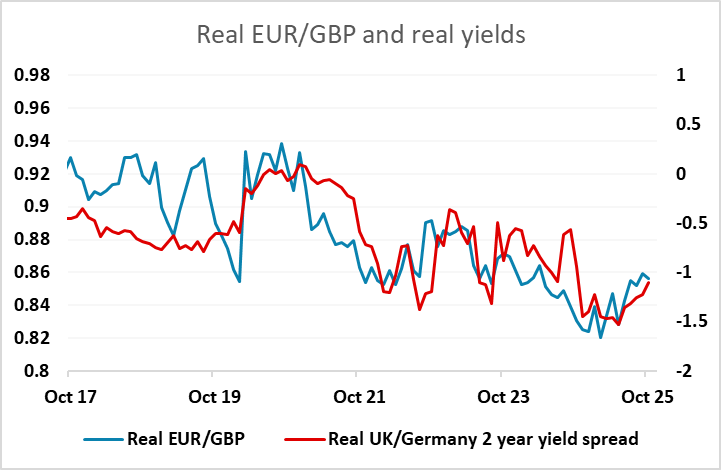

Following the CPI, the market is pricing in a much greater (35%) chance of a November 6 rate cut from the MPC. But we still doubt there is likely to be any action before the November 26 Budget, and data like these retail sales numbers, indicating still reasonably robust consumer demand, suggests the MPC members will mostly see little risk in waiting until the December meeting. While we do expect to see GBP weaken steadily against the EUR in the next year or two, as UK and Eurozone real interest rates are likely to converge, a break to new EUR/GBP highs for the year above 0.8763 will be difficult this side of the Budget unless we see either some very weak UK data or a significant deterioration in global risk sentiment.