Preview: Due September 17 - U.S. August Industrial Production - Autos to correct from weak July

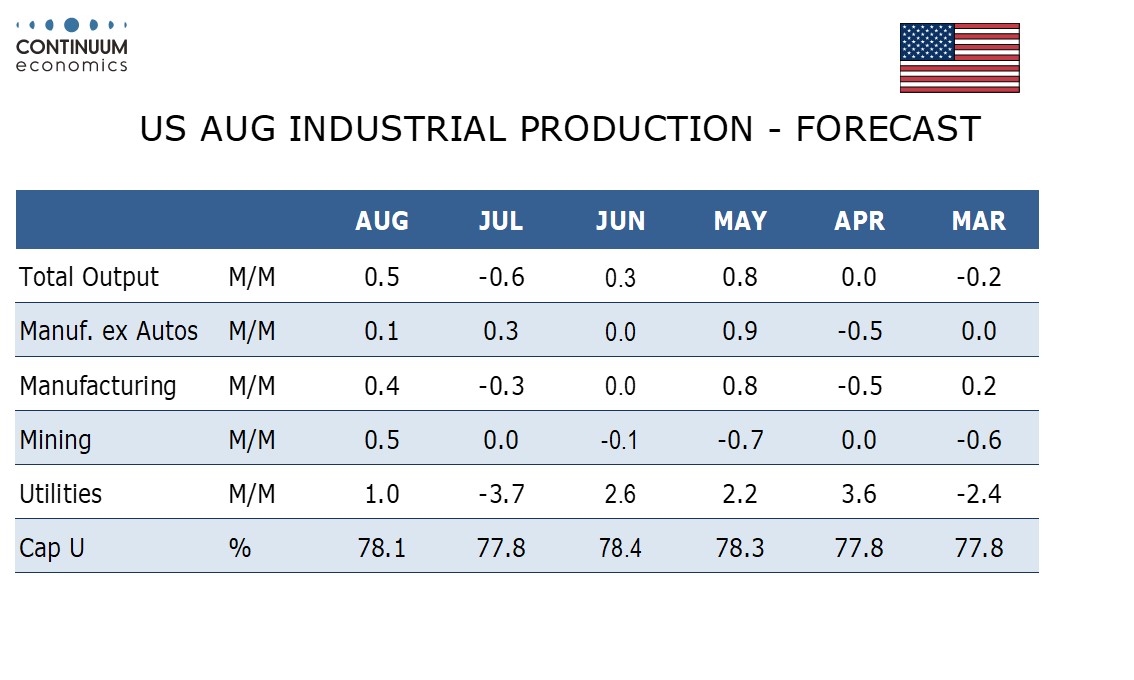

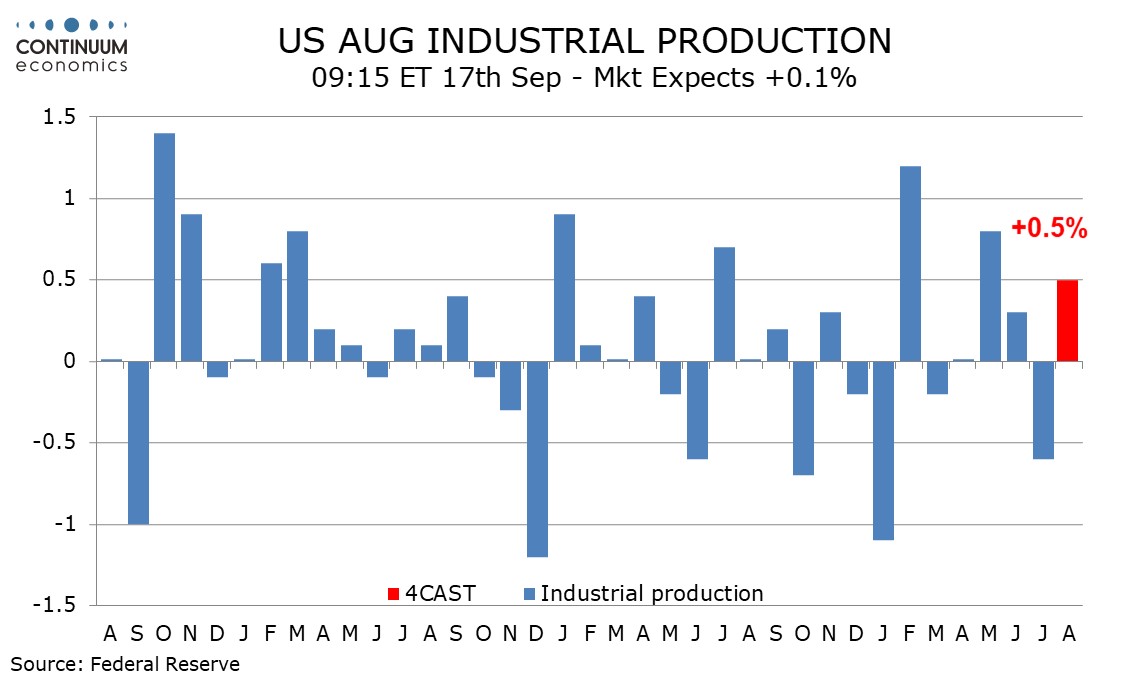

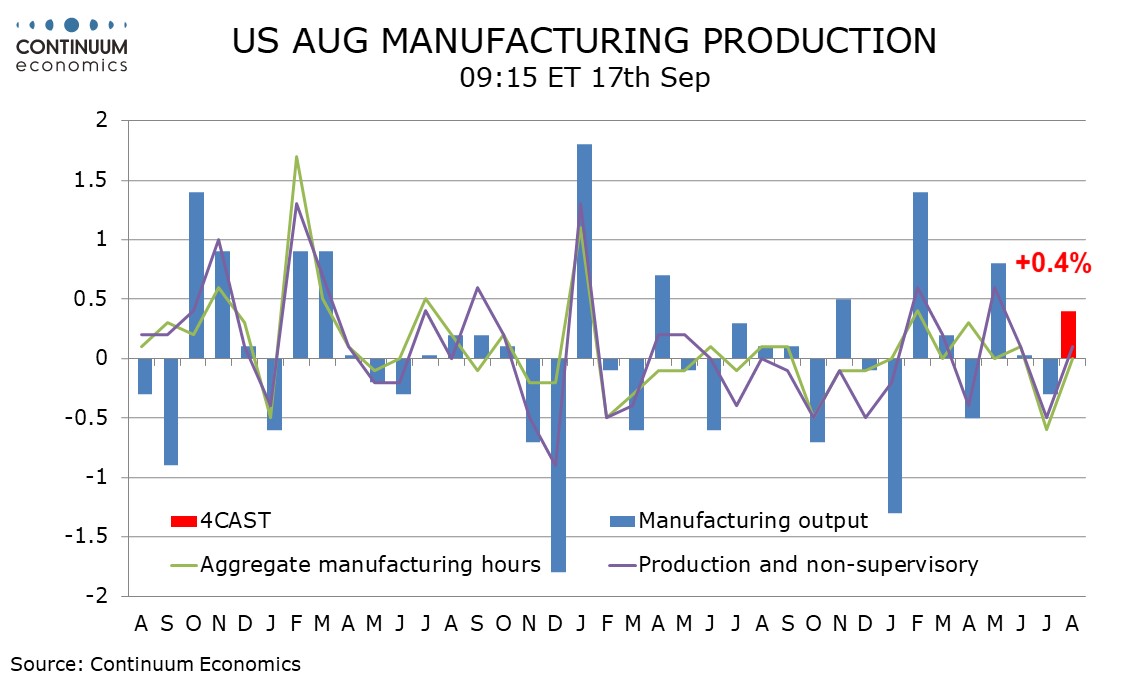

We expect August industrial production to rise by 0.5% after a 0.6% June decline, while manufacturing increases by 0.4% after a 0.3% July decline. Autos are likely to lead the rise after leading the July decline.

We expect manufacturing ex autos to increase by a marginal 0.1%, slowing from a 0.3% increase seen in July. ISM manufacturing data remained weak while payroll manufacturing employment declined. However, aggregate manufacturing hours worked were little changed the payroll detail, which should allow a marginal increase in output ex autos.

We expect auto output to only partially reverse a July decline with sales faltering in August. Electrical output suggests utilities will also see a partial correction from a sharp July decline, lifting industrial production growth above that of manufacturing. Aggregate hours worked data also implies a modest increase in mining.

We expect capacity utilization to rise to 78.1% from 77.8% but this will remain below June’s 78.4%, which as a 7-monh high. We expect manufacturing to rise to 77.5% from 77.2%, reversing a July decline.