Preview: Due December 3 - U.S. November ISM Services - Correcting from a stronger October

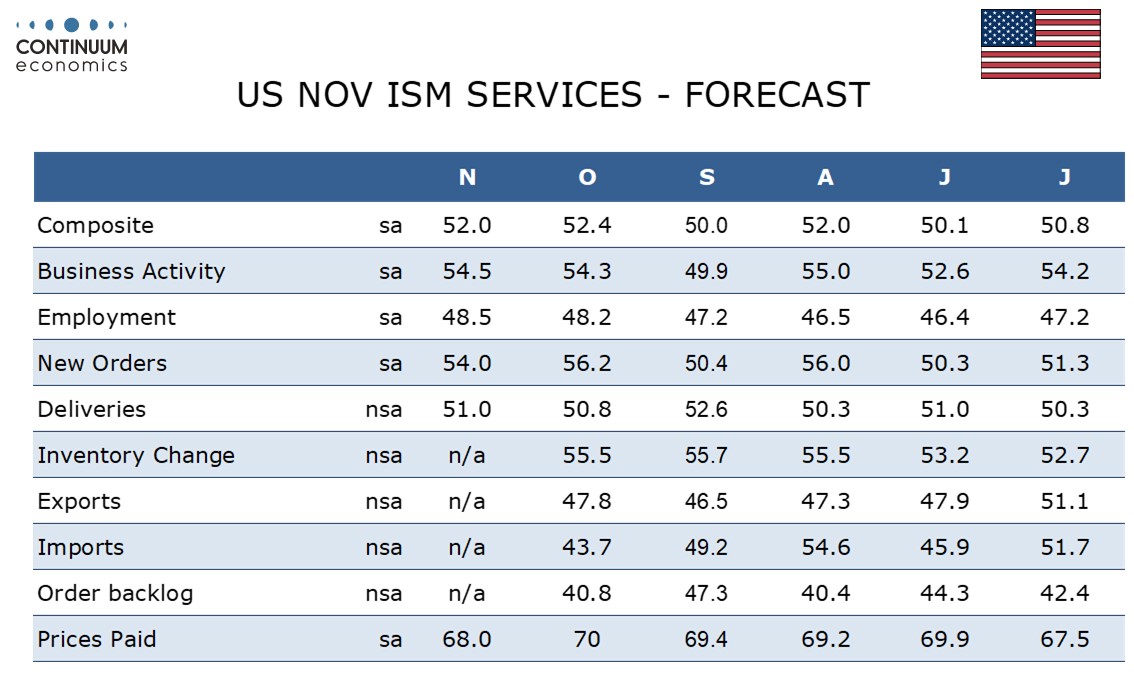

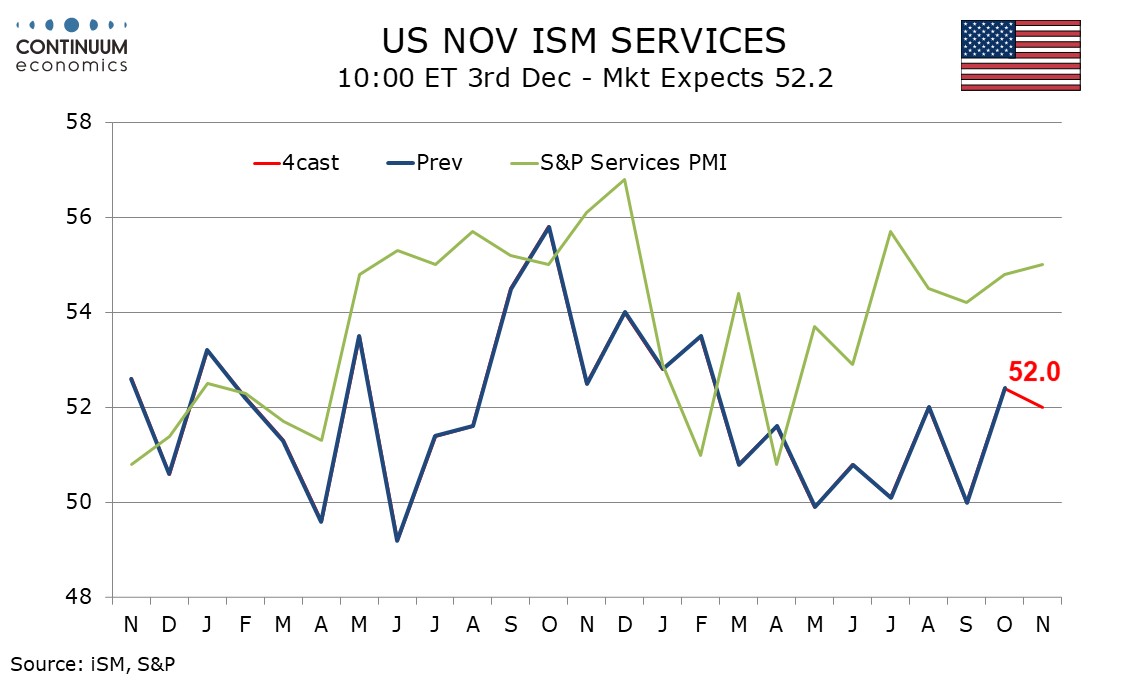

We expect November’s ISM services index to correct lower to 52.0 from 52.4 in October which was the highest reading since February. The last twelve readings have seen the index move in the opposite direction to the preceding month.

The S and P’s service index was firmer in November but still below July’s level and not a clear signal for a further improvement in the ISM’s, particularly with regional service sector surveys remaining mostly subdued. Seasonal adjustments have played a part in recent volatility but are fairly neutral for November. They are however slightly tougher for new orders which we see slipping to 54.0 from 56.2, outweighing modest improvements in the other three components of the composite, business activity, employment and delivery times.

Prices paid do not contribute to the composite and here we expect a fall to 68.0 from 70.0, assisted by oil. This series has been in a tight range since picking up after April’s tariff announcement. Despite the modest size of the dip we expect November would be a 5-month low after an October reading that was the highest since October 2022.