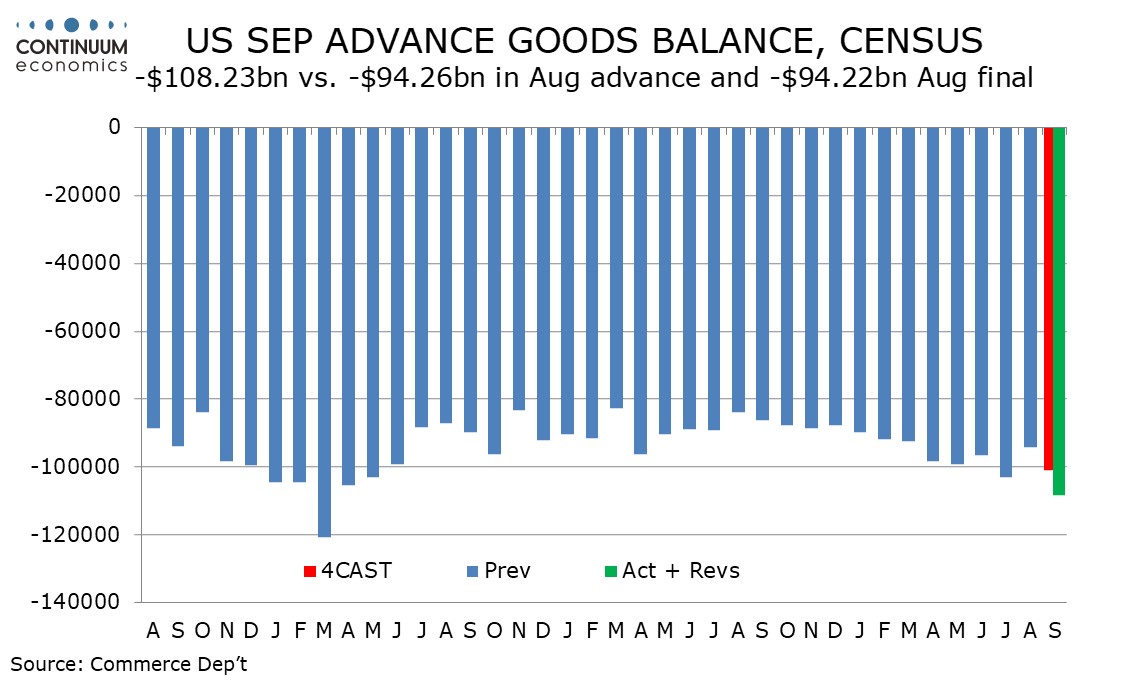

U.S. September Advance Goods Trade Deficit brings downside risk to Q3 GDP

September’s advance goods US trade deficit of $108.2bn is significantly wider than expected and adds to downside risks to Q3 GDP (we will stick to our already below consensus 2.4% call which assumed a wider September trade deficit).

Advance September inventory data is mixed, strong in retail with a 0.8% rise but weak in wholesale with a 0.1% decline. The inventory data net of upward revisions to August is on balance marginally positive for GDP but outweighed by the sharp rise in the trade deficit.

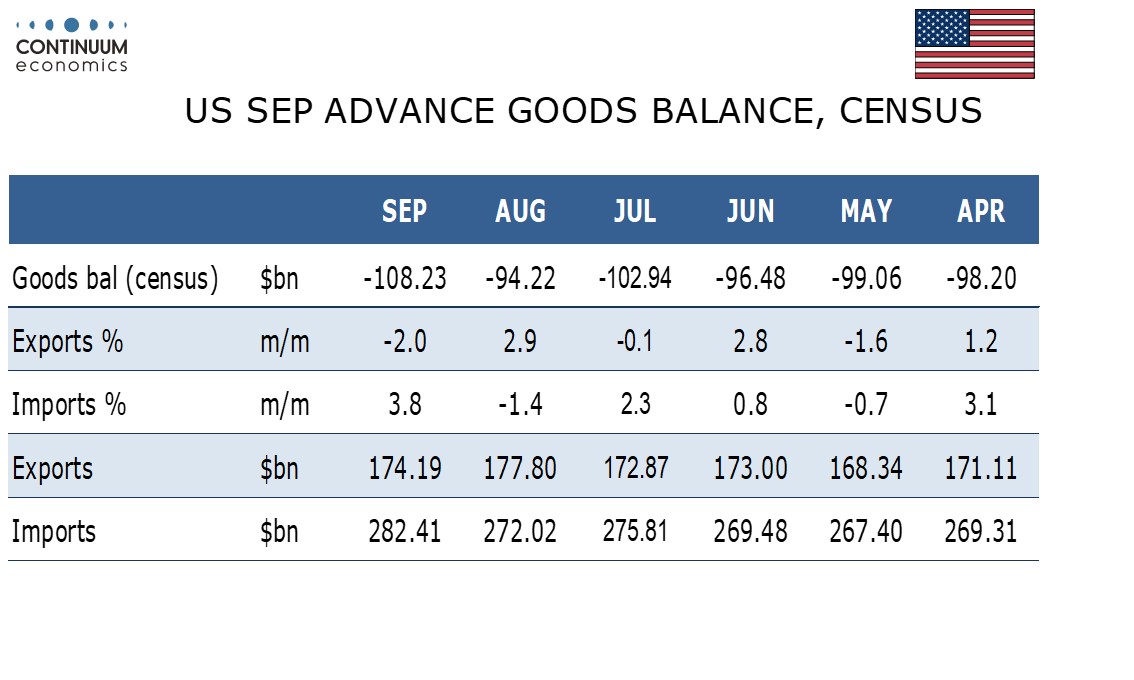

Exports fell by 2.0% after a 2.9% August increase with gains in food and autos and significant declines elsewhere. Imports rose by 3.8% in a broad based rise after a 1.4% decline in August. Imports may have been inflated by the approach of what tuned out to be a brief strike at East Coast ports in early October.

The September deficit is the widest since March 2022 and restores a negative trend after August data corrected a sharp increase in July’s deficit.