USD flows: USD still mid-range with mild downside bias

USD in the middle of the range seen in the last two months. More tariff news or significant data required for ranges to be tested

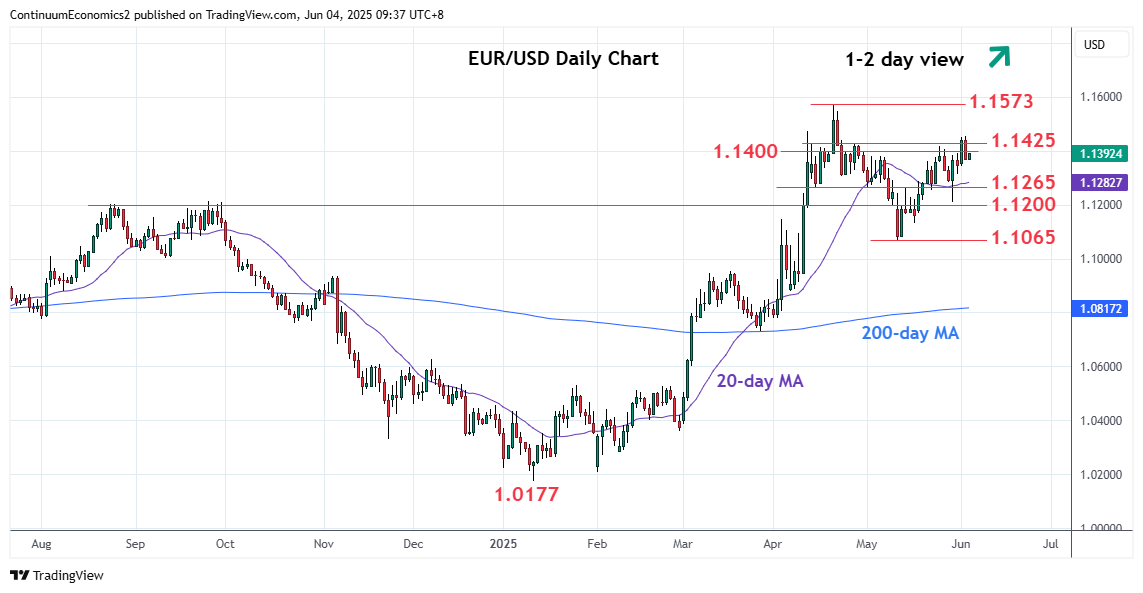

It’s looking like a quiet Wednesday session with the US ADP employment data and ISM services numbers later the only significant releases. The USD is showing a marginally firm tone, with EUR/USD dipping back towards the centre of the 1.1065-1.1573 range that has held since early April and the announcement of the reciprocal tariffs, while USD/JPY is in the middle of its 139.88-148.65 range that has held over the same period. While we still see big picture USD weakness, short term declines will likely require either more tariff announcements or some evidence of weakening in the economic data. This week’s employment report may show some modest softening, and that may mean the USD edges a little lower, but it’s unlikely to threaten the edges of the recent ranges unless we hear more on tariffs.

For today, we see the ADP and ISM data being slightly on the soft side of consensus, so the firmer USD tone seen in the last 24 hours may reverse, but we wouldn’t expect major moves.