U.S. December JOLTS and January Consumer Confidence deliver strong labor market signals

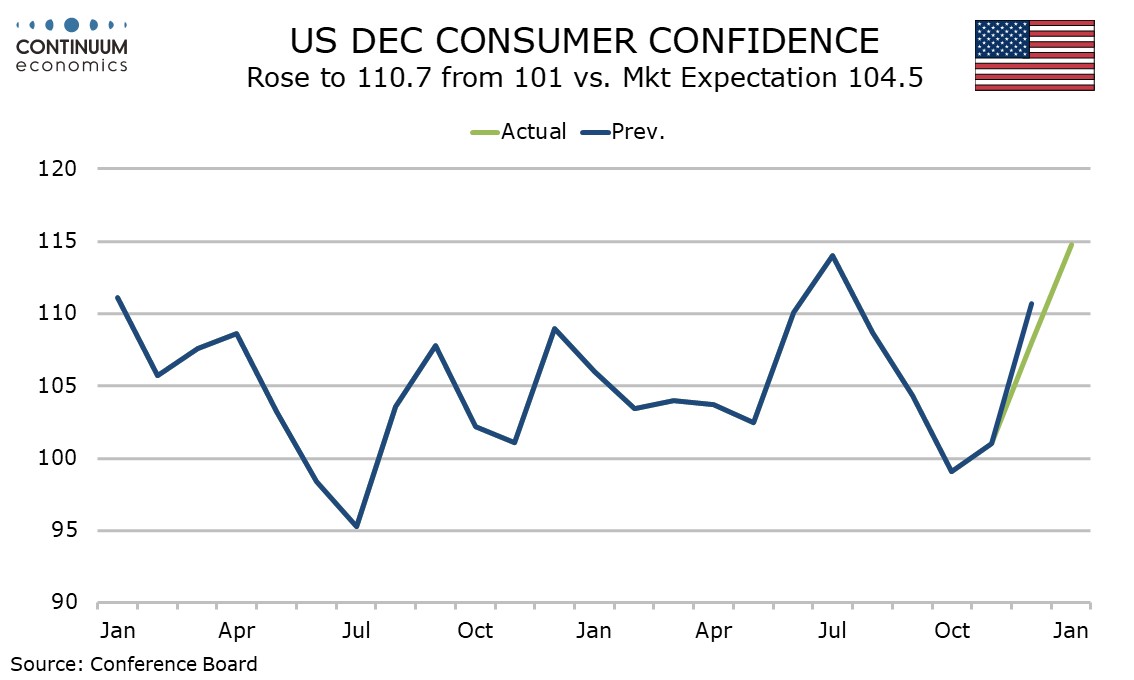

December JOLTS job openings at 9.026m from 8.925m (revised up from 8.79m) add to the case that the labor market is seeing some acceleration, which a rise in January consumer confidence to a 2-year high of 114.8 from 108.8 (December was revised down from 110.7) also implies.

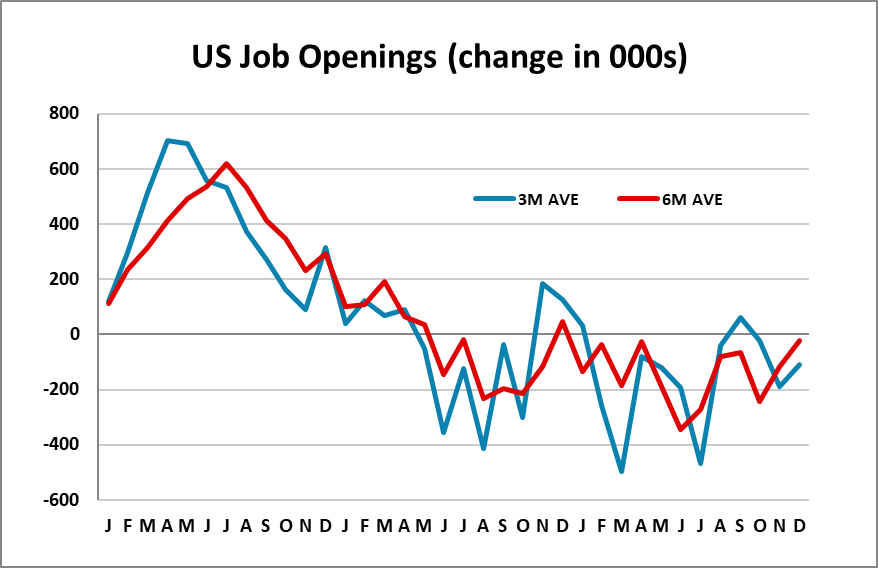

Openings increased by 101k in December after a revised November outcome that now reports an increase of 73k. While the gains do not fully reverse a 498k decline in October, trend is only modestly negative, at -108k for a 3-month average and near neutral at -23k for the 6-month average. Openings are still well above levels around 7 million prior to the pandemic.

Hirings rose by 67k and separations fell by 36k, consistent with the stronger rise in December’s non-farm payroll, though the fall in separations was more than fully due to a 132k fall in quits. This is the second straight fall of over 100k in quits, and falling quits is consistent with the labor market cooling.

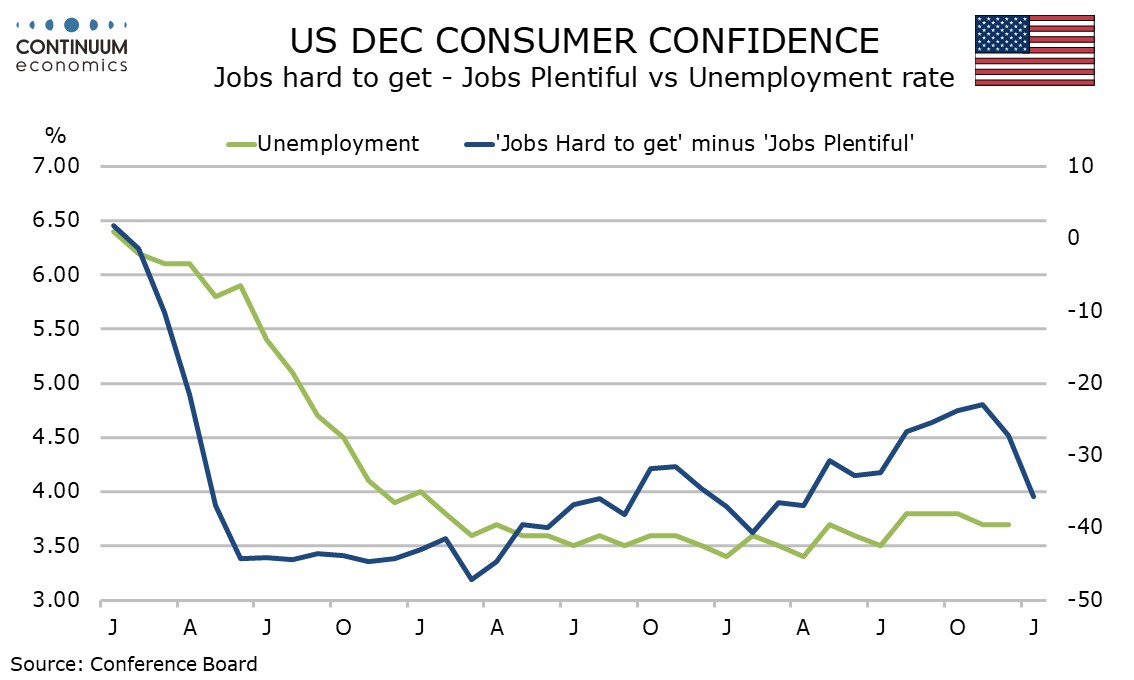

Still, most of the current signals, including the initial claims trend, suggests that there has been a recent regaining in labor market momentum, and this is backed by a sharp improvement in labor market perceptions in January’s consumer confidence report. The proportion seeing jobs as plentiful less those seeing them as hard to get rise to 35.7% from 27.3%, a sharp rise to a 9-month high.

The overall consumer confidence reading is the highest since December 2021 and follows recent improvements in the Michigan CSI. We attributed the Michigan CSI gain to lower mortgage rates and stronger equities, but in the Consumer Confidence report the present situation index led the rise, up to 161.3 from 147.2, probably led by the labor market. Expectations rose only modestly to 83.8 from 81.9.

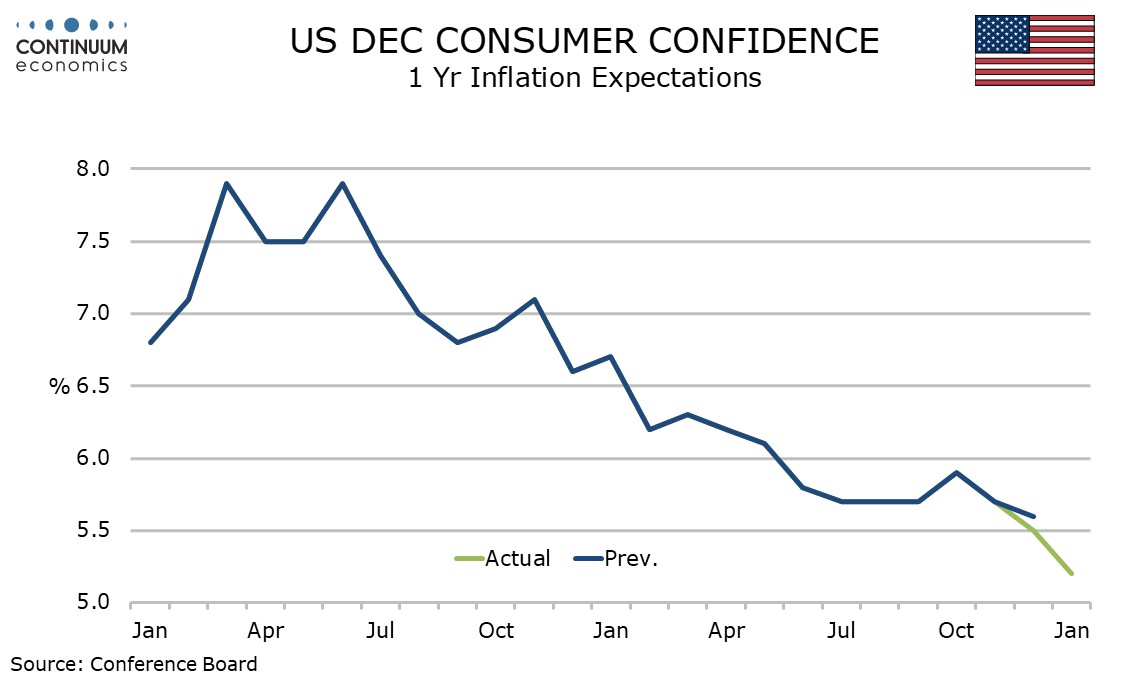

Inflation expectations are slower, at 5.2% from 5.5%. This series always outperforms actual inflation and the level is the lowest since March 2020, further explaining the rise in consumer confidence.